It’s no longer Cold War posturing or quiet academic chatter. The United States and China are now launching satellites at a pace so aggressive, it’s starting to warp global resource flows—and one of the biggest casualties is already silver.

With over 9,000 satellites currently orbiting Earth and thousands more on the launch pad, the race to dominate space isn’t just a contest of power projection. It’s a resource black hole. From radiation shielding to solar panels, circuitry, and thermal control systems, silver is being consumed in bulk—and quietly, it's evaporating faster than most realize.

Satellite Launch Surge: 2025 Snapshot of Nations and Corporations Pushing Silver to the Brink

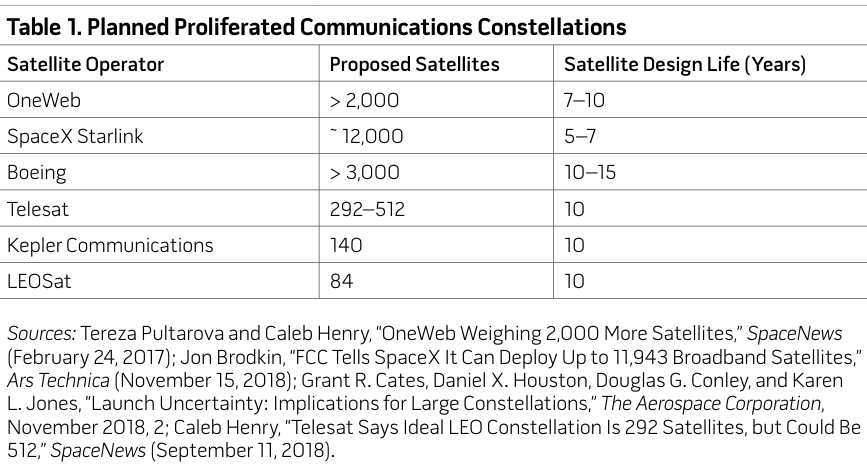

As of 2025, the global satellite arms race has reached fever pitch. The number of launches isn’t just a metric of space dominance—it’s an indirect measure of how much silver is being vaporized in boosters, coatings, and payload electronics. The following table summarizes the key players and their satellite activity this year:

| Country/Company | Launch Details | Date | Notes |

|---|---|---|---|

| United States – SpaceX | Launched 23 Starlink satellites from Vandenberg via Falcon 9 | March 2025 | Continues rapid Starlink expansion; silver used heavily in avionics and onboard systems |

| China – CASC | Tianzhou-7 cargo craft sent to Tiangong space station | January 2025 | Supplies included thermal shielding, likely using silver-based components |

| UK – Surrey Satellite | Three Earth observation microsats launched to LEO | April 2025 | Uses silver-based thermal films; part of Earth surveillance network |

| France – ArianeGroup | GEO communications satellite launched aboard Ariane 6 | February 2025 | Payload built with high-conductivity silver alloy circuits |

| India – ISRO | NAVIC-3 navigation satellite sent to medium Earth orbit | May 2025 | Power system reported to use silver-zinc batteries |

| Meta (w/ Anduril) | Secretive AI payload tested aboard commercial Falcon 9 launch | Ongoing 2025 | Unconfirmed reports of AI edge computing gear using silver-coated cooling systems |

| Russia – Roscosmos | GLONASS-M navigation satellite launched to replace aging units | April 2025 | Soviet-era silver-zinc battery tech still in use |

| UAE – Mohammed bin Rashid Space Centre | Mars data relay microsat launched via rideshare on Falcon 9 | March 2025 | Emirates pushing scientific autonomy; payload specs suggest silver thermal shielding |

China's "Landspace", US "SpaceX" and "RocketLab", UK, France, India, Meta, Russia, and UAE have been on a launching spree this year. Each launch represents not just another step toward digital surveillance or global connectivity, but another dent in terrestrial silver inventories. Silver’s role—thermal regulation, battery stabilization, and circuitry—makes each of these missions a micro-extraction event from Earth’s diminishing reserves.

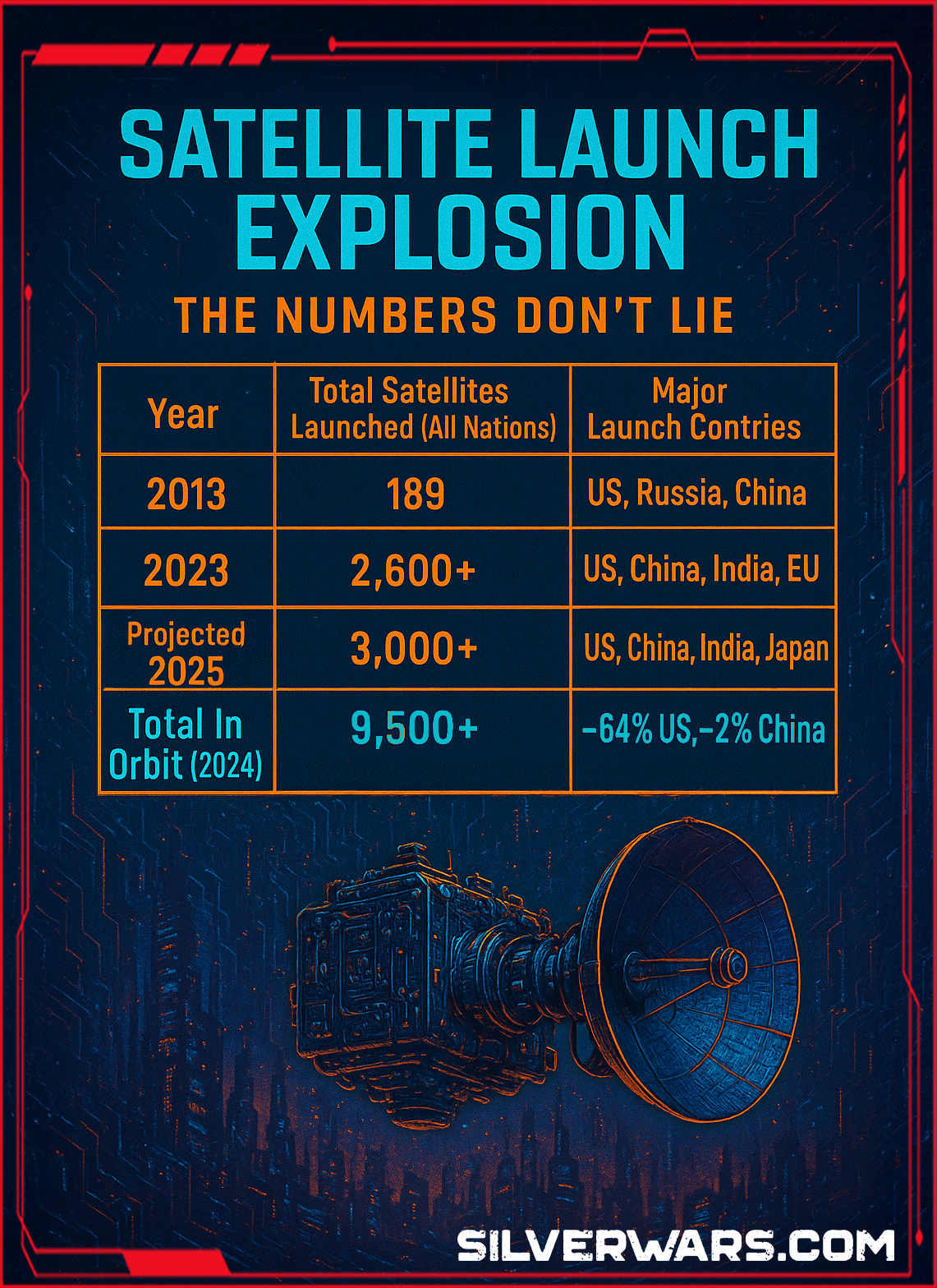

Satellite Launch Explosion: The Numbers Don’t Lie

| Year | Total Satellites Launched (All Nations) | Major Launch Countries |

|---|---|---|

| 2013 | 189 | US, Russia, China |

| 2023 | 2,600+ | US, China, India, EU |

| Projected 2025 | 3,000+ | US, China, India, Japan |

| Total In Orbit (2024) | 9,500+ | ~64% US, ~22% China |

Source: Union of Concerned Scientists Satellite Database; corroborated by space-track.org and Euroconsult

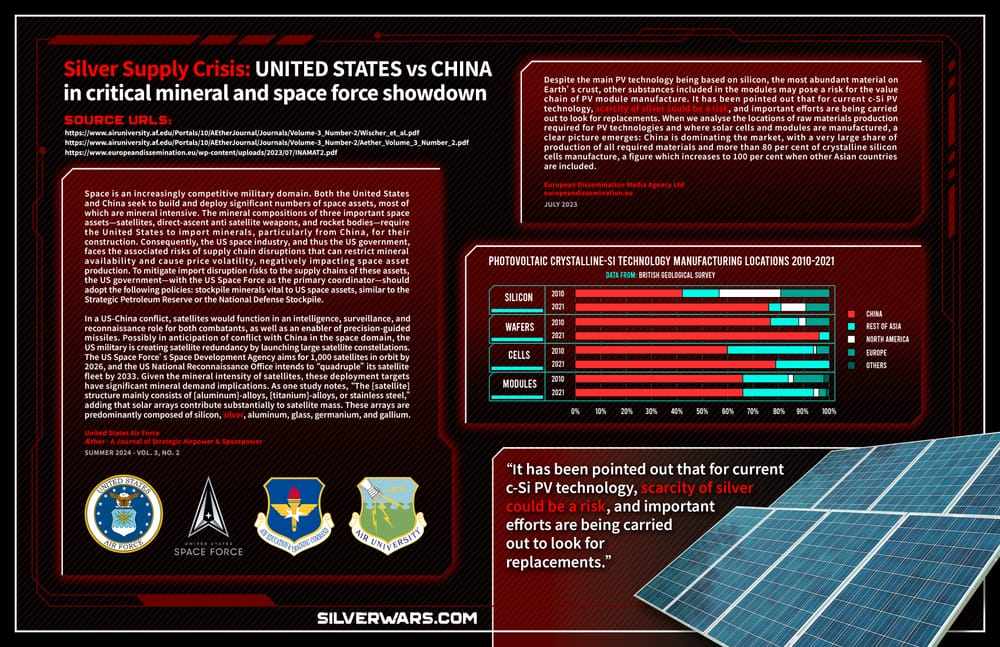

The US accounted for 62% of new satellite deployments in 2023. China came in second at 24%, but it’s closing in fast with its hyper-accelerated commercial and military launch schedules. India and the EU trail behind but are rapidly building up.

What’s more, this isn’t just about putting communication devices into orbit. Earth observation, military ISR (intelligence, surveillance, reconnaissance), anti-satellite tests, and classified payloads now make up a growing share of orbital traffic.

Silver in Satellites: A Burn Rate Nobody Talks About

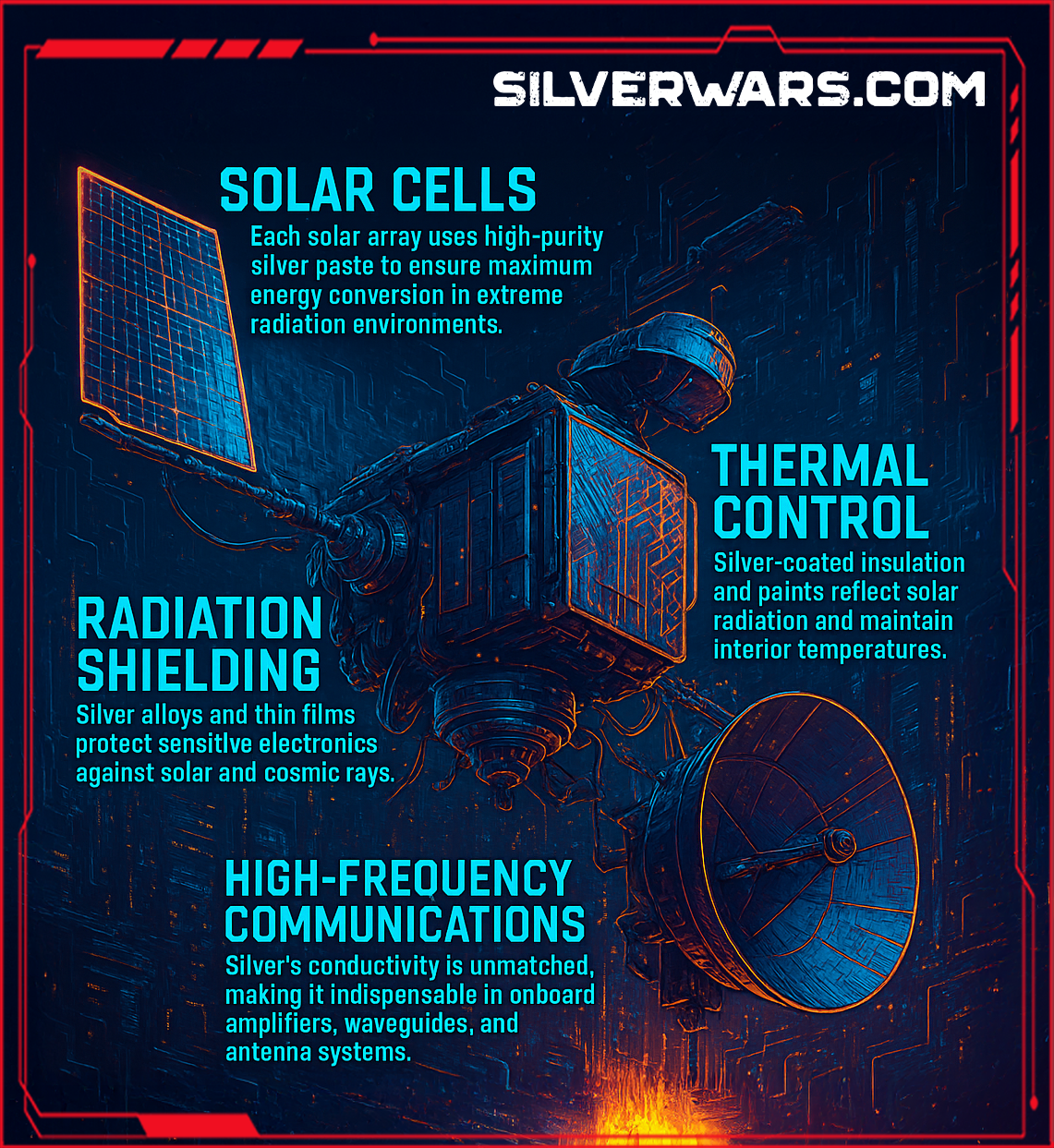

Most satellites require silver in several mission-critical systems:

- Solar Cells: Each solar array uses high-purity silver paste to ensure maximum energy conversion in extreme radiation environments.

- Thermal Control: Silver-coated insulation and paints reflect solar radiation and maintain interior temperatures.

- Radiation Shielding: Silver alloys and thin films protect sensitive electronics against solar and cosmic rays.

- High-Frequency Communications: Silver’s conductivity is unmatched, making it indispensable in onboard amplifiers, waveguides, and antenna systems.

According to data from the European Space Agency and corroborated by NASA contractors, the average medium-sized satellite (200–600 kg) uses between 20 to 50 ounces of silver across its internal components. Large communications satellites can use 75 ounces or more.

Silver Use in Global Satellite Launches

At this pace, nearly 130,000 ounces of silver could be launched into space every year—silver that will never be recovered, recycled, or reused. Unlike industrial uses in electronics or solar, satellite silver doesn’t come back down. It literally vanishes into orbit.

US and China Weaponizing Orbit—The Payload Gets Heavier

Both nations are embedding military surveillance, missile tracking, and AI-powered imaging into their satellite architecture. China’s BeiDou navigation system is a rival to GPS, and the Pentagon is fast-tracking the deployment of Next-Gen Overhead Persistent Infrared (OPIR) systems. These are hardened satellites with advanced optics, cooling systems, and electromagnetic shielding—loaded with silver-dense materials.

Los Angeles Air Force Base, home to Space Base Delta 3 and our Field Command, Space Systems Command (SSC). The USSF Space Systems Command’s Future Operationally Resilient Ground Evolution Program, also known as FORGE, is the ground system that will support the next generation of OPIR programs, including continued operations of legacy Space Based Infrared System (SBIRS), Next Gen OPIR GEO & Polar satellites, and Resilient Missile Warning / Missile Track Medium Earth Orbit (MEO) satellites.

Even Elon Musk’s Starlink network, which now has over 5,000 satellites, is expected to cross 30,000 by the end of the decade. SpaceX uses silver-heavy photovoltaic cells and gold-silver alloy bonding for thermal and radiation management.

This isn't just happening in low-Earth orbit. Geosynchronous and MEO payloads—especially military-grade ones—are growing, and they require far more shielding and onboard power.

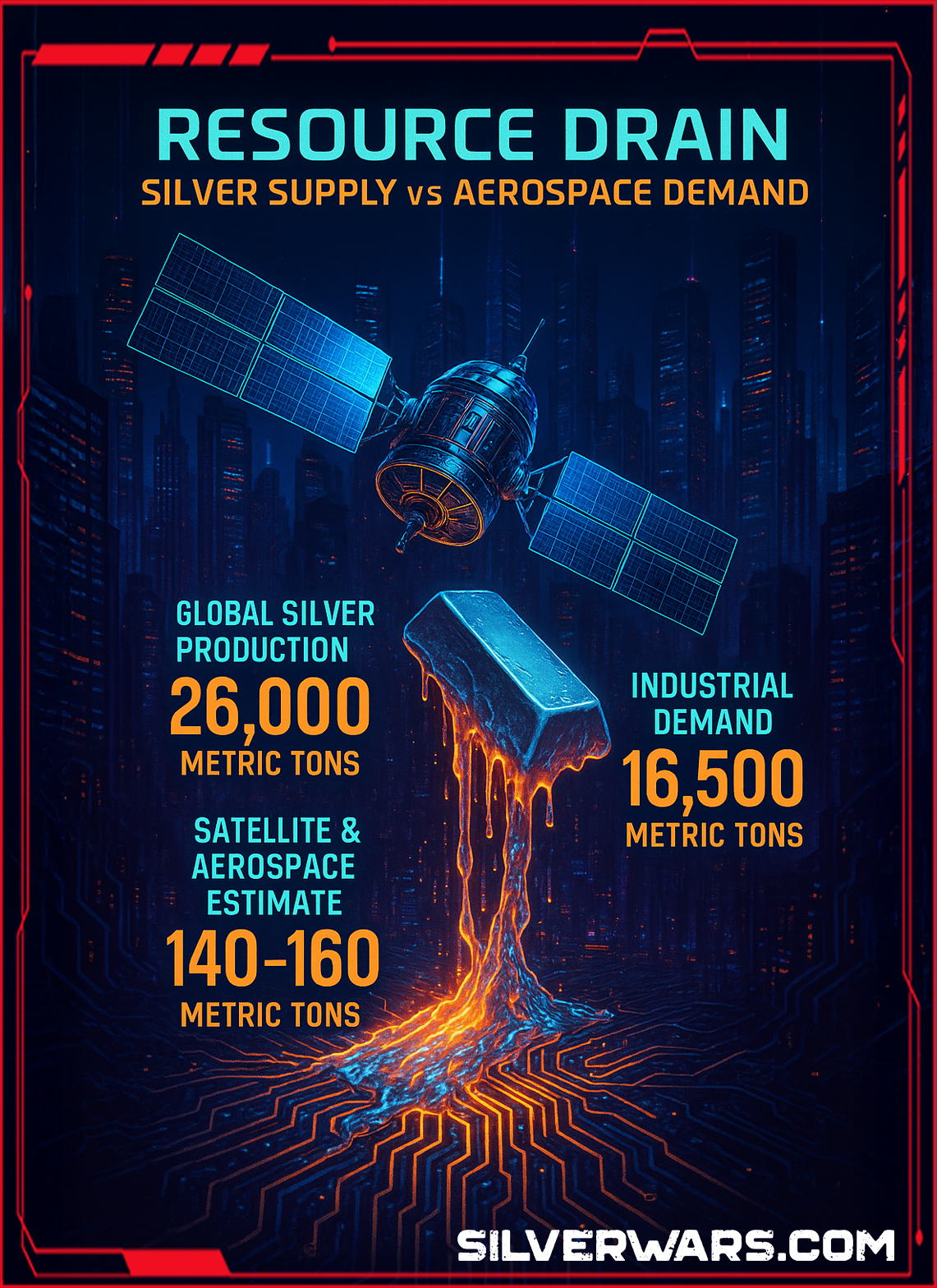

Resource Drain: Silver Supply vs Aerospace Demand

| Global Silver Production (2023) | 26,000 metric tons |

| Industrial Demand (2023) | 16,500 metric tons |

| Satellite & Aerospace Estimate | 140–160 metric tons |

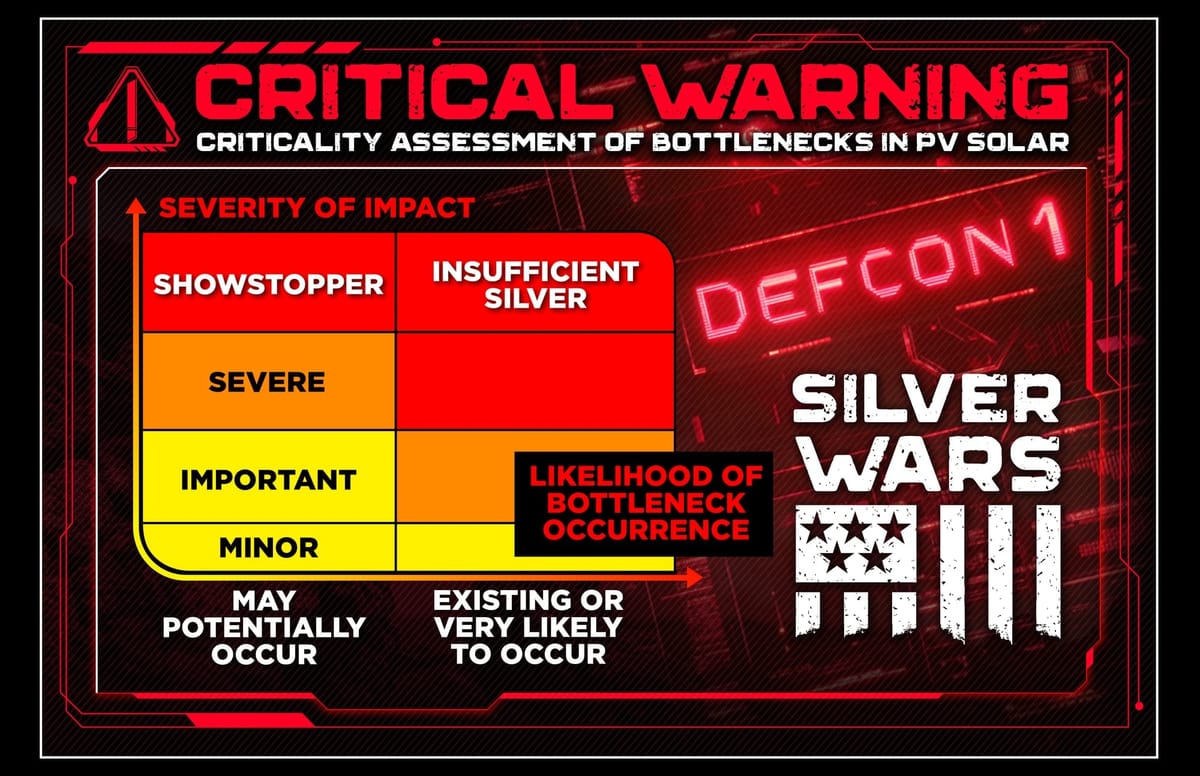

Satellite-based silver usage may still be a small share of total industrial demand—less than 1% today—but it's completely unrecoverable. And the growth curve is vertical. As launch capacity increases and more militaries rely on autonomous constellations, the extraction-to-evaporation pipeline will only widen.

Who's Buying Up Silver for Aerospace?

The buyers aren’t always visible, but the procurement is undeniable. US defense contractors like Lockheed Martin, Northrop Grumman, and Raytheon are sourcing rare-metal components under Pentagon contracts. China’s CASC and CNSA source from domestic mines but have turned to African and Latin American silver through multi-decade mineral partnerships.

In both nations, critical mineral stockpiles are being expanded, and silver is included in classified defense procurement lists, especially as satellite warfare and EMP resistance become more relevant.

What This Means for the Silver Market

The demand side pressure is mounting. While retail investors and solar manufacturers drive price momentum, the space race introduces a silent burn—consistent, non-recoverable demand that pushes silver permanently out of the supply pool.

Mining cannot scale fast enough to match the exponential launch cycle. That means above-ground silver stockpiles, ETFs, and sovereign reserves may become far more important over the next decade.

In a rare public comment, a former Pentagon logistics advisor was quoted in Defense One stating, “If you launch silver into orbit, you’d better be damn sure you don’t need it back.”

The Silver Wars Continue

The orbital frontier isn’t just filled with billion-dollar payloads and geopolitical flexing. It's slowly becoming a graveyard of lost silver. And as US and Chinese satellite counts rise into the tens of thousands, the metal’s role in this high-stakes chessboard is no longer just industrial—it’s strategic. Silver is being burned in silence, 200 miles above us, and the clock is ticking.