Venezuela’s long-standing narrative as an oil-dominant petrostate obscures a deeper strategic reality: the country sits atop significant critical mineral and metal deposits essential to 21st-century defense, industrial, and energy supply chains. Gold, silver, antimony, coltan, bauxite, and associated polymetallic ores position Venezuela not merely as an energy producer, but as a latent materials power.

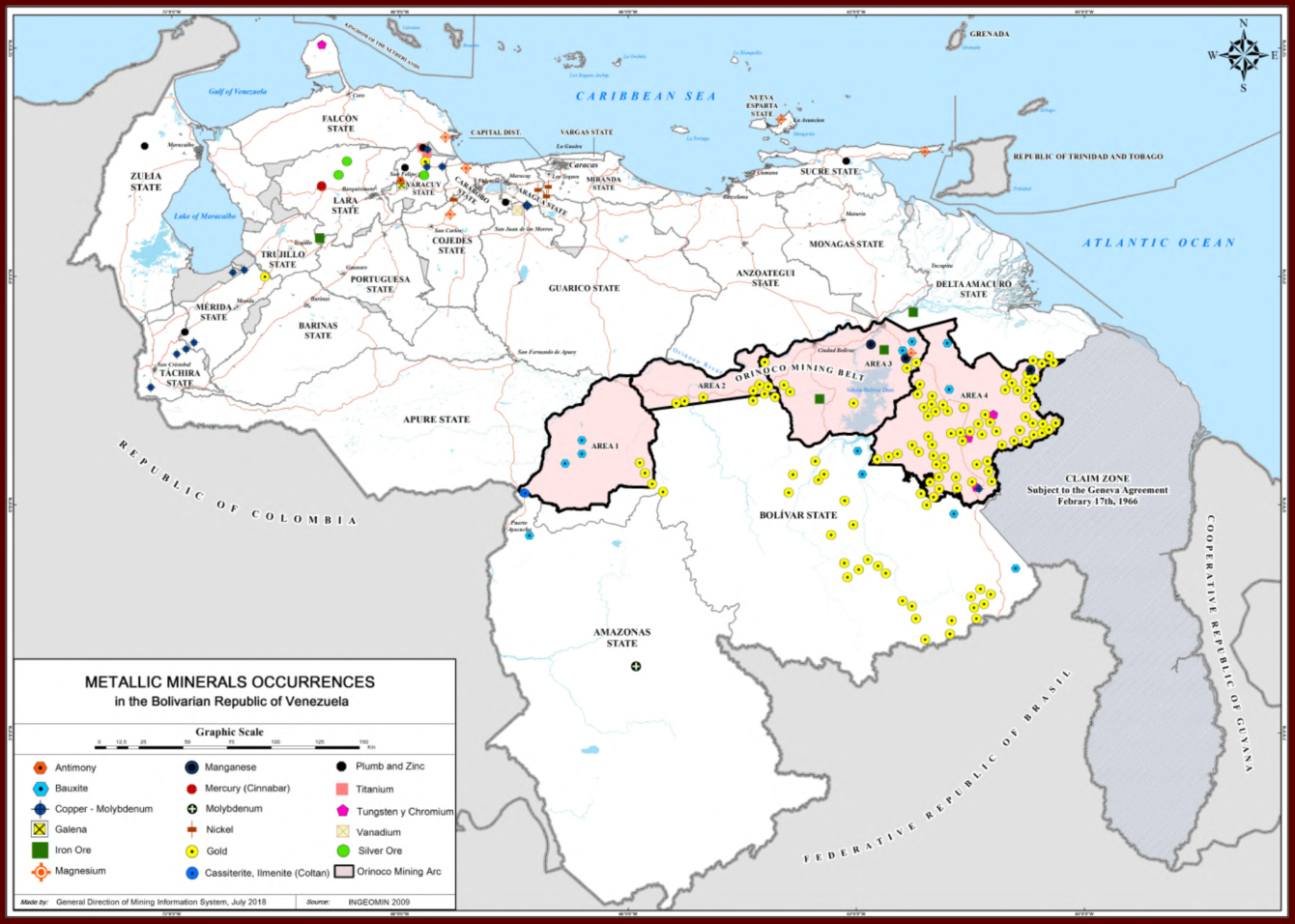

This mineral reality was formally acknowledged in 2016 with the creation of the Orinoco Mining Arc Strategic Development Zone (OMA). Covering approximately 112,000 km², nearly 12 percent of Venezuelan territory, the Arc has since become a contested mineral theater, where state authority, criminal networks, foreign interests, and strategic finance intersect.

Although oil remains the headline commodity, critical minerals increasingly underpin modern military and industrial capability, enabling alloys, electronics, sensors, batteries, and weapons systems. Reflecting this shift, the United States formally reaffirmed silver and other minerals as national-security-critical materials in late 2025, underscoring their strategic relevance well beyond monetary or industrial uses.

ORINOCO MINING ARC - Zone of Strategic Importance

The Venezuelan government’s 2016 enactment of the Orinoco Mining Arc was framed as an economic stabilization mechanism amid national collapse. On paper, the Arc centralizes state control over exploration and export of resources including gold, diamonds, coltan, bauxite, silver, antimony, and associated metals.

In practice, however, the Arc has evolved into a hybridized shadow-state economy:

🔴Criminalized Extraction:

The Arc has become a magnet for illegal mining operations controlled by non-state armed actors, including organized crime syndicates, guerrilla groups, and state-aligned militias. These actors dominate extraction, logistics, and enforcement, blurring the line between sovereign resource control and illicit enterprise.

🔴Silver as a Hidden Strategic Output:

While gold dominates headlines, silver is systematically extracted as a by-product of illegal gold mining, embedded within gold doré bars that frequently contain 10–50 percent silver. This silver exits Venezuela invisibly, laundered through gold supply chains and refined abroad, effectively bypassing all formal reporting and sanctions frameworks.

🔴Environmental and Human Degradation:

Mining activity has caused severe ecological damage, including deforestation, mercury contamination of river systems, and devastation of Indigenous territories and protected ecosystems. These impacts destabilize governance and create long-term humanitarian liabilities.

🔴State Channeling of Illicit Output:

State-linked enterprises and military actors have, at times, absorbed illicitly mined product into official export pathways, sustaining regime finances while preserving plausible deniability.

The Orinoco Mining Arc thus represents a vast, unregulated, yet geopolitically critical mineral reserve, one that remains exploitable through either stabilization and reform or continued criminal entrenchment, depending on external alignment and intervention.

U.S. STRATEGIC INTERESTS – Minerals Move to the Forefront

Recent U.S. policy signals reflect a decisive shift:

🎯Critical minerals are now explicitly framed as national-security assets, not merely economic inputs. Strategy documents increasingly emphasize materials resilience alongside force posture.

🎯Western Hemisphere resource security has emerged as a counterweight to Chinese and adversarial dominance in global mineral supply chains.

🎯Pressure on the Maduro regime aligned not only with democratic norms, but with supply-chain denial logic aimed at preventing hostile consolidation of strategic materials.

Taken together, these signals suggest a reordering of strategic priorities in which control over upstream resource flows is treated as a prerequisite for sustained military readiness and industrial autonomy.

Power in the next era is decided upstream, where minerals are secured, denied, or weaponized long before territory is contested.

INDUSTRIAL AND DEFENSE SUPPLY-CHAIN STAKES

Minerals embedded in Venezuelan geology are foundational to:

🎯Battery systems and power storage

🎯Advanced electronics and semiconductors

🎯Aircraft, missile, and propulsion components

🎯Communication, radar, and sensor arrays

As U.S. and allied defense planning increasingly prioritizes secure, traceable, and allied-controlled material flows, Venezuela emerges as a latent supply-chain node whose future orientation remains unresolved.

China’s Economic Footprint in Venezuela

Beijing’s ties to Caracas did not begin with critical minerals, but have deep roots in oil-for-loans diplomacy and major infrastructure financing. Over the past two decades:

🔴Bilateral trade swelled dramatically from under $1 billion in the early 2000s to upward of $20 billion by 2012, with Venezuela becoming one of China's key oil suppliers. China provided multi-billion dollar loan packages structured to be repaid through Venezuelan crude exports.

🔴China's financial institutions, such as the China Development Bank and Export-Import Bank of China, became leading lenders to Caracas, cumulatively financing tens of billions of dollars in energy and infrastructure projects.

🔴Trade arrangements routinely included debt-for-oil repayment mechanisms, positioning Venezuela as China's fourth largest supplier at leak levels.

While oil dominated the initial phase of cooperation, critical minerals and resource extraction became part of China's broader engagement strategy.

Chinese companies have negotiated access to Venezuelan mineral projects, including iron ore, bauxite, gold, silver, and other rare earth-associated deposits, often in partnership with state-owned enterprises such as Corporación Venezolana de Guayana (CVG).

Analysts estimate that much of these deals are opaque or structured through joint ventures with undisclosed ownership layers, a pattern consistent with China's broader critical mineral investment model worldwide.

Venezuela's Orinoco Mining Arc has been part of the backdrop of these engagements. Chinese firms have targeted these assets as part of both formal and informal off-takers of mined outputs.

Beijing's engagement in Venezuela cannot be viewed in isolation, but reflects a broader pivot towards securing critical minerals; however, China now has sunk-cost exposure. China is unlikely to accept quiet displacement. It only needs to deny clean Western consolidation long enough to preserve access or raise costs. Russia and Iran have asymmetric interests as well, which is likely to raise friction and unpredictability during transition phase.

FINANCIAL POSITIONING – Rothschild & Co. Engagement

In April 2024, Venezuelan authorities contracted Rothschild & Co. as a financial adviser to map the nation’s defaulted foreign debt and explore restructuring options.

This engagement carries strategic implications beyond balance sheets:

- Sovereign debt advisory roles often precede market normalization, capital inflows, and structured access to national assets.

- Financial advisors at this level routinely influence investment frameworks, debt-for-resource mechanisms, and concession architectures.

- Historical precedent shows that such positioning enables early leverage over resource access before political risk premiums compress.

This alignment warrants close monitoring. Financial restructuring frequently acts as the opening move in broader resource realignment, particularly where minerals are underdeveloped, unregulated, or informally monetized.

Intelligence confirms a historical financial intervention linking the Rothschild dynasty to Subject: TRUMP via Wilbur Ross.

The 1990s Bailout: In the early 90s, Trump's Taj Mahal casino faced insolvency ($3B debt). Wilbur Ross, then Senior MD at

Rothschild Inc., represented the bondholders.

Volex has pivoted from commodity cabling to "Complex Industrial Technology," focusing on high-reliability sectors. This shift requires absolute supply chain control.

VENEZUELA CONNECTION:A post-sanction Venezuela requires total electrical grid reconstruction—a primary market for Volex. Access to the Orinoco Mining Arc lowers COGS for defense manufacturing.

GAME THEORY – Infrastructure as the Public Narrative

A recurring pattern in strategic resource theaters:

- Infrastructure investment precedes extraction.

- Roads, ports, power generation, and energy projects expand logistical reach and normalize access.

- Energy development, especially oil, provides political cover and public legitimacy, while mineral extraction benefits quietly accrue.

This model positions infrastructure as the visible objective, while critical mineral access remains the underlying strategic payoff.

“U.S. government and military sources describe extractive-sector development as infrastructure-bound: transport and power access determine mining feasibility, while hydrocarbon projects drive pipeline/refining build-outs that can expand the same logistics and access layer mineral projects rely on.”

INSTABILITY, LOCAL IMPACT, AND THE LONG GAME

Resource strategy must account for on-the-ground realities:

- Local populations engage in informal mining as a survival mechanism.

- Environmental toxins undermine health, governance, and economic recovery.

- Abrupt external intervention risks destabilizing entrenched informal economies.

There is no short-term mineral windfall. Sustainable access requires stabilization, environmental remediation, and structured economic transition, or risk perpetuating chaotic extraction zones incompatible with allied objectives.

STRATEGIC RECOMMENDATIONS

🔴Resource Priority Recognition:

Formally recognize Venezuela as a critical mineral theater, not solely an energy domain.

🔴Financial Intelligence Exploitation:

Scrutinize Rothschild & Co.’s advisory scope to:

- Identify future concession pathways

- Assess alignment risks between allied and adversarial capital flows

🔴Infrastructure Leverage:

Tie infrastructure development to defense-aligned mineral access and transparency benchmarks.

🔴Civil–Military Integration:

Couple mineral strategy with:

- Environmental remediation

- Local economic stabilization

- Security sector reform to displace criminal control

SITREP

Venezuela is not just oil.

Its minerals, illicit extraction networks, and converging financial mechanisms position it as a critical strategic resource theater with global supply-chain consequences. Access is contested, opaque, and increasingly weaponized.

The advantage for the United States and its allies lies in synchronizing financial leverage, infrastructure development, and security strategy to secure critical minerals before adversarial powers consolidate irreversible control.

This is not a question of if minerals matter.

It is a question of who controls them, how, and when.