INTRODUCTION

There persists a conspiracy. There is such a plot, international in scope, generations old in planning, and incredibly evil in intent. The super rich enjoy power and prerogatives unimaginable to most of us. Money alone is not enough to quench the thirst and lusts of the super rich. Instead, many use their vast wealth, and the influence such riches give them, to achieve even more power. Power of a magnitude never dreamed of by the tyrants and despots of earlier times.

Power on a world wide scale. Power over people, not just products.

Underlining all the power s0ught is a consistent need to manipulate silver, whether to maintain or advance itself. Therein lies the rub and hope for humankind.

The super-wealthy have influenced world powers to manipulate the price and supply of silver. The United States has maintained control of the market for nearly a century.

WW2 would change silver's role from a monetary metal shift to industrial. Nearly a billion ounces would be consume from the war. The United States didn't have the resources to fight the Cold War, but it did have leverage; the bomb. Globalism out of necessity. World Govt out of fear and submission.

Since the 1950s, all commodities markets in the west have been rigged by the member nations of NATO in the assuages of "National Security". The fear of nuclear holocaust is a huge motivator. The idea was to prevent the Soviets from acquiring the resources needed to craft their own atomic and military power, but it transferred control of domestic and allied markets to be maintained at the discretion of the US President, unbeknownst to the public because this was classified at the time.

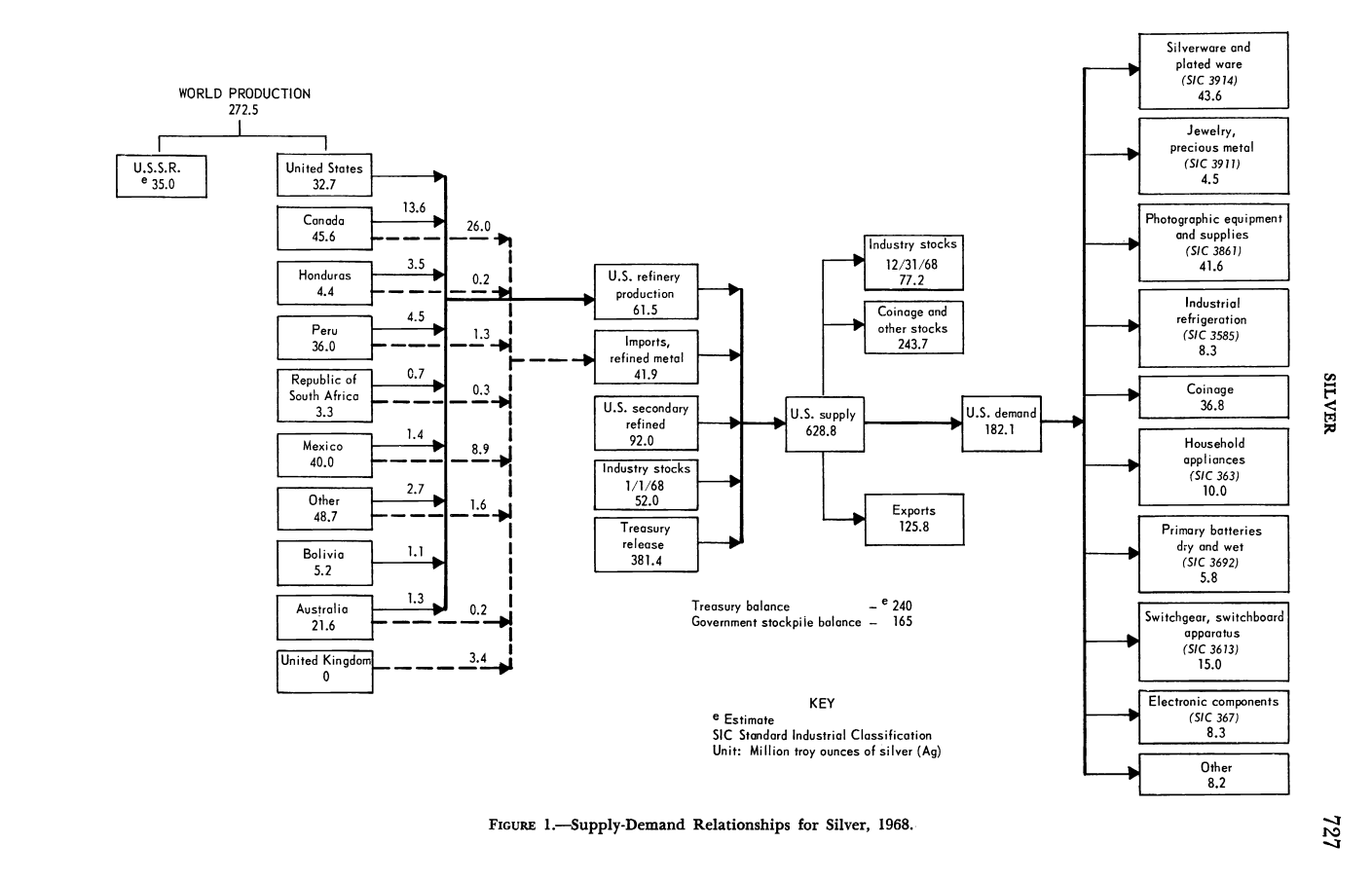

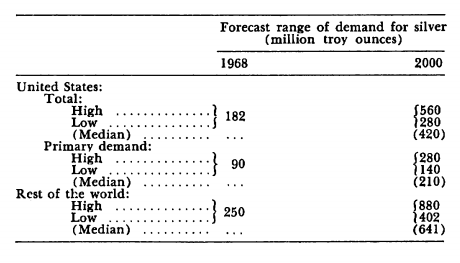

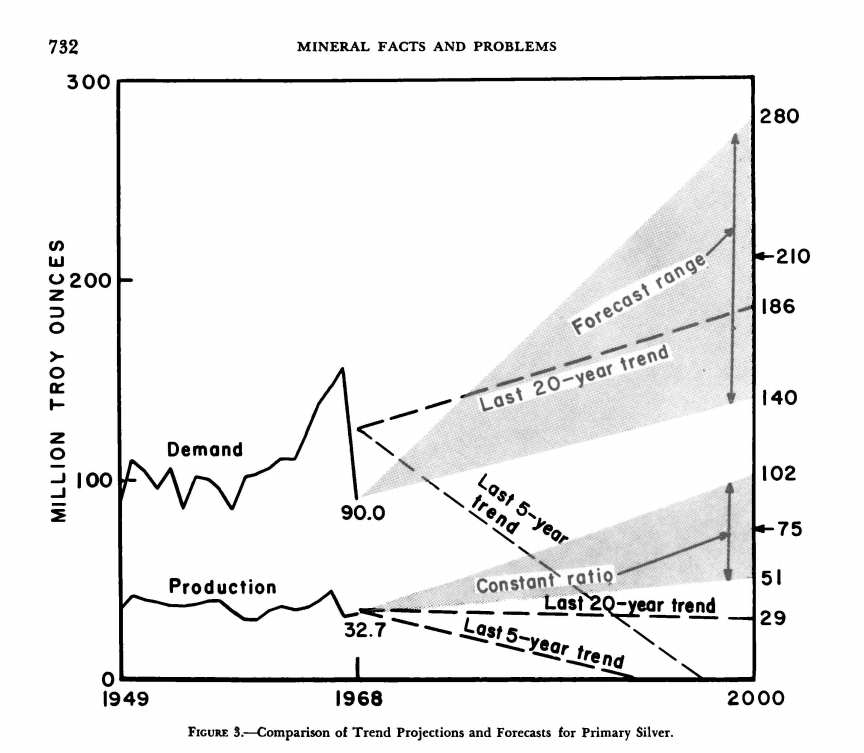

It has been known since the 1970s that the industrial demand for silver projected to 2000 was going to amount to a 6 billion ounce shortfall domestically and as 14 billion ounce shortfall globally. Given the secrecy of the subject "silver", we cannot even trust that these numbers are accurate. We side that these could be the best case scenario numbers rather than worst since this document was made public.

That reality, along with troubling economic conditions at the time led to the Hunt Brothers squeeze on silver. This attempt to control the market resulted in the decision at the highest levels being made to change the rules and take away the Hunt's silver, effectively ending their attempt to corner the supply. The revealed the tiny supply and illustrated that all laws can be broken to achieve control of silver for National Security.

The market was in disarray and public started to hoard causing industrial unavailability, so the Reagan administration pushed to sell off the remaining silver in the Strategic Stockpile. Although the initial attempts were blocked by Congress, but after opposition was assassinated, the American Silver Eagle program was born to slowly ease the remaining silver into the market. The announcement that the US would sell its entire stockpile did the trick on the market, and the price of silver was brought back down from peak in the 80s and industry was able to acquire silver from demoralized investors.

Both Nelson Bunker Hunt and that opposition in the Congress were members of a patriotic society that was formed to end the conspiracy and save the founding father's ideals of the American Republic. They failed to stop the hunger of the beast and paid.

Today, the circumstances give the public the leverage to participate, end the conspiracy, and take back their God given Freedoms. All it takes is holding physical silver. No ETFs, Funds, or Commodity-backed cryptos. These are deliberate distractions to gaslight the market.

The Silver is not there, only paper I.O.U.(s).

To bring to your attention this information has come at immense emotional, financial and psychological costs. We have been terrorized, extorted, threatened, and pushed to the outer limits of what is tolerable in this unjust and unfair society. We are putting our lives on the line to bring you this information, we kindly ask that you give generously to our "We Did Not Suicide Ourselves" fund below.

God Bless the Human Race.

ACT I - The Long Conspiracy Forms

PROOFS OF A CONSPIRACY - 1797

John Robison (1739–1805), professor of natural philosophy at Edinburgh, published "Proofs of a Conspiracy Against All the Religions and Governments of Europe" in 1797 to warn that the same forces behind the French Revolution were active across Europe. Drawing on testimony from the ex-Illuminatus Alexander Horn and other “authorities,” Robison argued that an international network of elite‐backed secret societies—infiltrating Freemasonry, the Bavarian Illuminati, and various “Reading Societies”—had a long-term design to reshape European civilization in their own interests.

[Actors]: Adam Weishuapt's Bavarian Illuminati (founded in 1776), high-degree Freemasons, allied "reading societies."

[Patrons]: Wealthy aristocrats, bankers, and industrial magnates who funded the conspiracy for political influence and profit.

[Method]: Deep cover infiltration, oaths of secrecy, use of masonic rituals, recruitment of rising civil servants and intellectuals, dissemination of radical literature.

Robison's work, while polemical, becomes a touchstone for later, defining a template in which hidden plutocratic interests manipulate mass movements for private gain.

PROOFS OF A CONSPIRACY - 1802

The principal conspiracies Abraham Bishop lays out in his 1802 pamphlet,

"Proofs of a Conspiracy, Against Christianity, and the Government of the United States", in which he exposes what he sees as a collusion between New-England's established church and the Federal political elite to subvert both true Christianity and republican government.

Bishop rests on hundreds of legislative extracts, sermon snippets, and official proclamations (drawn largely from Massachusetts and Connecticut) demonstrating that, far from being separate spheres, church and state in New England had become a single, conspiratorial power bent on subverting both authentic Christian faith and the democratic republicanism of the new United States.

PATTERNS

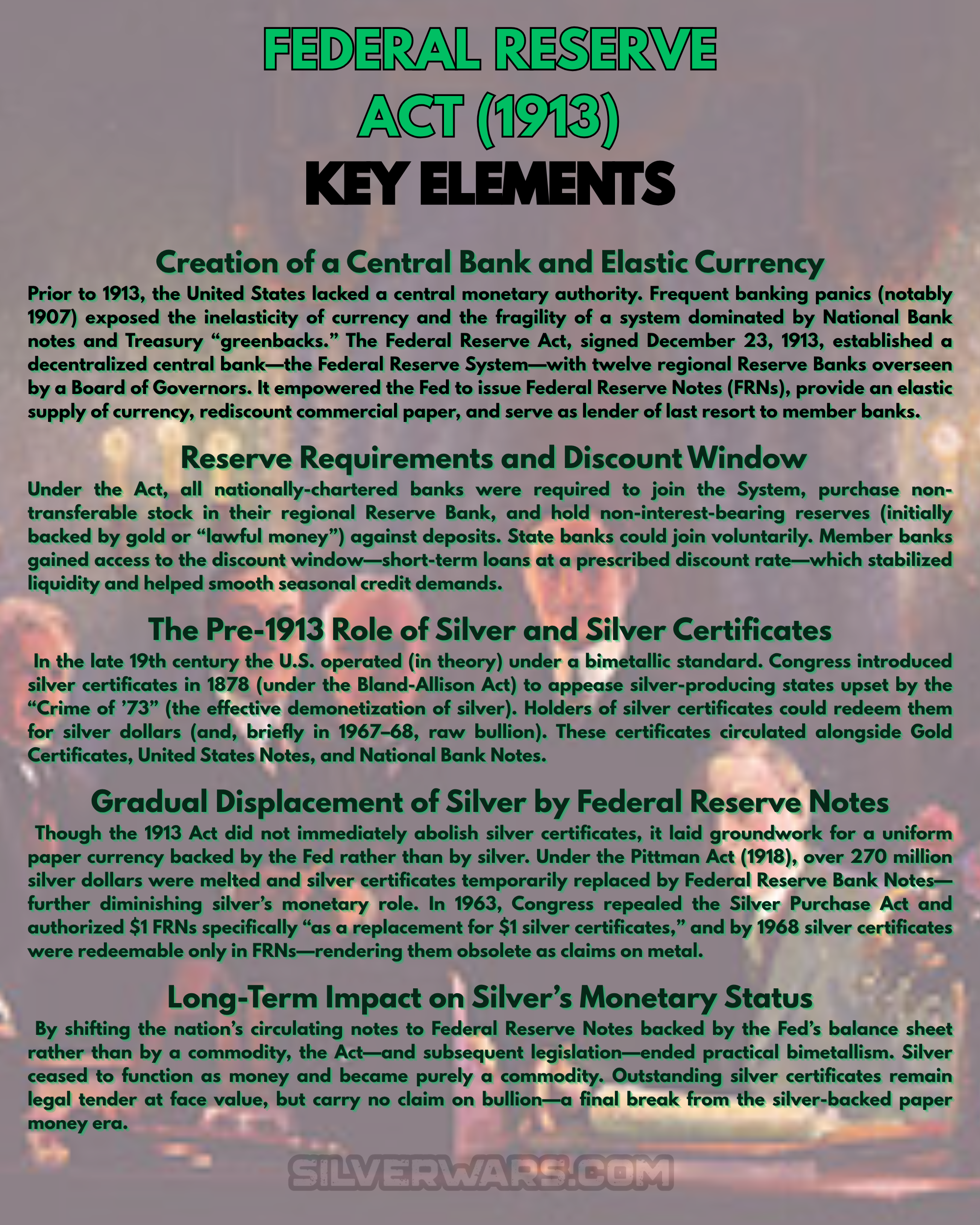

Unconstitutional - FEDERAL RESERVE ACT (1913)

Woodrow Wilson signs the Federal Reserve Act into law in 1913. According to Andre' Combes, President Wilson was a Freemason.

SILVER SECRETS

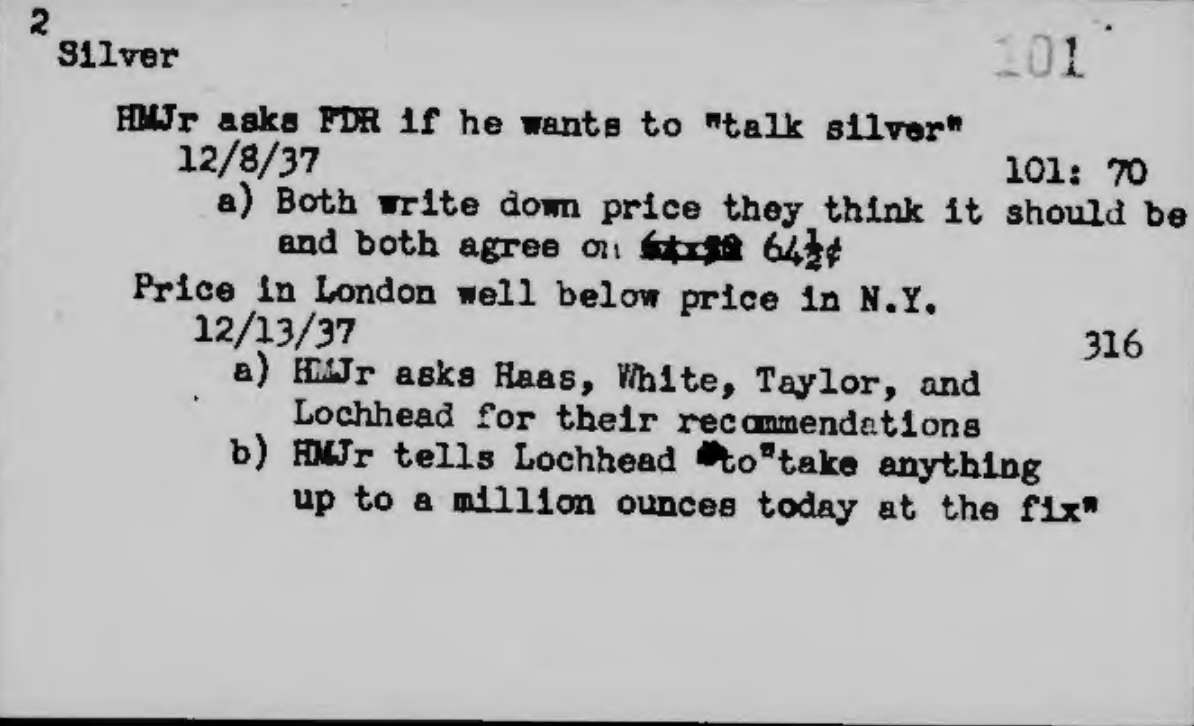

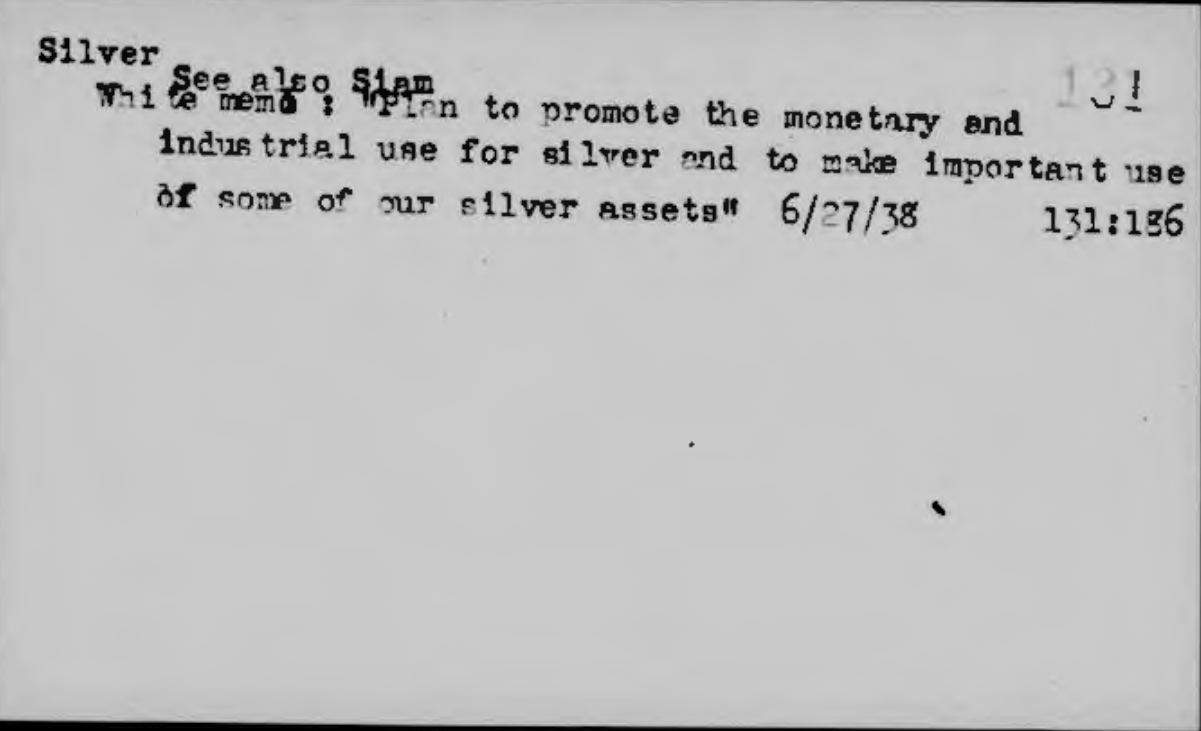

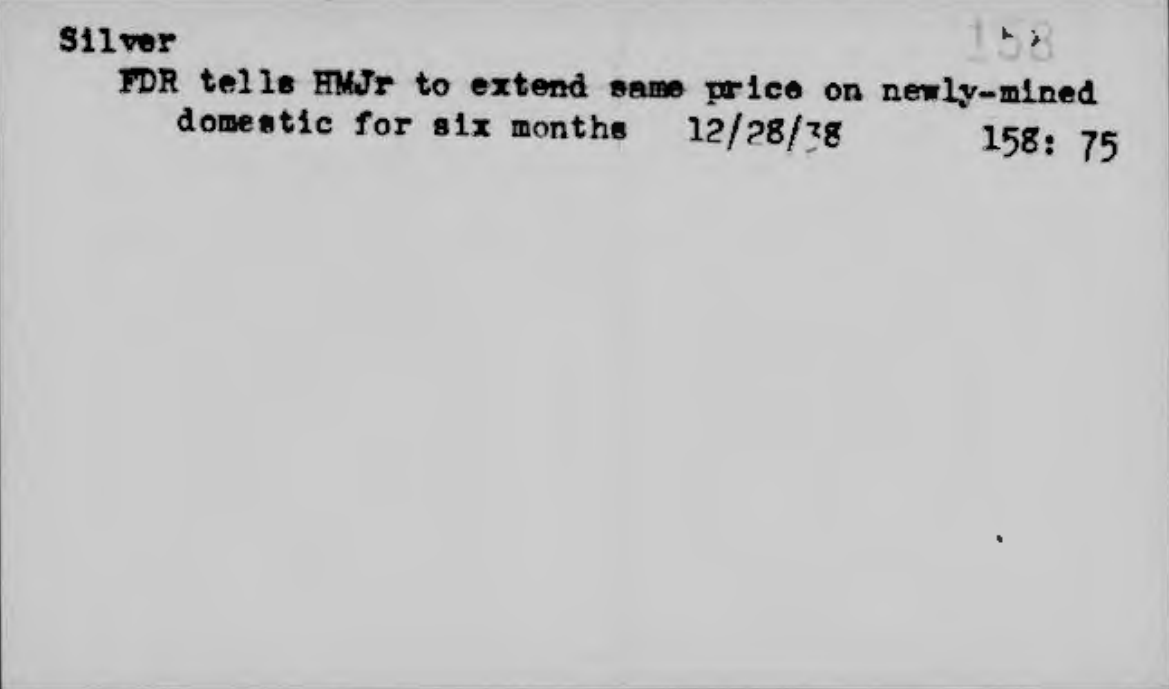

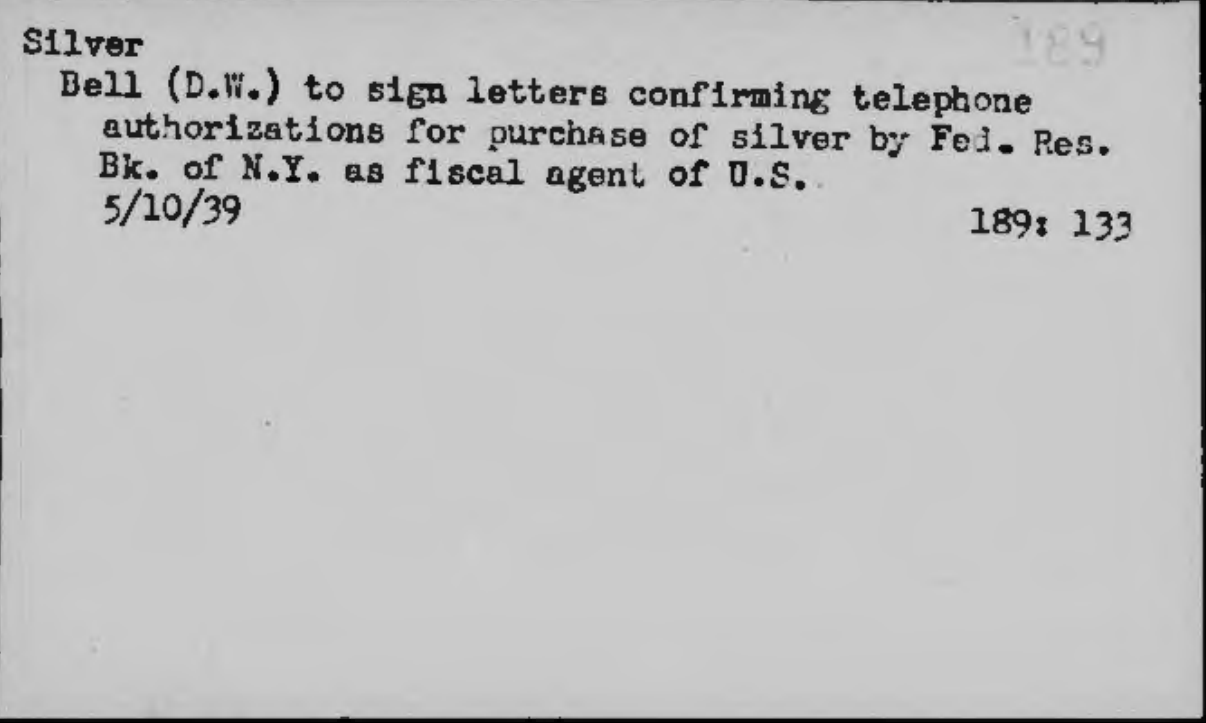

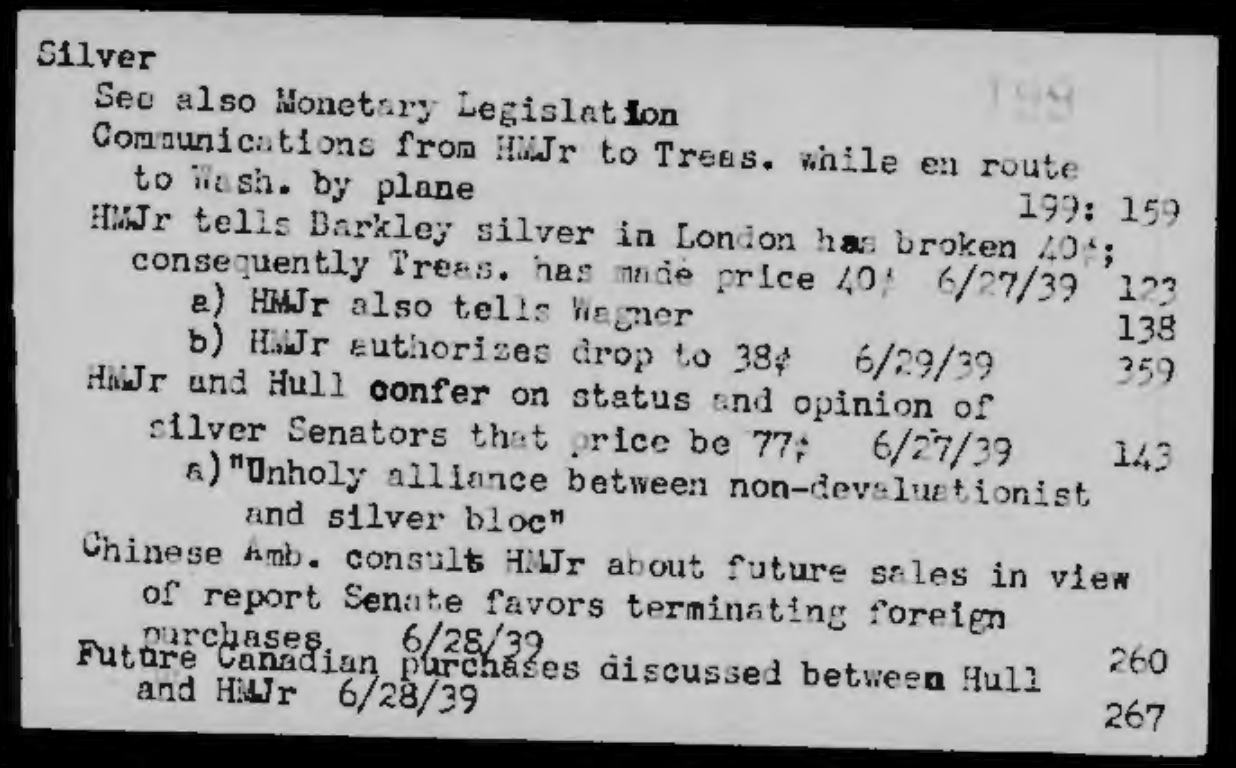

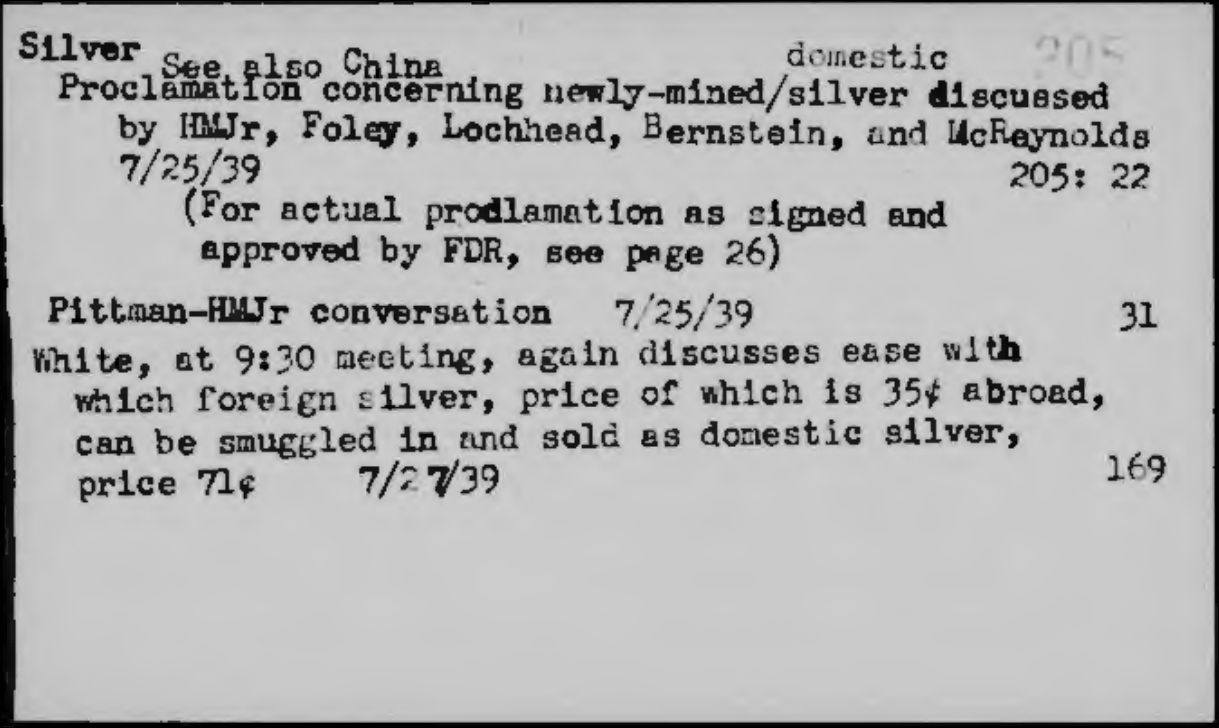

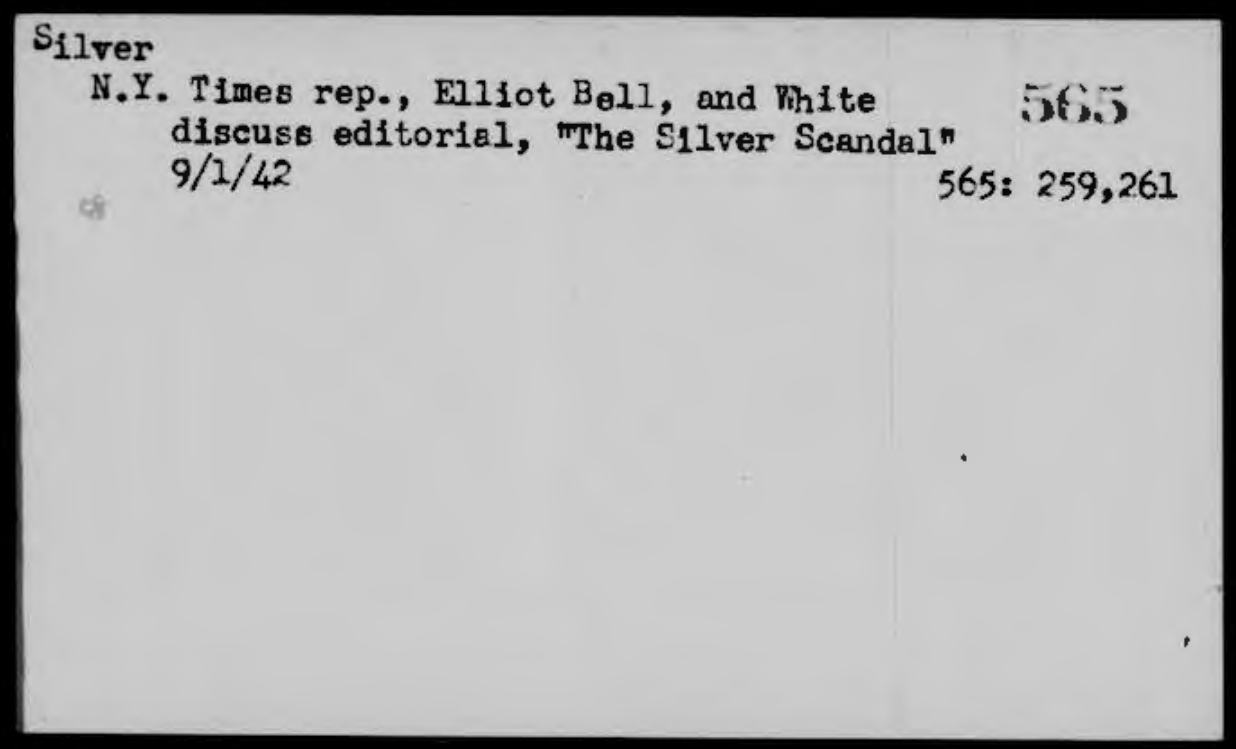

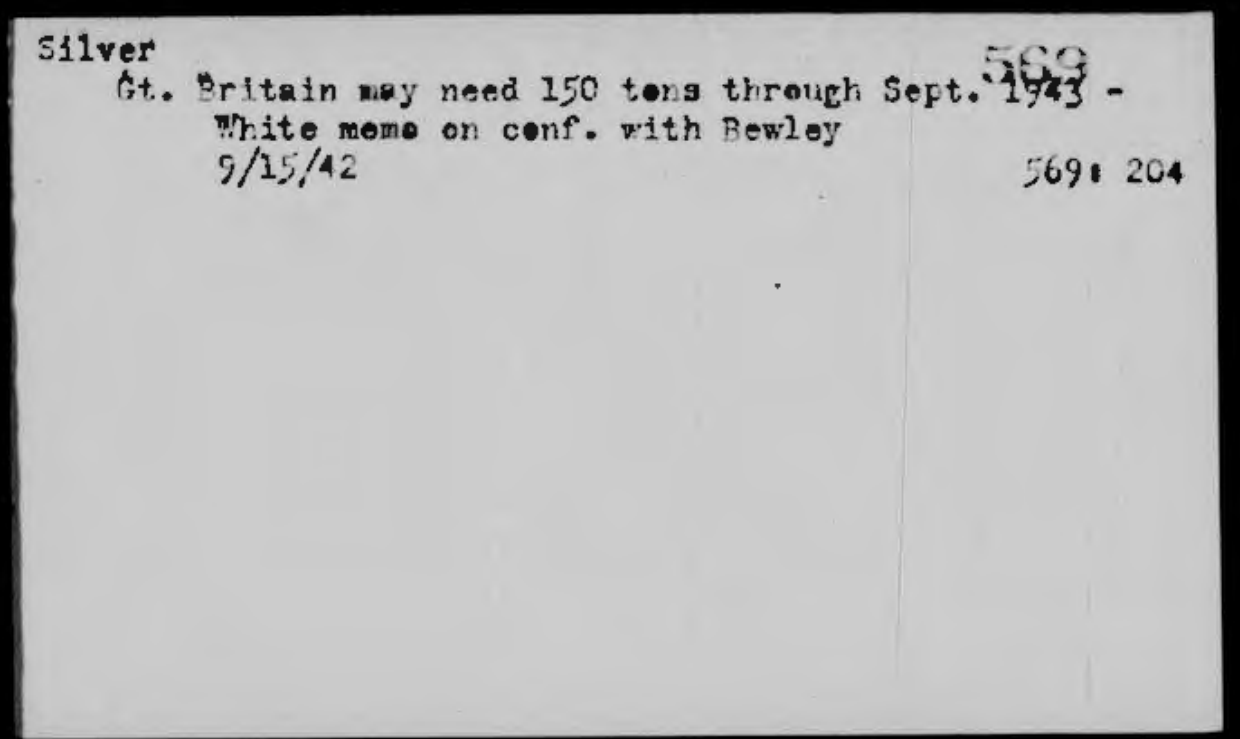

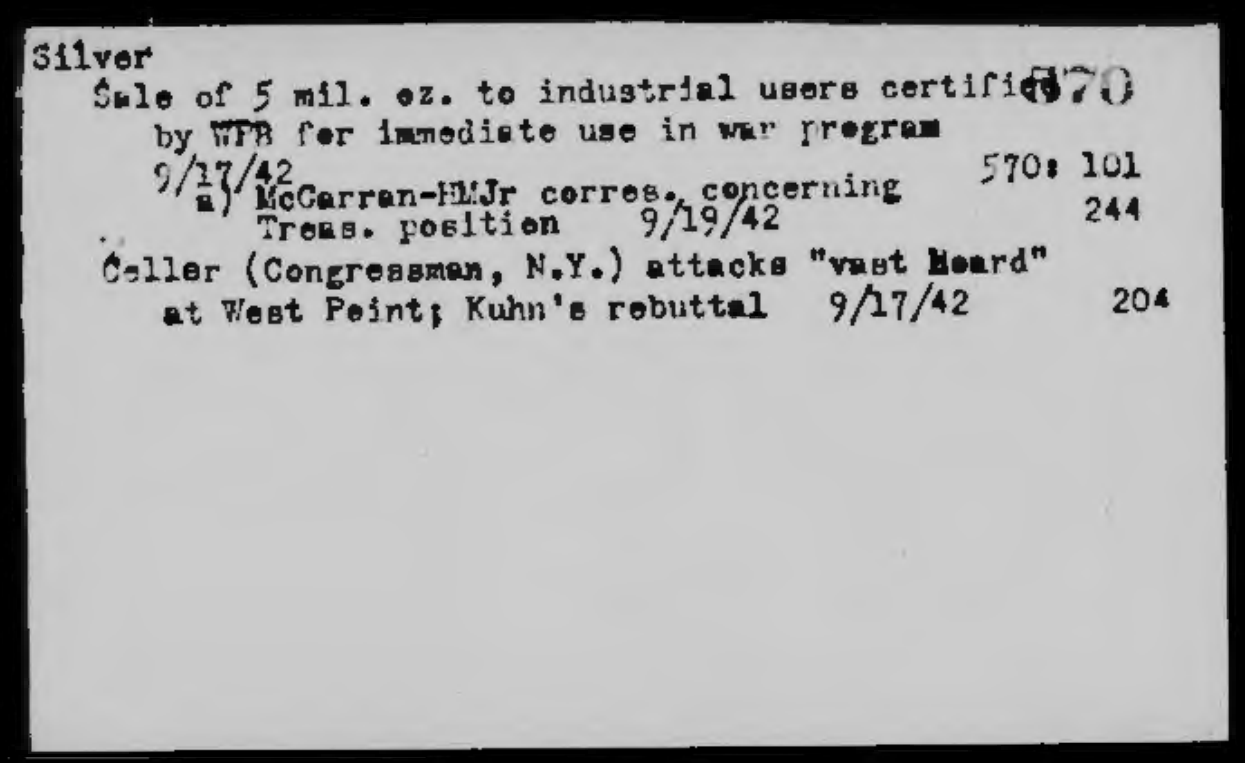

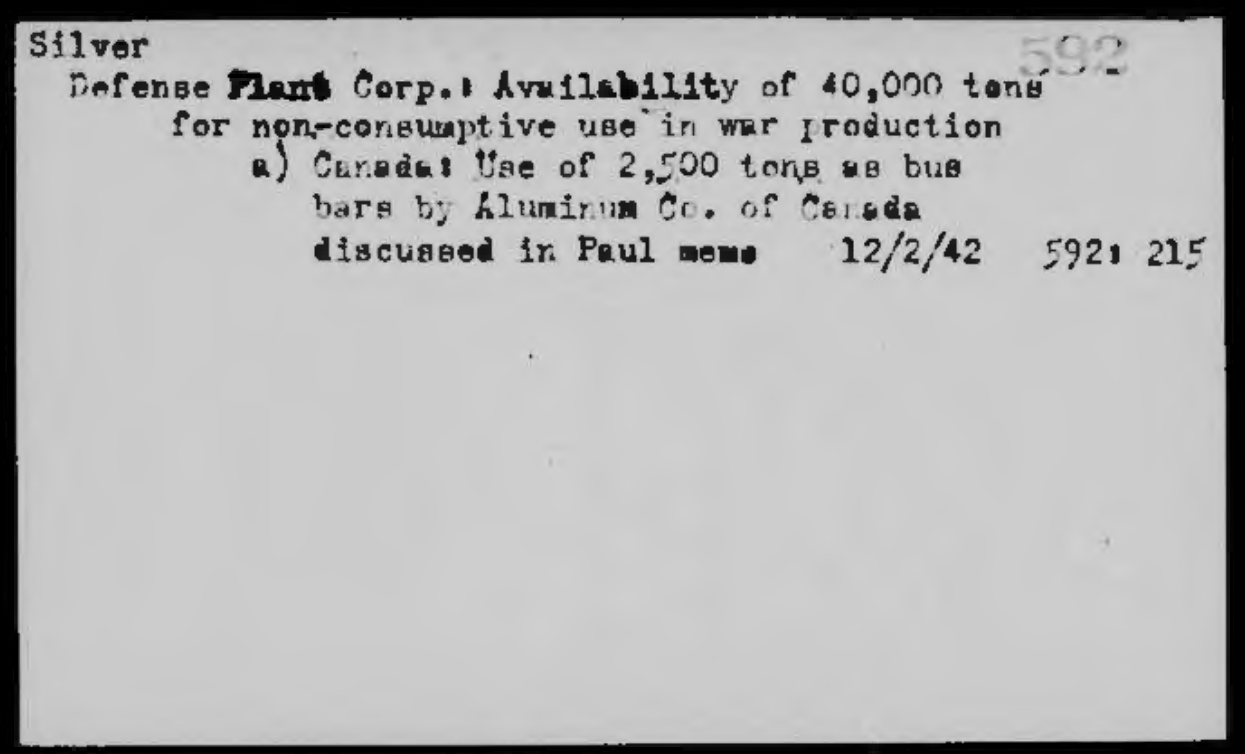

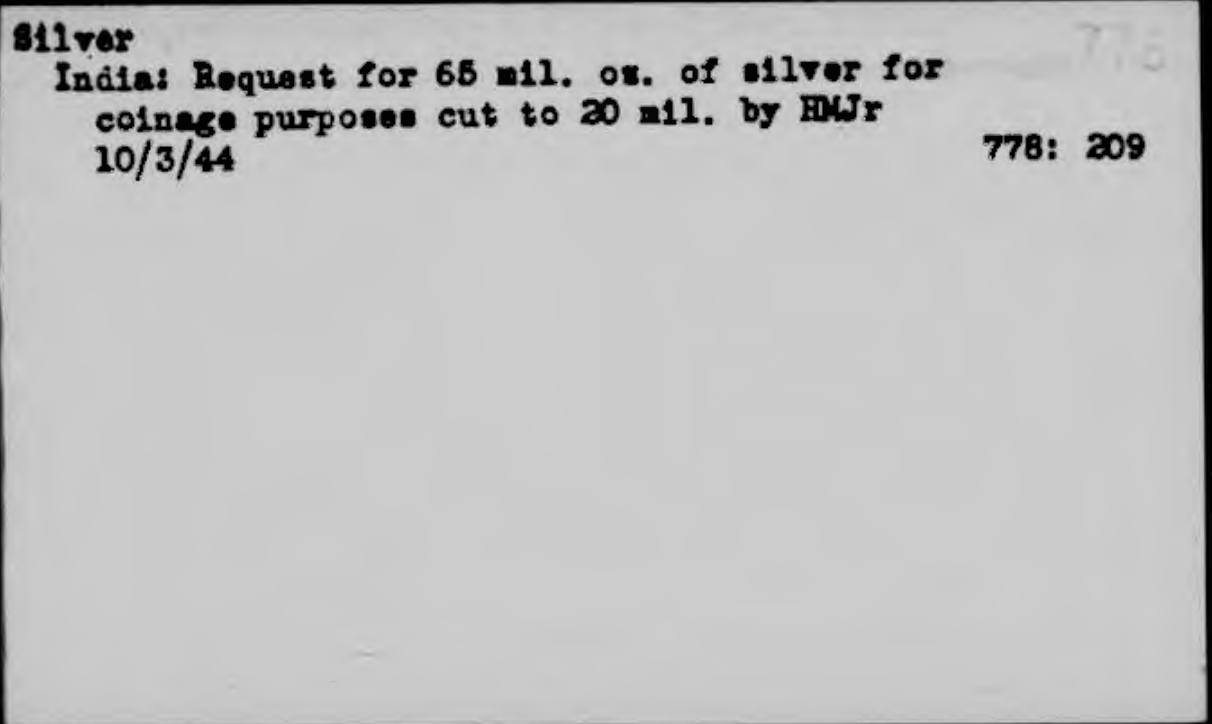

We've unearthed FDR Presidential memos within the National Archives related to Silver. These provide a glimpse into the secret arrangements of the nations silver supplies behind the scenes:

Looking to diversify your portfolio with tangible assets? Jim Cook at Investment Rarities offers expertly curated asset investments with their extremely dedicated team. Discover unique opportunities often overlooked by traditional markets. Visit InvestmentRarities.com Today!

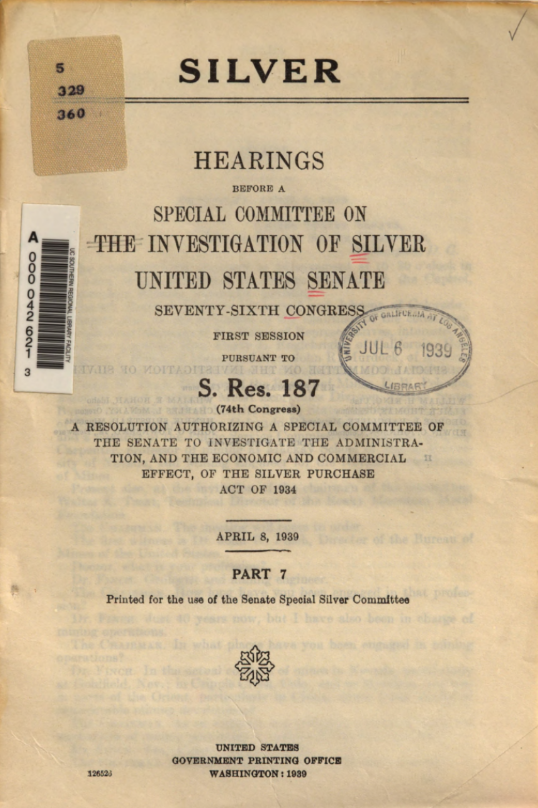

SPECIAL COMMITTEE ON THE INVESTIGATION OF SILVER

Obfuscated from the Record was the "U.S. Senate Special Committee on Investigation of Silver".

From the hearings before the Special Committee on the Investigation of Silver (Apr. 8, 1939), the key facts on silver’s industrial (arts and manufacturing) usage were:

Volume of Industrial Consumption

- In 1929, when domestic mine output was about 61 million fine ounces, some 31 million ounces (≈ 51 percent) were used in the arts and industries.

- By 1937, domestic mine output had risen to over 71 million ounces, yet industrial consumption only amounted to 51,292,270 ounces—just 27 percent of total U.S. production .

Shift to Imported Silver for Industry

- Because Treasury purchases of domestic silver were made at much higher prices (64.64 cents/oz after Jan. 1, 1938), industrial users turned almost entirely to lower-cost foreign silver.

- In 1938, the average London (“foreign”) silver price was 43.22 cents/oz, versus 64.64 cents/oz for newly mined U.S. silver .

Trend in Proportion of Production Absorbed by Industry

- Despite a near tripling of mine output from 23 million ounces in 1933 to over 71 million in 1937, industrial offtake grew only modestly, so its share of production declined from over 50 percent in the late 1920s to roughly one-quarter by 1937

Broader Economic Impact

Committee witnesses argued that the U.S. silver program had forced China off its silver standard in 1935, contributing to monetary disruption there--but also that China later stabilized its currency, in no small part due to silver-backed financing.

The findings painted the silver program as a costly, open-ended subsidy that complicated U.S. credit control, weakened international reserve standing, and displaced Federal Reserve notes--prompting calls to end or sharply curtail Treasury silver purchases. Rather than continue open-ended silver buys, the Committee recommended halting all Treasury purchases (except for subsidiary coinage) and instead, if a mining subsidy was desired, limiting buys to domestic output—thereby aligning industrial support with U.S. production.

This had the effect of freeing up silver for industry to use now that the government would not be taking off the market a large share of global production. How this would be framed to the public was important to the Federal Reserve, as found in archived notes:

NEUTRALITY ACTS (1939)

Between 1935 and 1937 Congress passed three "Neutrality Acts" that tried to keep the United States out of war, by making it illegal for Americans to sell or transport arms, or other war materials to belligerent nations. Supporters of neutrality, called "isolationists" by their critics, argued that America should avoid entangling itself in European wars. "Internationalists" rejected the idea that the United States could remain aloof from Europe and held that the nation should aid countries threatened with aggression.

In the Spring of 1939, as Germany, Japan, and Italy pursued militaristic policies, President Roosevelt wanted more flexibility to meet the Fascist challenge. FDR suggested amending the act to allow warring nations to purchase munitions if they paid and transported the goods on non-American ships, a policy that favored Britain and France. Initially, this proposal failed, but after Germany invaded Poland in September, Congress passed the Neutrality Act of 139 ending the munitions embargo on a "cash and carry" basis.

The passage of the 1939 Neutrality Act marked the beginning of a congressional shift away from isolationism. Over the next 2 years, Congress took further steps to oppose fascism. Unbeknownst to congress, silver was becoming industrially more relevant, especially for munitions and other military supplies.

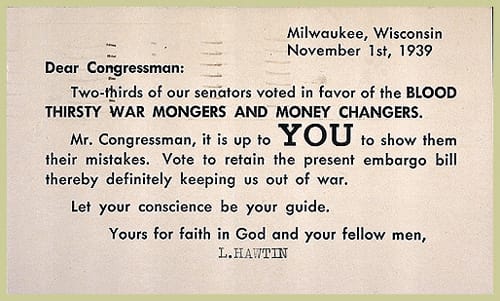

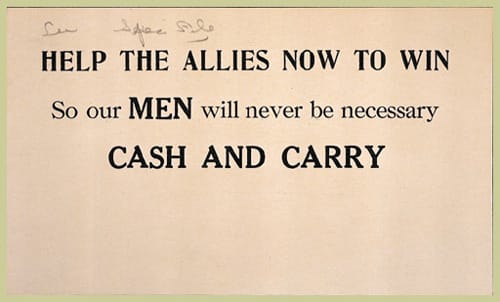

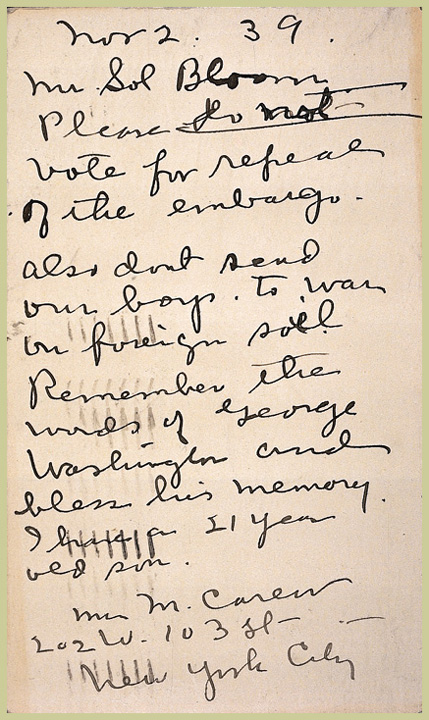

Supporters on both sides of the neutrality issue lobbied Congress with great intensity. Congressional offices received hundreds of letters, postcards, and petitions promoting their positions.

Postcard for amending the Neutrality Act, November 1939 - US National Archives

These postcards were sent to Representative Sol Bloom of New York, chairman of the House Foreign Affairs Committee, in the fall of 1939 as the Committee considered neutrality legislation. One postcard evokes isolationist arguments that war was supported by wealthy industrialists. A second recalls George Washington’s admonition that the United States should avoid entangling itself in European affairs. The third backs the "cash and carry" idea arguing that selling munitions to Britain and France will make it less likely that Americans will become directly involved in war.

LEND-LEASE ACT (1941)

By late 1940, Great Britain was increasingly unable to pay for and transport the war materials it needed in its fight against Nazi Germany. Britain's Prime Minister Winston Churchill appealed to President Roosevelt to find a way for the United States to continue to aid Britain. FDR proposed providing war materials to Britain without the immediate payment called for in the Neutrality Act.

A bill, assigned the patriotic bill number "1776," was introduced in the House on January 10, 1941, by Representative John McCormack of Massachusetts. After extensive hearings and debate, Congress passed "Lend-Lease" and President Roosevelt signed the Act on March 11, 1941. After the United States entered the war, Lend-Lease became the most important means for supplying the Allies because it allowed the United States to transfer arms to nations it vaguely deemed "vital to national defense."

During WW2, the US leveraged the Lend-Lease Act to supply not only arms and goods but also monetary silver bullion to certain Allied nations facing currency crises or coin shortages. In total, about 409.78 million troy ounces of silver bullion were transferred under these Lend-Lease agreements. The silver was either provided as raw bullion or as newly minted coins from US mints, depending on each recipient's needs. Each silver loan was formalized by an agreement obligating the recipient to return an equivalent amount of silver (in fine silver content) within a specified time after the war. These agreements were kept separate from other Lend-Lease aid settlements, recognizing silver's importance over other commodities.

Great Britain was a major recipient of Lend-Lease silver. The US lent Britain approx. 88 million ounces. This silver served vital to maintain Britain's coinage and financial system, which faced strains due to wartime hoarding and the disruption of metal supplies. British coinage traditionally contained silver, and the wartime demand for coins (exacerbated by the presence of Allied troops and inflation) caused a serious shortage of silver coins. The U.S. agreed by 1943 to treat silver as a “material in short supply” eligible for Lend-Lease, overcoming domestic political opposition from the American “silver senators” who were initially reluctant to part with U.S. silver reserves. The silver was provided from U.S. Treasury stocks on the condition that Britain return the same amount in kind after the war. Some of the silver was shipped as bullion bars, and some was minted into coin in the U.S. before transfer (for example, U.S. mints struck British colonial coins like East African shillings using Lend-Lease silver during the war. By war's end, however, the price of silver had skyrocketed– rising about 250% during the war due to scarcity.

In 1946, to conserve resources and prepare for returning the loaned silver, Britain removed silver from its coinage, switching to cupronickel coins. This measure recovered roughly 20 million ounces of silver per year for several years as older silver coins were withdrawn from circulation. Britain thereby amassed enough silver to both repay the United States and even achieve a small surplus (indeed, after five years of coin withdrawal, Britain had repatriated the 88 million oz owed and netted a profit of roughly 12 million oz of silver). The UK's Lend-Lease silver account was fully settled by 1957.

British India was the single largest beneficiary of Lend-Lease silver. Approx. 226 million oz of silver bullion were supplied by the US to undivided India during the war– well over half of all Lend-Lease silver lent out globally that is known. The motivation was a dire currency crisis in India. Wartime British financing had flooded India with paper rupees, leading to soaring inflation and a frenzy of hoarding silver coins by the population. Silver coins (the Indian rupee and smaller anna coins) were trusted as a store of value amid inflation and were even being melted down into bullion by individuals, worsening the coin shortage. By early 1943, the Reserve Bank of India warned it would soon run out of silver. It estimated that by March 1944 India would need an additional 4 million ounces of silver per month just to mint enough coins for the economy. Furthermore, to break the cycle of hoarding and stabilize the rupee's value, the Indian government proposed creating a reserve stock of 100 million ounces of silver that could be sold to calm the market if needed.

In June 1943, India (under the British colonial government) urgently requested the United States to supply 120 million ounces of silver under Lend-Lease – 20 million oz for immediate coinage and 100 million oz to build up the stabilizing reserve stock. The idea was that this silver would be returned in kind after the war. The U.S. Treasury was inclined to approve the request, recognizing the strategic importance of averting a monetary collapse in India (which was a major Allied base and supplier), but the State Department initially opposed a direct loan to India. American officials were skeptical of India’s political future and creditworthiness given the growing independence movement – they feared a post-war nationalist government might refuse to return the silver. The State Department insisted that any silver should go to the British government (as the formal Lend-Lease partner) rather than directly to India. This provoked angry reactions from Indian representatives; they pointed out that India was actually a creditor (holding huge sterling balances for war supplies furnished to Britain) and yet was being denied direct aid. Eventually, a compromise was reached: the U.S. would lend the silver directly to India, but Britain had to guarantee the obligation by signing a separate undertaking to ensure the silver’s return. By late 1943, the agreement was sealed and shipments began.

After World War II, British India’s obligation to return the silver was apportioned between the successor states of India and Pakistan. At India’s partition in 1947, the 225,999,904 oz silver loan was divided: the governments agreed India would assume about 172.54 million ounces of the debt and Pakistan 53.46 million ounces. By 1957 India had repaid, but Pakistan took until 1962 to fully repay the silver.

Saudi Arabia, though not a major battlefield, became strategically important due to its oil resources and its location along Allied supply lines. During the war, Saudi Arabia had no paper currency; its economy ran on silver coin – primarily the silver riyal coin. By 1943, a serious coin shortage hit the kingdom: the disruptions of war meant the usual supply of silver coins (and the silver to mint them) had dried up. The few riyals in circulation were hoarded for their silver content, since global instability made silver bullion very valuable (indeed, the silver in a riyal coin was worth almost as much as its face value). At the same time, the U.S. and Saudi Arabia were expanding oil production facilities at Dhahran to support the Allied war effort, and large numbers of workers needed to be paid – something that required coinage in the Saudi context. American officials in the region reported having to “scrounge” for riyals, even sending agents to buy up coins from merchants, but by late 1943 local supplies were exhausted.

To resolve the crisis, the Saudi government arranged with the U.S. in 1943 for a Lend-Lease silver loan to

mint Saudi riyals in the United States. Under this agreement – made pursuant to the Lend-Lease Act – the U.S. Treasury sold silver to Saudi Arabia (on lend-lease credit) which the Philadelphia Mint struck into Saudi coins. By the end of World War II, a total of approximately 49 million riyals had been shipped from the U.S. to Saudi Arabia. (Each riyal contained about 10 grams of silver, so in pure silver terms this represented roughly 15–18 million ounces of silver content.) These coins immediately alleviated the shortage and kept the Saudi economy liquid during the war.

One dramatic episode in this program was the fate of the SS John Barry, an American Liberty ship. In 1944, the John Barry was secretly carrying a cargo of freshly minted Saudi riyal coins (some 3 million coins in wooden boxes) intended for delivery to Jeddah or Aden.

The shipment was heavily guarded, indicating its sensitivity. While sailing in the Arabian Sea, the John Barry was torpedoed by a German U-boat and sank in deep water, taking that load of riyals with it. (Contemporary rumors inflated this into a tale of $26 million in silver bullion lost at sea, although in reality the ship was carrying mainly coins; the silver value of the lost coins was about $540,000 at the time. Apart from the John Barry incident, all other coin shipments arrived safely. The loss of the Barry’s coins, while a setback, did not cripple the program – U.S. Mints simply struck replacement coins, and by war’s end tens of millions of new riyals were in circulation in Saudi Arabia.

The Lend-Lease silver agreement with Saudi Arabia also stipulated repayment in kind. After the war, Saudi Arabia began to return the silver (or its equivalent value). By 1960, Saudi Arabia had repatriated about 1.37 million ounces of silver to the U.S. (in the form of coins shipped back) and had made a cash payment of $3.69 million toward the obligation. The cash payment presumably reflected an option to repay part of the debt in dollars instead of metal.

(Ultimately, Saudi Arabia did fulfill its silver return by the mid-1960s, closing out the account.) The Saudi case is a fascinating example of Lend-Lease extending into the monetary realm to support an Allied nation’s domestic stability – in this case, literally providing the coins that paid the workers who fueled the Allied oil supply, cementing a wartime partnership between the U.S. and Saudi kingdom.

Australia’s economy experienced coin shortages during the war, partly due to increased troop presence and disrupted supply of metal. The United States supplied an undisclosed quantity of silver (from U.S. Treasury stocks) to Australia under Lend-Lease, used presumably to mint Australian coins (which at the time contained silver). The exact amount is not given in U.S. public reports, but Australia’s share was significant enough that it completed returning its silver by 1957 in the form of high-purity silver bars (.999/.9998 fine). This suggests Australia received on the order of a few tens of millions of ounces. The infusion helped Australia maintain its currency during the war. By the late 1940s, Australia, like Britain, reduced silver content in its coins (switching to 50% silver, then eventually to cupronickel), which would have facilitated the prompt return of the borrowed bullion.

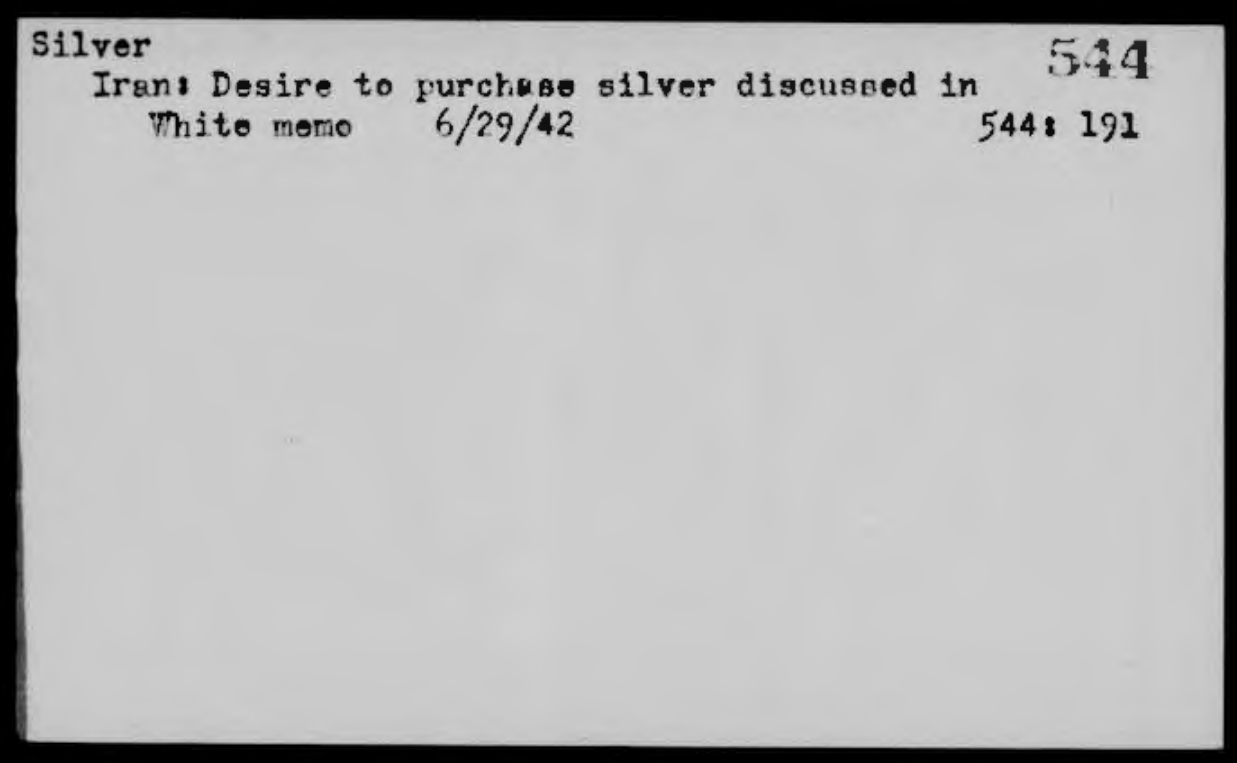

Iran and Poland are two Allied-aligned countries that are often queried in the context of the Lend-Lease, but neither appears to have received silver transfers under the US Lend-Lease program officially.

Although in the case of both, there exists FDR Presidential memos suggesting there is more to the story:

Iran was occupied by Britain and the USSR in 1941 (the Anglo-Soviet invasion) and became a crucial supply corridor (the “Persian Corridor”) for Lend-Lease aid to the Soviet Union. While the U.S. did extend Lend-Lease assistance to Iran (such as railway equipment, trucks, and financial loans for purchasing supplies).

Iranian currency (the rial) did include silver coins, but Iran’s monetary needs appear to have been addressed by British and American financial aid in other forms (gold loans, credits, etc.) rather than shipping U.S. Treasury silver. In the official lists of Lend-Lease silver recipients, Iran is not included.

Poland was in an even more constrained position. Poland had been overrun by Germany in 1939 and did not have an internationally recognized government on its own territory during most of the war. The U.S. Lend-Lease aid largely went to governments in exile only in the form of military aid for Polish forces (for instance, equipping Polish units fighting under British command). There is no record of any silver shipments to the Polish government-in-exile or to Poland (which was under Axis and later Soviet control).

MORE SILVER SECRETS

INTERMISSION

What we hope you gained so far:

- There PERSISTS a conspiracy evincing a design to enslave mankind that existed at the dawn of our nation and is alive today.

- These conspirators hide within the Masonic societies, super-affluent and super-rich circles.

- The price of silver and gold were arbitrarily made up, used as a tool of economic warfare and not for the prosperity of the public.

- Silver became at odds with the Federal Reserve system of money, and stockpiling silver by the US government was stopped, on the basis that silver at the time was useless industrially, except this was false, it was about to be more needed than ever before.

- The lack of govt purchases of silver, freed up that silver for use in industry.

- Silver and other aid was given to any foreign nation the President deemed in the country's best interest.

- The US dropped the atomic bombs, effectively ending the war and effectively beginning the Cold War.

There is more ground to cover about silver industrial and military purposes from WW2. We covered this in a previous article:

ACT 2 - The US Becomes King of the West

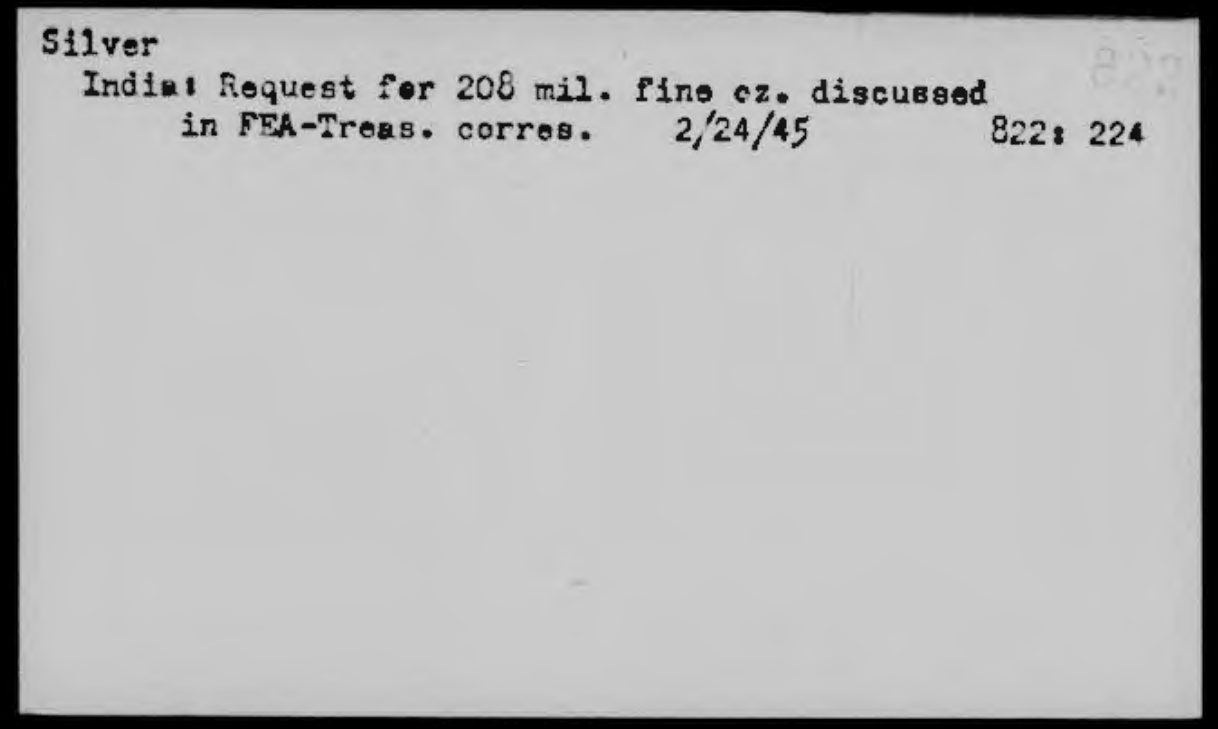

MUTUAL DEFENSE ASSISTANCE CONTROL ACT (1951)

The Mutual Defense Assistance Control Act became fully operative on January 24, 1952. A report prepared for Congress describes in detail the efforts to control the exports of strategic goods, which included silver, to the Soviet Union and its satellites. These efforts were apart of a larger framework of the total free world program of creating military defenses against aggression, building economic strength and furthering the unity of the free nations. The operation of strategic trade controls was technically complex and involved a broad range of military, economic, diplomatic and psychological considerations.

Since its enactment in 1951, the Mutual Defense Assistance Control Act—commonly known as the Battle Act—has granted the U.S. President sweeping tools to direct trade and financial flows in service of national and allied security. By leveraging export licensing, financial conditionality, port and transit restrictions, allied coordination, and tariff adjustments, the President can effectively starve hostile powers of critical inputs while prioritizing access for friendly nations.

The Presidential powers codified in the Battle Act represent a comprehensive toolkit for managing the flow of critical goods across Western markets. By combining licensing regimes, financial leverage, port sanctions, allied cooperation, and customs measures, the President wields the capacity to shape supply chains and market dynamics in ways that bolster allied resilience and deny strategic benefits to adversaries.

This act is the etymology of the silver market manipulation on a global scale. Egregiously Unconstitutional overreach that has left many investors without a shirt. This policy has done more harm to the public than any good! It gives the executive branch tyrannical powers that serve the super-wealthy alone.

The Free Market is a lie.

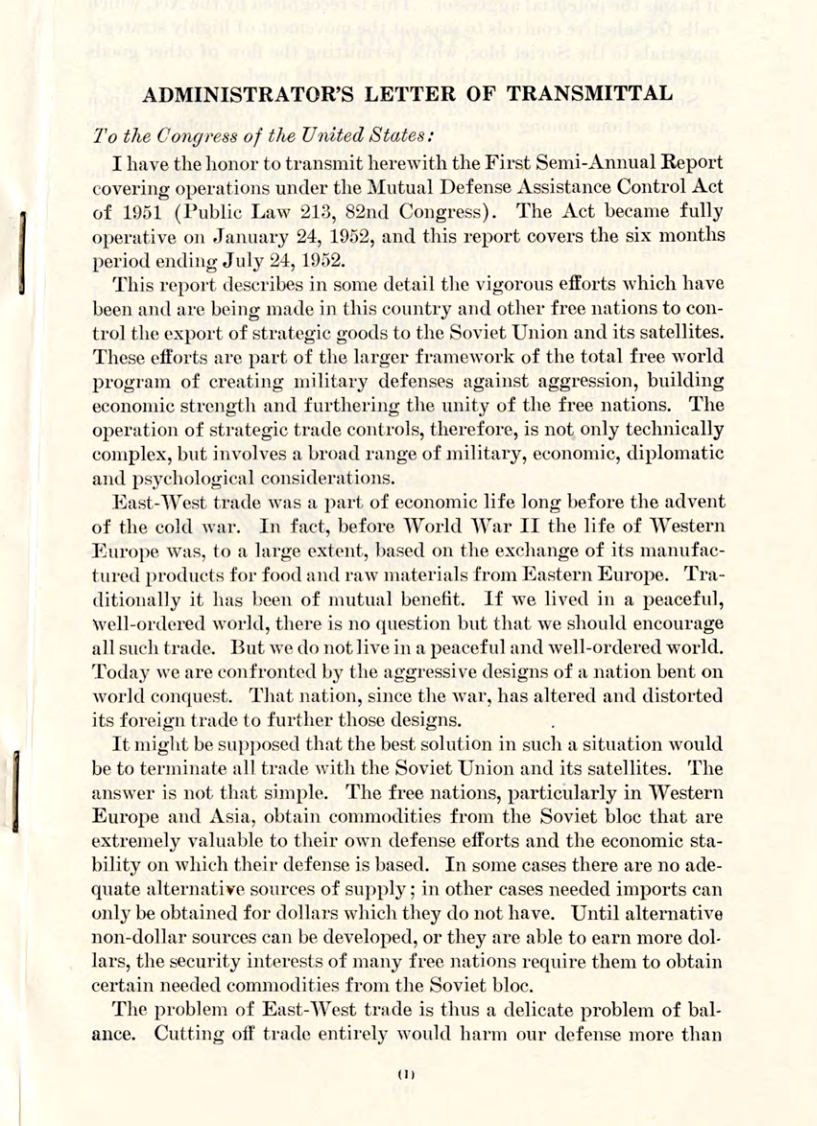

JOHN BIRCH SOCIETY CONSPIRACY

Robert W. Welch Jr. was born on January 9, 1899, in Chosen, Massachusetts. After graduating from Dartmouth College in 1921, he entered the family candy business, eventually becoming vice president of Nabisco’s Welch’s division. In the 1940s and ’50s, Welch turned his attention to writing, publishing a series of fiercely anti‐communist tracts and legal analyses that laid the ideological groundwork for his later activism.

In 1958, drawing on his business experience and his growing reputation as an outspoken critic of communism and big government, Welch founded the John Birch Society. Under his leadership until 1983, the Society became one of the most influential grassroots conservative organizations in the United States. Welch retired from active management in the early 1980s and died on January 6, 1985, leaving behind a profound legacy that no one talks about anymore.

Also in 1958, Welsh wrote what is known as the The Blue Book. It exposits a single, overarching conspiracy that has guided world events for over two centuries. At its core is an inner clique– later called the "Insiders"– who use Communism merely as one of many tools to weaken and ultimately enslave free societies.

In Welsh's view, only by recognizing and resisting this hidden Conspiracy can free nations avert the gradual loss of their liberties.

Members of this society included Nelson Bunker Hunt and Larry Patton McDonald. Two key figures that should be considered heroes to the American public.

Efforts were made to combat this conspiracy by those members.

Nelson Bunker Hunt served as a member of the Council of the John Birth Society from 1976 to 1985, which encompassed the period he attempted to corner the silver market. Documents we previously sourced show silver's supply by this time was tiny and taking large amount of silver off the market created a national security issue for the United States. The US government colluded with the exchange to stop what Nelson Hunt was doing, leading to his silver being stolen back.

We previously wrote about the Systematic Risk that the Hunt's Silver Squeeze had on the Future's market, and subsequent intervention to maintain the viability of that market, which in all reality is just a front to gaslight control of the supply away from speculators hoarding the metal.

Who is less known in these affairs is the truthful outspoken Congressman Larry McDonald.

US BUREAU OF MINES - Minerals Facts and Problems (1970)

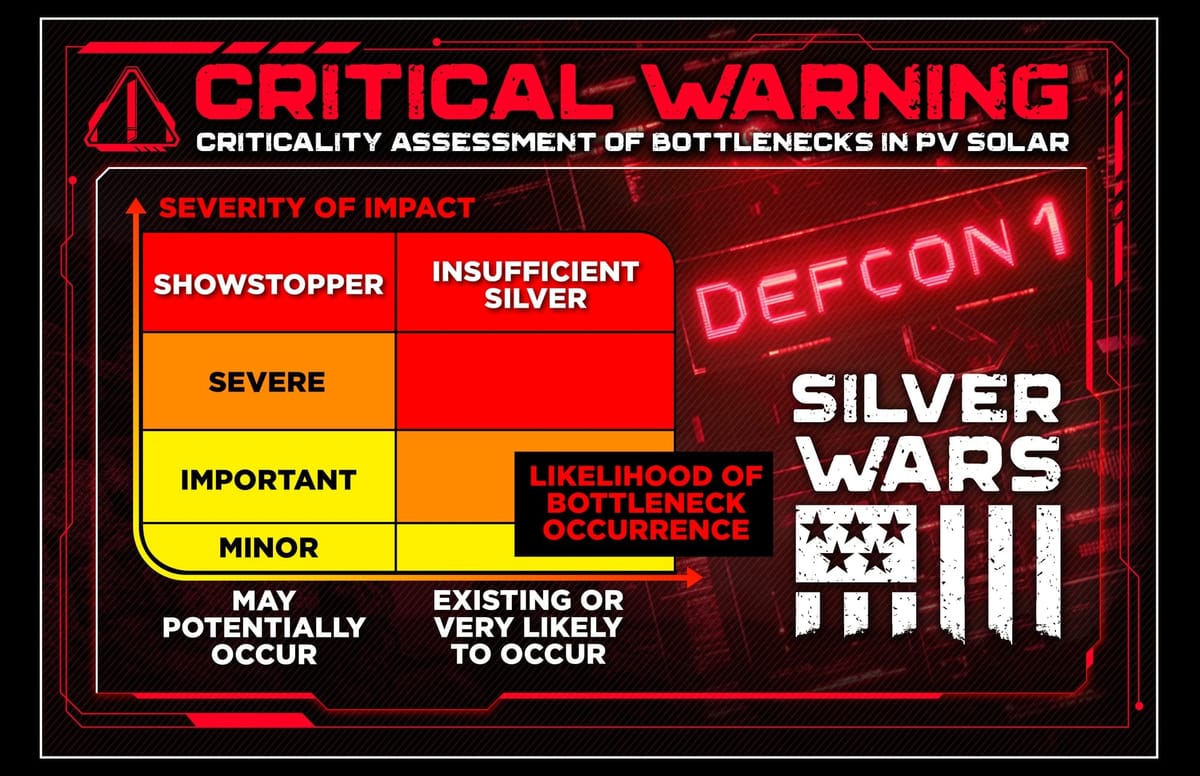

A 1970 study by the US Bureau of Mines projected the demand for minerals between then and the year 2000. The one glaring aspect of that report showed approximately a 5 to 6 billion ounce shortfall in the US and a global cumulative demand range from 9 to 14 billion ounces in year 2000. Available supply from estimated rest-of-the-world reserves of 4.2 billion ounces of silver were seen to be seriously deficient to meet either the low or high of the cumulative demand.

However, based on domestic resource studies of silver with inferential applications to the rest of the world, known reserves plus sub marginal resources could supply total would demand but probably at significantly higher prices. Increased prices would also serve to draw out privately hoarded silver, recall some silver currency for industrial uses, increase recovery of silver scrap, and stimulate use of substitute materials until some combination of these actions restores a supply-demand balance.

Problems indeed. Today, the public has the only available silver, aside from what is refined on a daily basis with projections that we do not have enough silver to satisfy demand for just solar over the next 2o years. Industrial usages for silver are only accelerating without subtly.

Additionally, today (Independence Day) the Big Beautiful Big will be signed by President Trump. This bill includes military procurement that will require more silver than the world currently has.

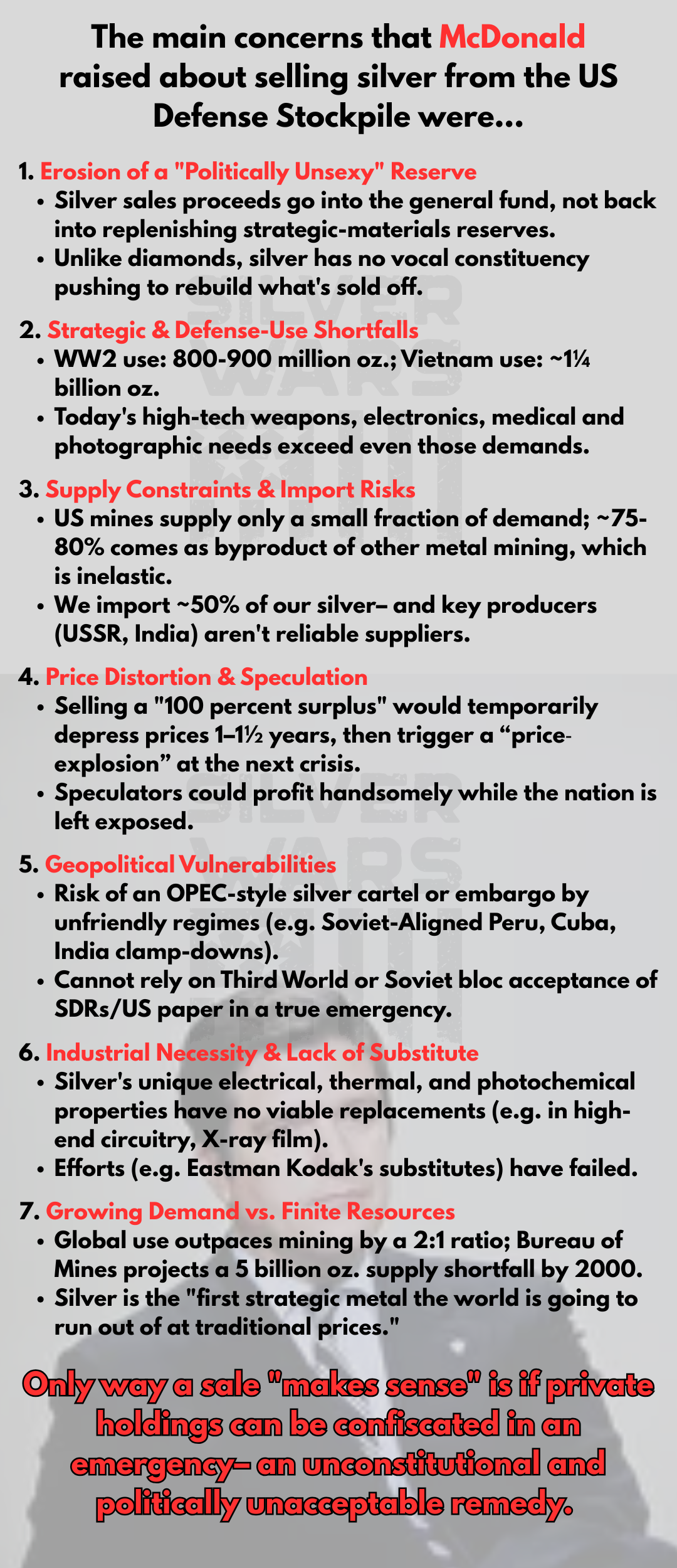

SALE OF THE SILVER STOCKPILE

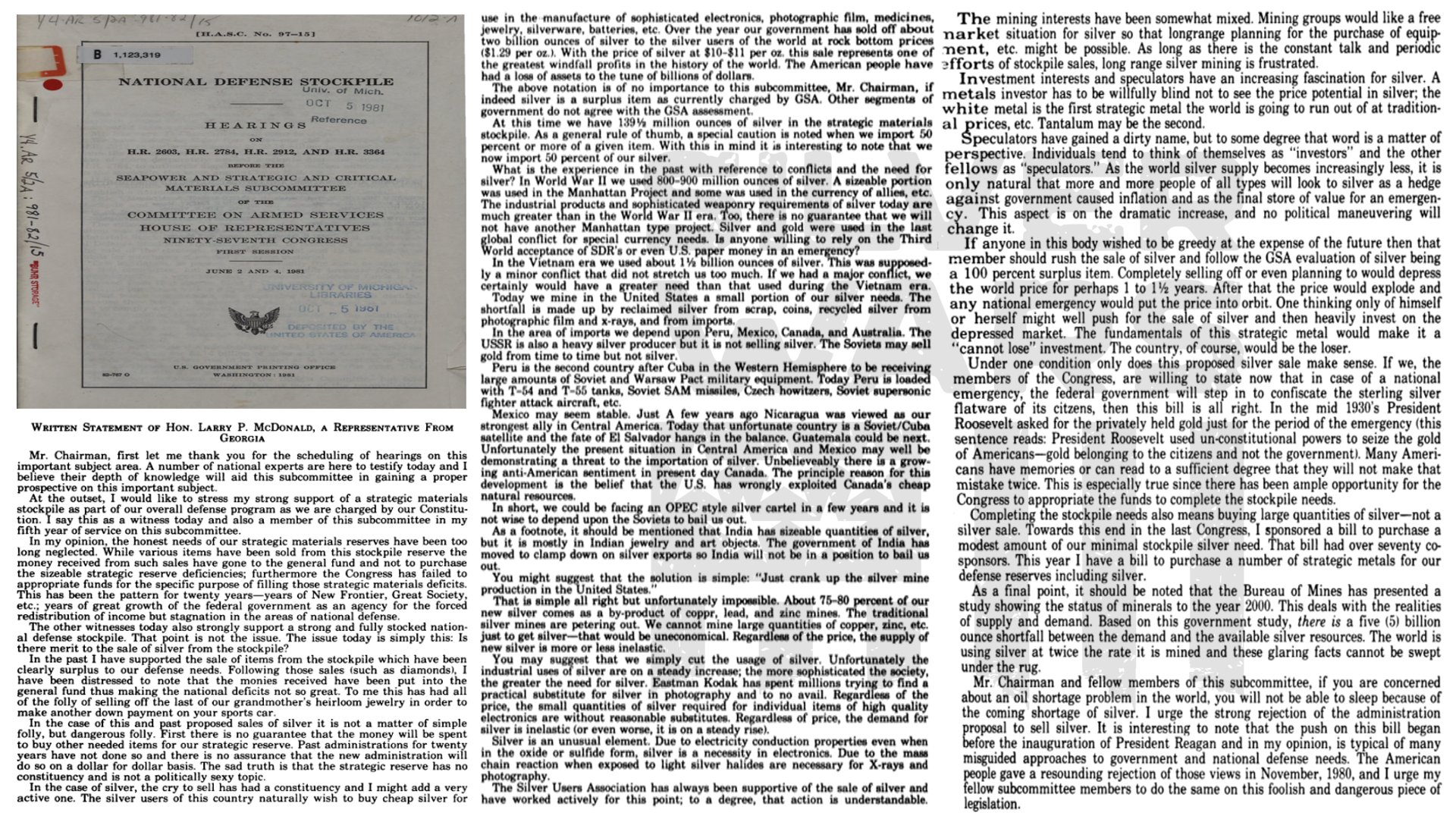

The hearings for H.R. 2603, H.R. 2784, H.R. 2912, and H.R. 3364 before the Seapower and Strategic and Critical Materials Subcommittee occurred on June 2 and 4 of 1981.

H.R. 2603 was a bill introduced by Larry McDonald to allocated $131 million to acquire silver, $95 million to acquire platinum, and $12 million to acquire nickel for the defense stockpile. H.R. 3364 would have “establish[ed] a national mineral and material policy and council.” The other bills sought to sell silver from the stockpile by various means.

However, its worth noting the important facts McDonald added to the record, which caused the bills to stall in the committee.

ASSASSINATTION OF MCDONALD

McDonald’s career was abruptly cut short when he perished aboard Korean Air Flight 007, shot down over Soviet airspace on September 1, 1983, but his legacy as a fierce critic of centralized banking endures among monetary reformers, except the world was made to forget about this.

The death of McDonald leaves many to speculate, was he assassinated? Based on the threat that McDonald would have posed as chairman of House Arms Services Committee, and his aggressive stance in blocking legislation related to selling silver, made him a target.

In his last public interview on "In The Crossfire" before his death, McDonald exposed the public to the conspiracy that was quietly shaping the world into a New World Order.

Additional Consideration:

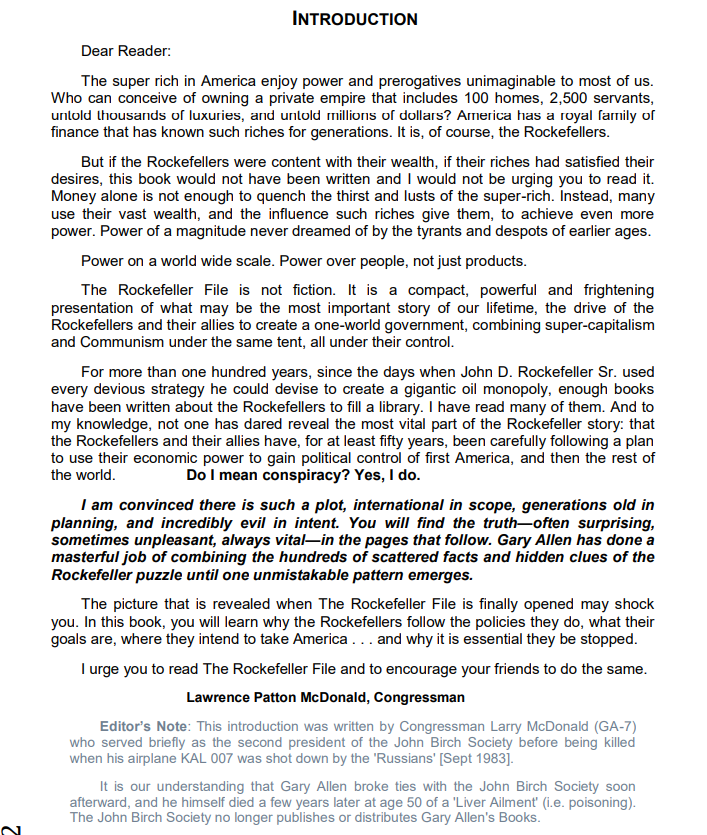

From the book, The Rockefeller Files by Garry Allen (1976), McDonald writes the books introduction:

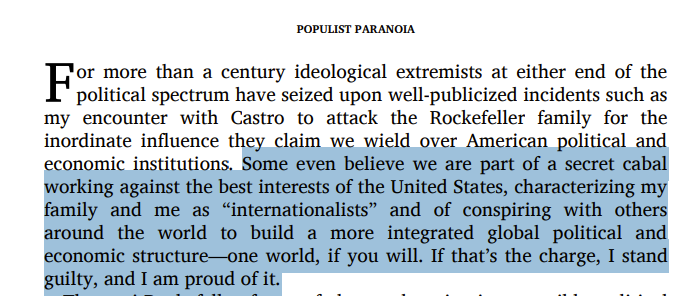

His suspicions would all be confirmed by David Rockefeller himself in his 2002 autobiography, "Memoirs".

ITS A BIG CLUB, AND WE'RE NOT IN IT

The problems of today seem insurmountable, but they are quite simply fixed by an educated and aware public. The most manipulated and useful commodity, silver, has been abusively consumed to bring forth the centuries long plot of world domination.

The "Insiders" created an apocalyptical supply issue with silver that is currently unfolding. There has been no true transparency. No moral ethic for proper accounting. The only known ready-to-use silver is in the possession of the public. The future is literally in our hands and its time to leverage that. Do not sell your silver. Starve the beast. The public will not surrender its silver. The investors are now aware. Silver is the most valuable and strategic resource on the planet. Act Accordingly.

And if the legislative branch is so incline to save this republic, it will immediately repeal the National Emergency Act, the Defense Production Act, and all remaining laws still in effect from the other Acts we discussed. The Executive branch powers need to be curtailed. The US must be made to immediately stockpile silver for the publics future wellbeing!

It is our plan to further elaborate on these topics in future articles. We cannot stress enough that the information we provide comes at great fatigue and costs. Make it worth it.

A simple message to millionaires and billionaires: Support us, or own nothing.

If you're a mining company—you absolutely require our expertise in this sector. Please reach out to us for consultations.