Solar, AI, and Missiles: Where Silver Goes to Die

The silver bulls keep screaming about scarcity, but the mainstream media still thinks we can just "recycle it." Here’s the truth: modern industry doesn’t recycle silver — it consumes it. And once it’s gone, it’s gone.

We’re talking about solar cells, semiconductor wafers, AI data centers, missile guidance systems — every single one of them kills silver on contact. This isn’t the old-school coin melt era. This is an industrial death march.

Let’s break down where the silver’s going, how fast it’s disappearing, and why 2025 may be the last year Wall Street can pretend there’s no problem.

Where the Silver Goes (and Never Comes Back)

Modern tech uses microscopic amounts of silver — but on a massive scale. And the recovery cost often exceeds the value of the silver inside. That’s not a theory. That’s a cold economic fact.

| Sector | 2024 Silver Demand (Moz) | Recoverable? |

|---|---|---|

| Photovoltaics (Solar Panels) | 190 | Rarely |

| Automotive (EVs, ICEs) | 80 | No |

| Semiconductors / AI chips | 70 | No |

| Defense / Aerospace | 55 | No |

| Consumer Electronics | 115 | Limited |

[Source: Silver Institute, IEA, U.S. Department of Defense]

The moment silver gets embedded in a solar wafer or missile avionics package, it’s done. Even if you could extract it, you’d spend more in labor and acid baths than you’d ever recover.

This is what makes silver different from gold. Gold is hoarded. Silver is used.

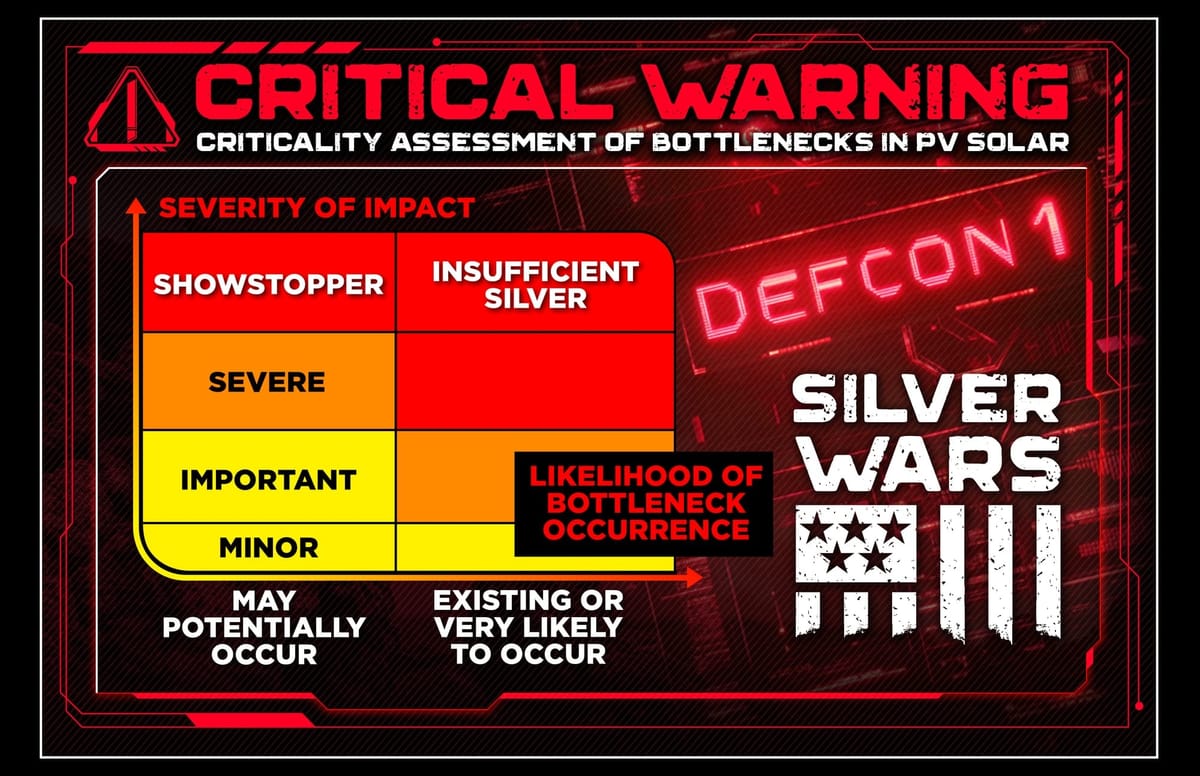

Solar Is the Black Hole

The biggest offender? Solar panels. Silver is used in photovoltaic (PV) cells to create conductive pathways. Every panel contains about 10–20 grams of silver.

With over 300 gigawatts of new solar capacity installed globally in 2024, that translated to nearly 190 million ounces of silver — nearly 23% of all mined supply.

| Year | Global PV Installations (GW) | Silver Use (Moz) |

|---|---|---|

| 2022 | 190 | 130 |

| 2023 | 240 | 168 |

| 2024 | 308 | 190 |

[Source: IEA PV Market Report 2024]

And here's the killer: solar panels aren’t recycled. Less than 1% are dismantled for metals. The rest get dumped, crushed, or left in landfills. You might as well throw silver bars into the ocean.

Silver Wars is dedicated to Safe Guarding the World's Silver Future.

The AI Monster Is Just Getting Started

Everyone’s hyped about generative AI, but no one’s talking about its metal diet.

Training just one large language model (like GPT-4 or Gemini) requires tens of thousands of GPUs — and each AI GPU contains high-purity silver in connectors, substrates, and interconnects.

Multiply that by the scale of global data center construction — and you’re looking at another 70+ million ounces per year headed straight into unrecoverable computing hardware.

And no, those AI chips aren’t getting recycled either. Once they’re obsolete, they’re scrapped like broken calculators.

The Military Takes, But Never Gives Back

Silver is a strategic metal for the U.S. Department of Defense — and it’s in everything from:

- Missile guidance systems

- Radar arrays

- Infrared targeting optics

- Secure communication circuits

- Space-based weapons platforms

These systems are built once and never dismantled. The military doesn’t recycle missiles — it launches them.

According to the 2024 NDAA procurement budget, silver use in U.S. defense systems has increased 42% since 2020. That’s an additional 55 million ounces a year — most of it gone forever.

Recycling: The False Savior

Let’s put this myth to bed. Here’s the actual breakdown from the Silver Institute’s 2024 World Silver Survey:

| Category | 2024 Supply (Moz) |

|---|---|

| Mine Production | 822 |

| Recycling | 180 |

Recycling provided only 18% of total silver supply in 2024. And most of that came from jewelry and old silverware — not tech.

The silver we need is the silver we’re not getting back. And as demand from AI, solar, and defense ramps up, that gap becomes fatal.

Schiff’s Take: You Can’t Print Silver

Here’s the blunt truth: central banks can paper over a liquidity crisis, but they can’t paper over a physical metal shortage.

You can’t bail out a commodity supercycle. You can’t QE your way into more silver mines. And you sure as hell can’t ask China or Mexico nicely once they nationalize their supply.

The tech sector is eating silver faster than miners can produce it. But Wall Street’s too busy selling you “exposure” through ETFs while the real metal disappears into black boxes, warheads, and rooftops.

Price Revaluation Is Inevitable

At some point, the pricing mechanism breaks. Silver isn’t priced as a strategic material — it’s priced like a soft commodity. That mismatch will not last.

Expect the following:

- Solar silver demand to hit 220 Moz by 2026

- AI chip production to triple by 2027

- Military budgets (and silver usage) to surge with global conflict escalation

Meanwhile, silver production is flatlining. Grade depletion is real. New mines take 7–12 years to come online. And good luck getting permits in the West.

AI Will Eat All The Silver

You can believe in recycling fantasies. You can trust the COMEX price. Or you can look at the hard numbers:

- Nearly 1 billion ounces of silver consumed in 2024

- A majority of it unrecoverable

- Mining supply falling short

- Governments waking up, but retail still asleep

Don’t be the guy who realized this at $80 an ounce.

Be early. Be loud. Be physical.

Read the charts. Then read SilverWars.com.