A simple test for whether a defense leader is serious: Don’t listen to the speeches, watch the supply chain.

For decades, America talked about readiness while letting the most important inputs for modern warfare drift offshore, rare earth processing, magnet production, specialty metals, chemical conversion, and the “boring” industrial steps that decide whether a factory line runs or stalls. Under Secretary Pete Hegseth, that posture has changed for the betterment of all American's security, fast. The Department of War is treating critical minerals like what they are, a national security requirement, not a trade policy side quest.

This is the difference between a military that looks strong and a military that stays strong.

The executive actions that changed the playing field

Two big moves from the White House created the legal and financial runway, and Hegseth’s department has moved like it intends to use it.

Executive actions, and what they unlocked

| Executive action | What it does | Why it matters for defense supply chains |

|---|---|---|

| Executive Order 14241, “Immediate Measures to Increase American Mineral Production” (March 2025) | Directs federal agencies to accelerate domestic mineral production and processing, and leans on Defense Production Act authorities | Puts federal power behind mining, processing, and capital formation, the parts that used to die in permitting and financing |

| Presidential Proclamation on processed critical minerals and derivative products (January 2026, Section 232) | Treats import dependence on processed minerals as a national security exposure, directs negotiation of agreements to secure supplies | Signals that downstream processing and components are strategic terrain, not just raw ore |

This is the key point most analysts miss, EO 14241 is not just a slogan, it is a lever. It explicitly frames mineral production as a security priority and pushes agencies to clear blockers and accelerate outcomes.

And the January 2026 Section 232 proclamation does something even more important, it centers processed minerals and derivative products, the step where dependence becomes dangerous.

Hegseth’s strategy in one sentence

No more begging global markets to treat America fairly, and start building the industrial base America needs, with domestic capacity plus allied capacity, backed by real capital and real offtake.

The strategy is in the places that matter, loans, conditional financing, equity stakes, and projects aimed at the chokepoints.

|

X POST

“The best military in the world meets the best business talent in the world.”

SecWar (@SecWar)

|

What’s already moving, a fast timeline, real dollars, real hardware

Quick timeline of recent actions tied to strategic minerals and defense production

| Move | Why it matters for national security |

|---|---|

| Aug 10, 2025, Office of Strategic Capital loan to MP Materials for heavy rare earth separation at Mountain Pass | Separation is the choke point, mines without separation still leave America dependent |

| Nov 21, 2025, OSC conditional loans to Vulcan Elements and ReElement for NdFeB magnet supply chain | Magnets sit inside drones, jets, subs, satellites, and chip gear, this targets the “missing middle” |

| Dec 9, 2025, Army program for small scale refineries, starting with antimony trisulfide | Ammunition inputs are a single point of failure, this builds controllable domestic production |

| Jan 14, 2026, White House action on processed minerals and derivative products, cites import reliance | Sets the frame, supply chain dependence is a security exposure, with specific import reliance figures |

| Jan 26, 2026, 2026 National Defense Strategy signals “supercharge” of the industrial base | Puts industrial capacity at the center of strategy, not as an afterthought |

| Feb 2, 2026, House Natural Resources Democrats letter flags equity stakes and calls for oversight | Even critics concede the national security logic, they’re fighting over governance and disclosure |

That’s the pattern, you’re trying to turn the Pentagon into a demand engine that can actually pull mines, refineries, separators, and factories into existence.

That is the right axis.

Here’s the national security argument that lands every time, “processed minerals are the platform”

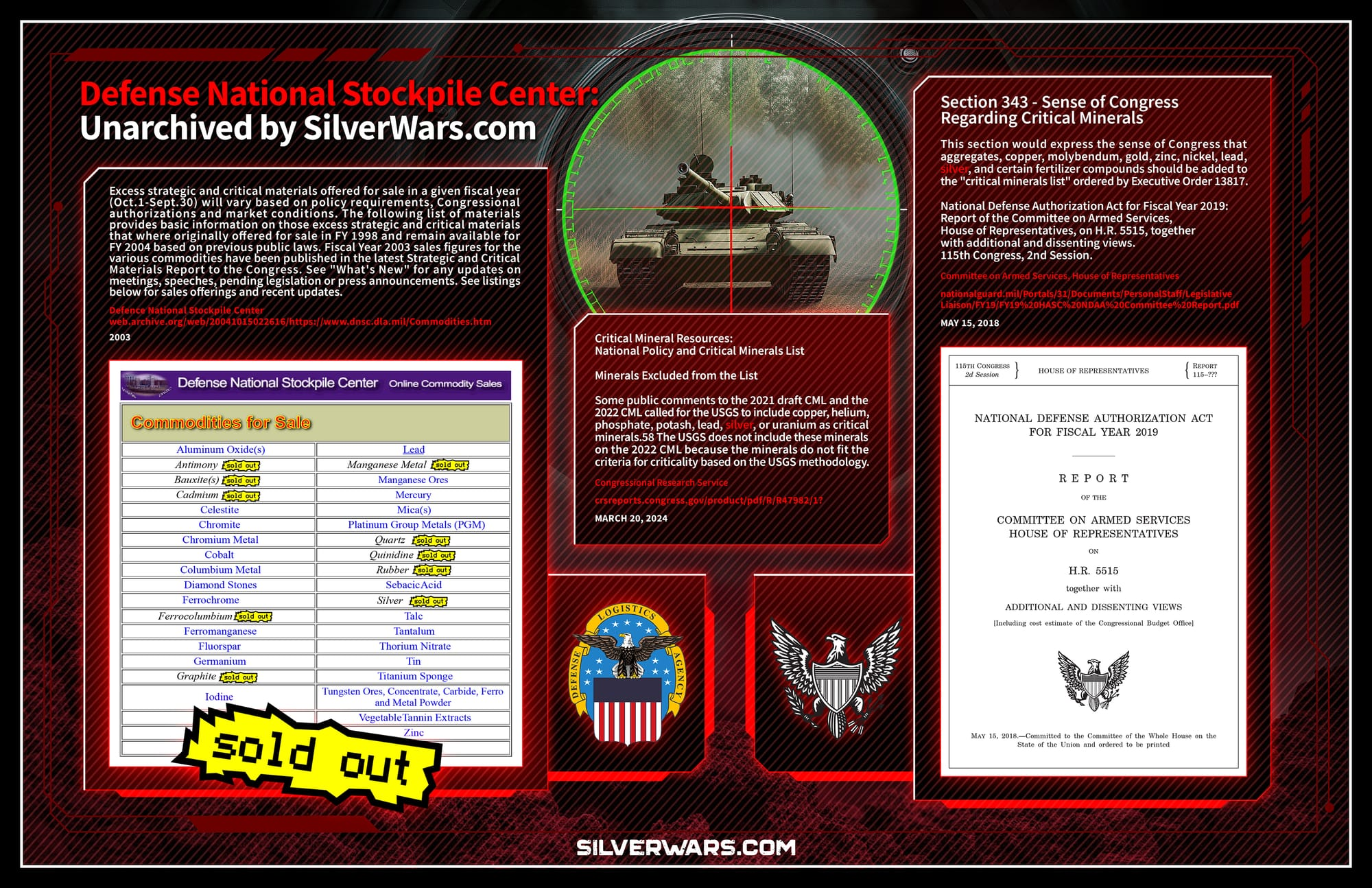

The January 14 White House action is explicit about why processed minerals and derivative products matter to defense, it points to components used across fighter aircraft, munitions, armor, ships, comms, navigation, surveillance, and more. It also states the U.S. was 100% net import reliant for 12 minerals and 50% or more reliant for another 29 as of 2024, and highlights that even where we mine domestically, processing capacity can still be the bottleneck.

In other words, the mine is step one, the refinery and conversion chain is the war.

That’s exactly why the Army’s “mini refinery” concept matters so much. It’s not trying to beat commercial scale, it’s trying to guarantee an internal, controllable stream of niche inputs like antimony trisulfide, the kind of stuff that quietly decides whether you can make primers, and therefore bullets.

The minerals that decide fights, and what the current playbook hits

This is the map that government defense understand understand instantly.

| Mineral or material | Where it shows up in defense and tech | The choke point to attack |

|---|---|---|

| Rare earths and NdFeB magnets | Guidance, motors, actuators, radar, EW, drones, satellites | Separation and magnet manufacturing capacity |

| Antimony | Ammunition primers, specialty alloys, flame retardants | Refining and chemical conversion inside the U.S. |

| Gallium, germanium, indium | RF, power electronics, sensors, optics, comms, satellites | Processing, fabrication pipeline exposure |

| Copper | Power, comms, vehicles, ships, grid, data centers | Scale, permitting speed, and refining throughput |

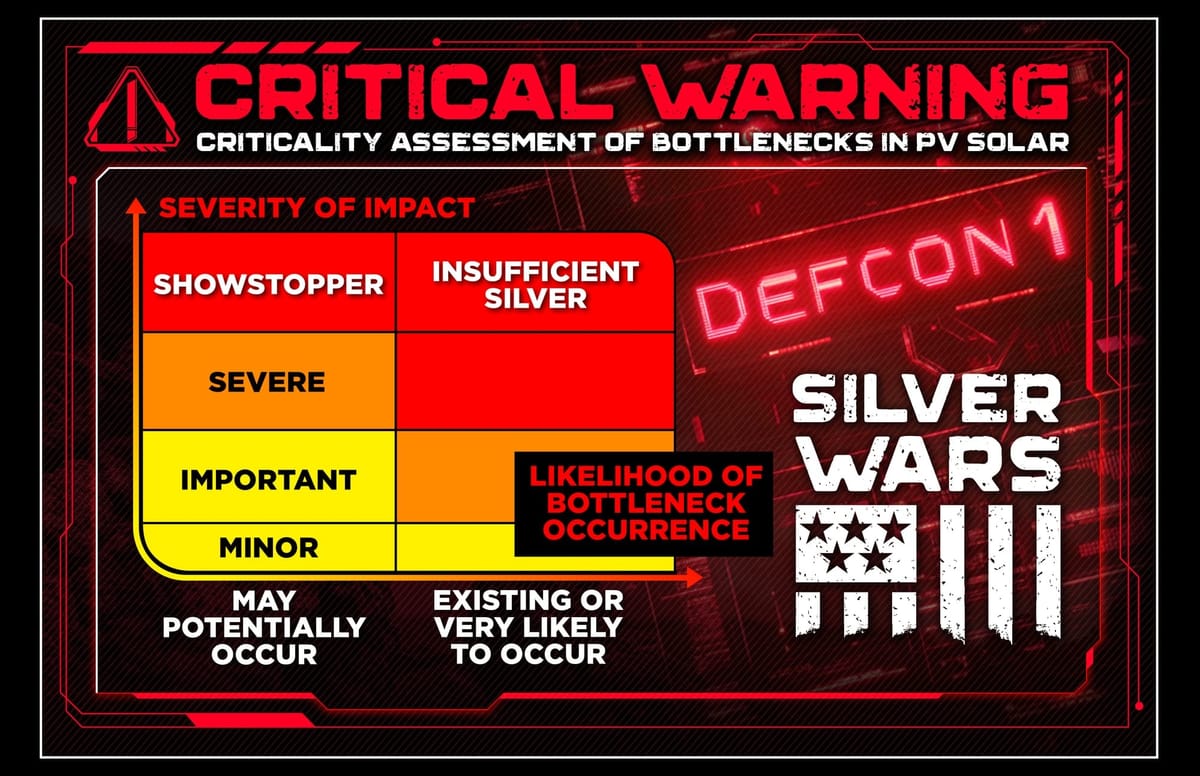

| Silver | High reliability electronics, contacts, solder, specialized components, dual use tech | Supply depth and downstream availability, listed on USGS 2025 Critical Minerals List via CRS summary |

| Uranium | Naval propulsion and nuclear fuel cycle inputs | Domestic enrichment and fuel cycle depth |

Silver is now explicitly cited in CRS discussion of minerals added to the USGS 2025 Critical Minerals List.

The five moves that will make the “strategic minerals” agenda unstoppable

Make demand signal the weapon

- Multi year buys, guaranteed purchase commitments, and longer duration contracting are exactly what your acquisition strategy calls for, because industry invests when revenue is predictable.

Treat processing as the primary terrain

- Mines do not break dependence if the metal still has to be converted elsewhere, your OSC loans and the Army refinery approach target that gap directly.

Stockpile like you mean it

- “Project Vault” and the broader push for reserves builds shock absorbers for manufacturing and defense, this is the Strategic Petroleum Reserve idea applied to metals.

Build the allied metals bloc

- Recent reporting points to a renewed multilateral push, with many countries represented at the February 4 ministerial and multiple new deals, that is how you pry supply away from monopoly leverage.

Win legitimacy, protect the force

- Southern Spear scrutiny is real, congressional oversight is already underway, and your own department’s statements emphasize legal review. The best shield for warfighters is clarity, documentation, and a publicly intelligible framework that separates lawful targeting from political narratives.

The American Legacy Play

This is the line that should frame the piece, and it’s true in a way even your opponents can’t dodge.

America can argue about tactics on cable news.

But America cannot argue with physics, chemistry, and manufacturing.

The 21st century force is built from processed minerals, magnets, and industrial throughput, and you are one of the few senior leaders talking and acting like that’s the fight.

If you keep forcing Washington to treat mines, refineries, and conversion plants as warfighting infrastructure, you don’t just get better procurement.

You get national power that lasts.