The Trump administration is pressing the gas peddle hard on the One Big Beautiful Bill, but is it just one big overreach by the Military Industrial Complex?

The answer is yes, whether this administration is aware or not, and this will have dire implications for the dangerously low global silver supply. Let us explain:

Silver is a strategic and industrially critical metal used across many defense applications due to its unique physical properties:

- Best electrical and thermal conductor among all metals.

- Corrosion-resistant, ductile, and malleable.

- Crucial in miniaturized, high-reliability components (missiles, satellites, avionics).

- Best reflector of light among all metals, critical for guidance and mirrors.

Silver’s critical role in advanced defense technologies makes its supply chain a prime target for Industrial Base Fund (IBF) interventions, which aim to secure and strengthen domestic manufacturing capabilities for national security.

These interventions, could include prioritizing limited silver supply to national security dependent objectives, "borrowing" from, Depositories, ETFs or Silver Trusts when ready-to-use silver is not available in large enough quantity, investing in mining projects and employ efforts to control the market sentiment through misinformation or confusing market conditions.

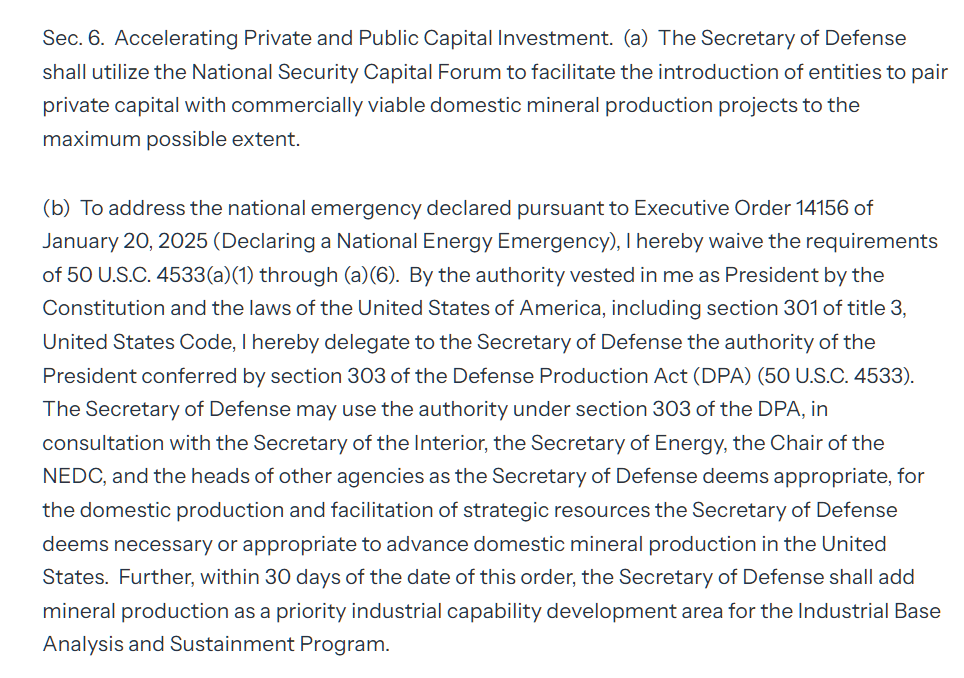

As we previously reported, a National Emergency, in conjunction with the Defense Production Act gives the US Military permission to manipulate the silver market, without any liability in breaking financial laws; or any for this matter.

Although, IBF's focus is on bolstering domestic silver production, refining, and recycling to ensure stable supply for critical defense system, and overall attempting to reduce the dependence on foreign sources which makes up a, if not the most significant risk to national security.

So far only minimal efforts have been taken. Silver has not been made a critical raw material by the United States Geological Survey despite meeting its criteria. Neither has the Department of Energy, even though silver also meets its criteria of critical.

But the IBF have moved forward funding such projects like Perpetua Resources, who have near silently received over $80 million to develop their project from the Department of Defense (DoD). Touted as the hope for Antimony, is actually a Red Herring for the DoD's Silver Hail Marry.

While yes China does have a near monopoly on Antimony currently, and this will be the only domestic source in operation, the amount actually utilized in the Defense sector is tiny and existing stockpiles insulate the US far greater than its lack of any such stockpiles for silver to be heard of since 2002.

Perpetua Resources operates the Stibnite Gold Project, which recently completed its Federal Permitting process their the FAST-41 program. It was added as a transparency project in April 2025 in response to President Trump's Executive Order, Immediate Measure to Increase American Mineral Product. This executive order took advantage of the active National Emergency to delegate the authority of the President to the Secretary of Defense, as well as the authorities granted by the Defense Product Act (DPA).

This means the DoD has the power of the President and ability to erode all laws to get their objective done. What is their objective? Obtain more silver.

The House Deals A Bad Hand

The House greenlit what may be the most ambitious naval buildout in a generation, tucked into Section 20002 of what’s now being dubbed the “One Big Beautiful Bill.” It’s a sweeping injection of resources meant to fortify America’s Military Power against Chinese and Russian aggression.

There’s just one problem: We don’t have enough silver.

Now in its fifth consecutive year of global supply deficit, the silver market is under historic strain — and yet, this bill reads like a wish-list for a world where silver flows as freely as hard steel.

Treasury on Tap Until 2029

Many sections authorize the Department of Defense to draw additional funds directly from the U.S. Treasury if current appropriations fall short — a rare privilege extended through fiscal year 2029. It’s a blank check with real implications: the ability to spend without delay as long as the shipyards can build. But building takes metal — and not just the kind you forge, but the kind that conducts, cools, and resists corrosion. The kind that’s disappearing.

Silver-Built Ships in a Silver-Starved World

- $250 million will go toward turbine generators, the beating heart of next-gen warships. These machines don’t just benefit from silver — they require it. For heat transfer. For corrosion resistance. For frictionless movement. For flawless conductivity. In short: no silver, no turbine.

- $450 million is allocated to additive manufacturing for wire production and machining. Translation? They're gearing up to 3D-print high-performance wire — wire that, in the military world, is often silver-plated to survive the salt, stress, and speed of maritime warfare.

- $50 million is set aside for naval propeller machining capacity. Propellers operate in punishing conditions, where efficiency hinges on materials that resist the ocean’s relentless assault. That material? Often silver. Used in plating, lubrication, and bearings, silver is what keeps the system spinning smoothly.

- $110 million will boost rolled steel and fabrication facilities — the heavy lifting of shipbuilding. But what’s often forgotten is the nervous system of the ship: the wiring. In warships, it’s not copper alone that carries the load — it’s silver-coated conductors, chosen for their superior performance in marine environments.

The High-Tech Fleet Needs a High-Grade Metal

- $450 million will push forward AI and autonomy for naval platforms — and every sensor, every signal, every circuit demands materials that can handle the load. You guessed it: silver.

- $750 million will support supplier development, potentially including upstream mining and material sourcing. But even that might not be enough. The world isn’t digging silver fast enough to match demand — especially not at military-grade purity.

- $500 million + $250 million for advanced manufacturing techniques reads like a clarion call for silver-based innovation: printed circuit boards, embedded sensors, high-frequency comms — all swimming in silver.

Billions for Ships, But No Metal to Wire Them?

- $4.6 billion for a second Virginia-class submarine in FY2026.

- $5.4 billion for two additional Guided Missile Destroyers (DDGs).

These aren’t wooden warships. Every inch of these vessels is soaked in silver: in sonar, navigation, fire control, communications, radar, batteries. When the systems ignite, it’s silver making the connections.

The Autonomous Swarm: Silver at Scale

The Navy is also leaning hard into unmanned platforms:

- $1.53 billion for small surface vessels

- $1.8 billion for medium surface vessels

- $1.3 billion for unmanned underwater vehicles

- $250 million for wave-powered underwater drones

Each of these is a floating supercomputer — a smart, sensor-laden, AI-driven platform that needs silver-rich electronics to function. Multiply that by hundreds of hulls, and you get an industrial-sized appetite for a metal in shrinking supply.

Big Ships, Big Needs, Big Shortage

- $2.1 billion will fund a new San Antonio-class LPD.

- $3.7 billion backs an America-class Amphibious Assault Ship.

- And $250 million is targeted at corrosion control programs, which — you guessed it — often depend on silver-based coatings and connectors.

All of this, against the backdrop of a silver market where global demand now outpaces mining and recycling by hundreds of millions of ounces annually. We’re burning through inventories, there are no strategic stockpiles, we don't have the required silver.

Meanwhile, the Shanghai price maintains a premium, shifting the flow of Silver to China through simple arbitrage. China is effectively ensuring our failure if this situation is maintained.

The simplest solution is for silver's price to continue to rise and stay lock-step or above what the Chinese is willing to offer, or afford.

Not Just Ships, But Munitions and More

In missile guidance systems like in the AIM-9X and AIM-120, silver is integral to wiring, relays, brushes, capacitors and conductive adhesives due to its superior electrical conductivity and reliability under high-stress conditions. Similarly, in electronic warfare and radar systems, silver’s use in high-frequency RF components ensures optimal performance in detecting and countering threats.

In satellite systems and space electronics, silver’s role is equally vital, with coatings and interconnects ensuring reliability in the extreme thermal and radiation environments of space. Silver alloys in munitions and fuses enable precision detonation, critical for modern smart weapons. Additionally, silver-zinc batteries, used in submarines and aerospace applications, provide high-energy-density power solutions for mission-critical systems. These diverse applications highlight silver’s strategic importance, but global supply constraints, including mining disruptions or export controls by major producers, could jeopardize defense readiness.

These applications demand high-purity silver and precise manufacturing, making supply chain vulnerabilities—such as reliance on foreign sources or limited refining capacity—a significant risk. There is just too many needs for silver and not enough oversight and judgement on where it should best be used and where less superior materials need to be used to fill the gaps.

$10.44 Billion Munitions Procurement Tucked In

(Quantity Data Limited due to National Security)

All of these munitions use some amount of silver ranging from a few ounces to several hundred pounds:

✈ Air Force Munitions

| Munition | Qty | Cost ($M) | Vendor(s) | Notes |

|---|---|---|---|---|

| AIM-9X | 396 | 357.8 | Raytheon | Short-range air-to-air |

| AMRAAM | 425 | 633.6 | Raytheon | Medium-range air-to-air |

| JDAM | 17,070 | 367.8 | Boeing | GPS-guided bomb kits |

| JASSM | 550 | 577.0 | Lockheed Martin | Long-range stealth cruise missile |

| SDB I | — | 243.6 | Boeing | Precision glide bomb |

| Hellfire | — | 149.7 | Lockheed Martin | Air-to-ground |

| GBU-57 (MOP) | — | 32.7 | Boeing | Bunker buster |

| MALD | — | 195.2 | Raytheon | Air-launched decoy |

| AGM-88 HARM | — | 221.9 | RTX (Raytheon) | Anti-radar missile |

🥾Army Munitions

| Munition | Qty | Cost ($M) | Vendor(s) | Notes |

|---|---|---|---|---|

| 155mm ER Arty | — | 186.5 | Northrop Grumman, GD-OTS | Extended range artillery shells |

| GMLRS | — | 1,197.9 | Lockheed Martin | Guided MLRS rockets |

| PAC-3 | — | 2,009.3 | Lockheed Martin | Advanced missile defense |

| Javelin | — | 176.3 | Javelin JV (Raytheon/Lockheed) | Infantry anti-tank |

| TOW | — | 216.9 | Raytheon | Anti-armor missile |

| Hellfire | — | 227.8 | Lockheed Martin | Rotary-wing launched |

⚓Navy / Marine Corps Munitions

| Munition | Qty | Cost ($M) | Vendor(s) | Notes |

|---|---|---|---|---|

| Tomahawk | — | 479.4 | Raytheon | Long-range strike missile |

| SM-6 | — | 1,055.4 | Raytheon | Ship-to-air/multi-mission |

| RAM | — | 218.8 | Raytheon / Diehl (JV) | Point defense missile |

| ESSM | — | 248.3 | Raytheon-led consortium | NATO-standard air defense |

| AIM-9X | — | 128.4 | Raytheon | Navy air-to-air variant |

| AMRAAM | — | 114.8 | Raytheon | Navy variant |

| Hellfire | — | 82.2 | Lockheed Martin | For helicopters/ships |

| Harpoon | — | 171.9 | Boeing | Anti-ship missile |

| Naval Strike Missile | — | 272.1 | Kongsberg / Raytheon JV | Anti-ship missile |

| LRASM | — | 257.8 | Lockheed Martin | Stealth anti-ship missile |

| SDB II | — | 108.5 | Raytheon | Moving target bomb |

| JAGM | — | 60.6 | Lockheed Martin | Multi-platform missile |

🔻Other / Defense-Wide

| Munition | Qty | Cost ($M) | Vendor(s) | Notes |

|---|---|---|---|---|

| MK-48 Torpedo | 148 | 209.0 | Northrop Grumman, SAIC | Sub-launched heavyweight torpedo |

| Precision Strike Missile (PrSM) | — | 243.2 | Lockheed Martin | Long-range fires system |

The Hard Question: Who’s Counting the Ounces?

With more than potential $25 billion in silver-reliant projects in this one bill alone, there’s an uncomfortable truth no one seems eager to confront: We’re planning a defense strategy with metal we may not be able to source.

The U.S. is charging forward into an electrified, autonomous, AI-enabled future — but until someone takes silver supply seriously, even the most beautiful bill might be building ships that can’t be wired, weapons that can’t be fired, and systems that can’t be powered.

And all this in the fifth year of a global silver shortfall.

The real war may not be fought at sea. It may be fought underground — for the last untapped veins of the world’s most essential strategic metal.

Download a copy of the bill: