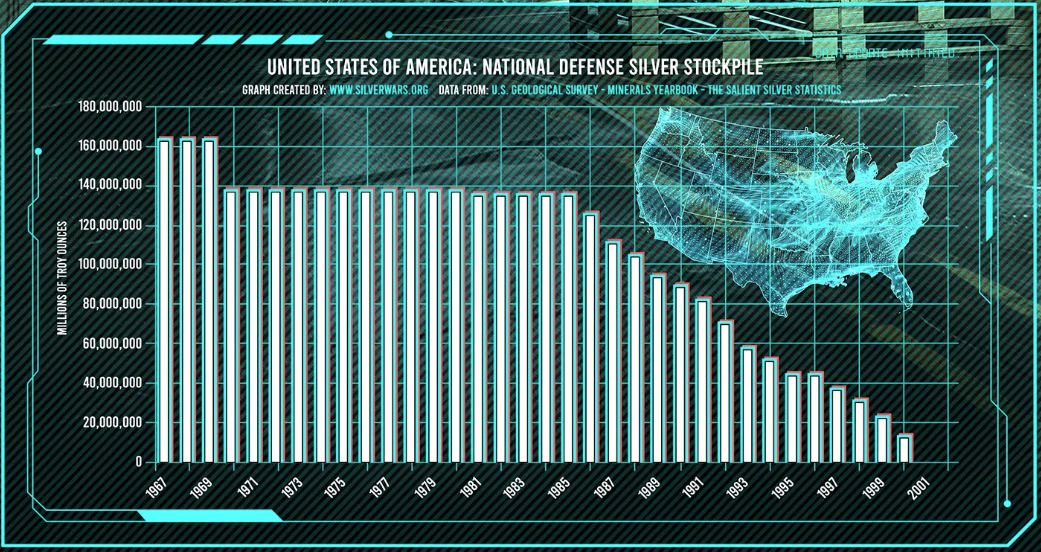

The US National Defense Stockpile (formerly Strategic and Critical Materials Stockpile) was established to hold materials deemed essential for national security and industrial needs. In June 1968, the Treasury transferred 165 million troy ounces of silver to the stockpile under the Strategic and Critical Materials Stockpiling Act. This transfer reflected that the US had ample Treasury silver after coinage changes and needed to set aside strategic reserves.

Two years later, the 1970 Bank Holding Company Act (84 Stat. 1768) authorized adjustments to silver certificate redemptions; consequently 25.5 million ounces were returned to the stockpile to the Treasury for use in coinage. By 1970, the stockpile held about 139.5 million ounces of silver (165 – 25.5).

The stockpile was managed by the General Services Administration (GSA) in cooperation with defense and civilian agencies. The Federal Preparedness Agency (FPA, later FEMA) was responsible for stockpile planning and setting goals, while the GSA’s Federal Property Resources Service executed acquisition, storage, and disposal materials. An interagency Stockpile Goals Committee—including representatives from GSA/FPA, OMB, and the Department of Defense, Commerce, State, Interior, and Treasury—reviewed and approved all goals.

At the time silver’s strategic uses were understood to be mainly in photography, X-ray film, electronics, batteries, and medical applications, so planners ensured enough supply to meet wartime needs around these considerations.

Reassessment in the 1970s – Goal Set to Zero

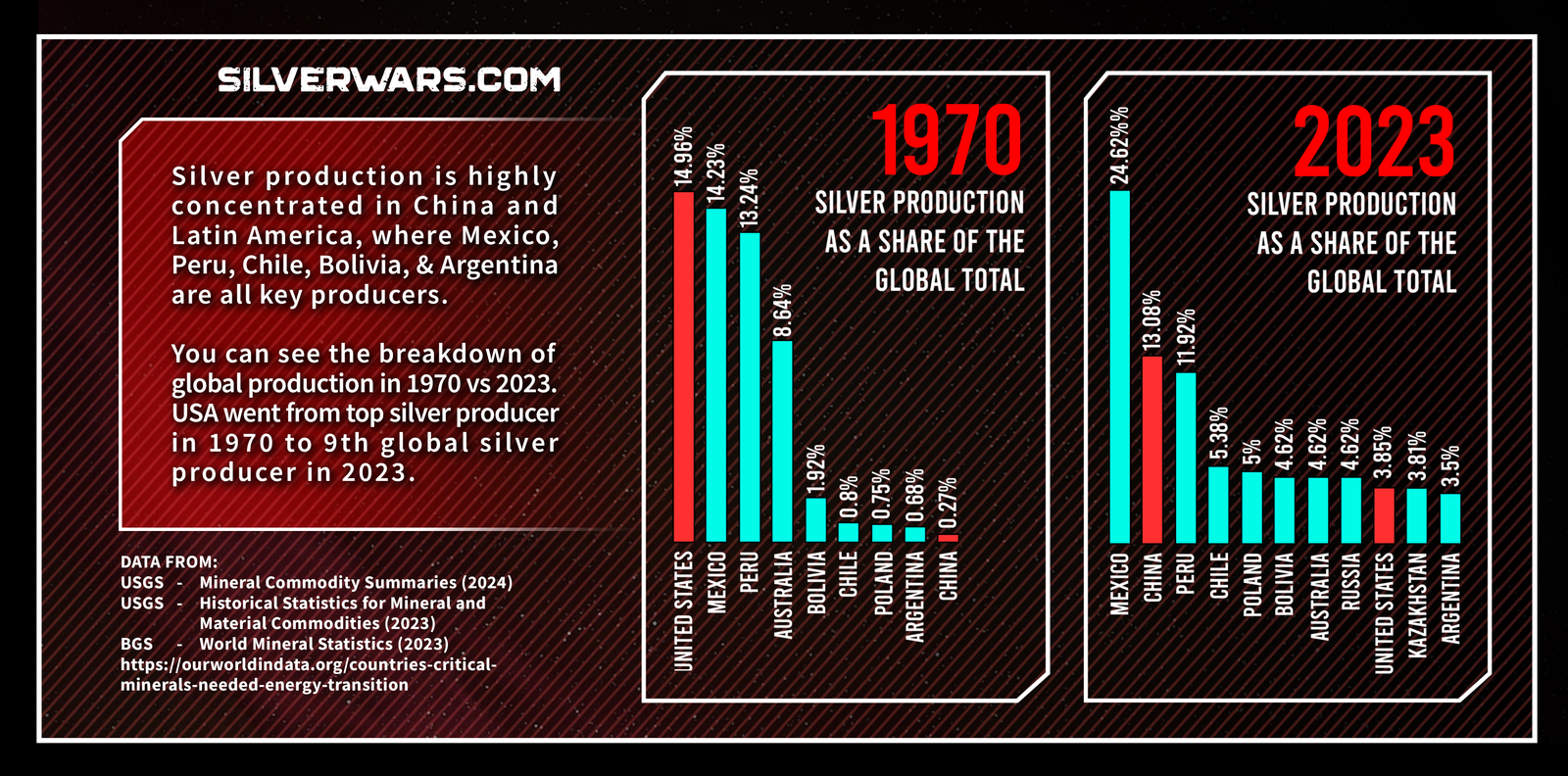

In the mid-1970s, stockpile analysts concluded that even in a major war silver would not be in short supply. In 1976 the FPA’s wartime-economy model found that North American production (USA, Canada, Mexico) plus existing stocks would far exceed US defense requirements for silver, even over a 3-year war.

Accordingly, FPA formally set the strategic stockpile goal for silver to zero in 1976. In other words, the entire stockpiled silver was deemed excess to security needs.

By October 1, 1981, the National Defense Stockpile still contained 139.5 million ounces of silver—a quantity larger than the entire US annual silver consumption reported at the time (117.6M oz in 1980).

These conclusions drew on input from DoD and others but relied heavily on economic modeling. GSA/FEMA analysts used a 3-year war scenario to compute requirements and consulted DoD, Commerce, State, Interior, etc., for supply and demand data. The GAO later noted that this methodology was “reasonable” by contemporary standards.

In sum, throughout the 1970s the government came to the view silver as not critical: domestic and allied supply was ample, alternate materials could cover civilian uses, and recycling or imports could meet military needs if necessary.

1981-82: Sale Proposals and Legislative Response

With silver judged non-strategic, the Carter and Reagan administrations looked to monetize the stockpile. In 1981 FEMA 9then managing stockpile policy) proposed selling part of the silver inventory to raise funds for other defense materials. Reagan’s FY1982 plan called for selling over 50 million ounces (about one-third of the stockpile) to generate roughly $500 million in revenue.

FEMA Director Paul Krueger argued that stockpiled silver was unused money: “If you evaluate it strictly on a national security basis, there is absolutely no reason to have silver in the stockpile,” he said. The budget proposal earmarked the proceeds for higher-priority minerals (e.g. $100M towards cobalt). GSA officials and GAO analysts concurred that North American (NA) production could supply far more silver than wartime needs – GAO reported NA mines could provide four times the projected defense requirements for a three-year war.

These sales proposals immediately drew opposition. Silver industry and mining-state lobbies mobilized Idaho’s congressional delegation and silver-mining interests warned that dumping government silver would crash prices and hurt miners. The Silver Users Association (an industrial group) also had an interest: because high silver prices were cutting consumption, users hoped a government sale might ease prices.

In Congress, legislators from mining states (like Senator Jim McClure of Idaho) added a rider to the Defense Appropriations Act (H.R. 4995) to block further silver auctions. The FY1982 Defense Appropriations law (P.L. 97-114, Dec 1981) suspended the planned sales, requiring a Presidential “redetermination” by July 1, 1982 that the silver was indeed surplus and Congress to approved any disposal plan. In effect, the legislation halted large-scale disposal pending further study.

Interagency Review and Coin Legislation (1982-85)

Congress also directed a new interagency review of silver’s needs. GAO was asked to evaluate whether conditions had changed since the 1976 study. GAO’s 1982 review reaffirmed the defense demand remained below the possible supply, essentially endorsing the zero-goal conclusion. However, before GAO’s final report, the “massive disposal” plan had stalled. A mid-1982 GAO update noted that the required Interagency Commodity Committee had never released its study, and by October 1985 “there were no proposals for a massive disposal of stockpile silver”. In practice, the political consensus was shifting rather than selling bullion by auction, Congress looked for an alternative use of the metal that would not destabilize the market.

One solution was coinage. Senators McClure (Idaho) and Craig (Idaho) proposed amending law to convert stockpile silver into coins. In 1985, McClure successfully attached an amendment (the “Liberty Coin Act” to the Statue of Liberty commemorative coin bill (H.R. 47). This law (P.L. 99-61, §201) authorized the new American Silver Eagle bullion coin (launched in late 1986) and explicitly directed that the silver content come from the National Defense Stockpile.

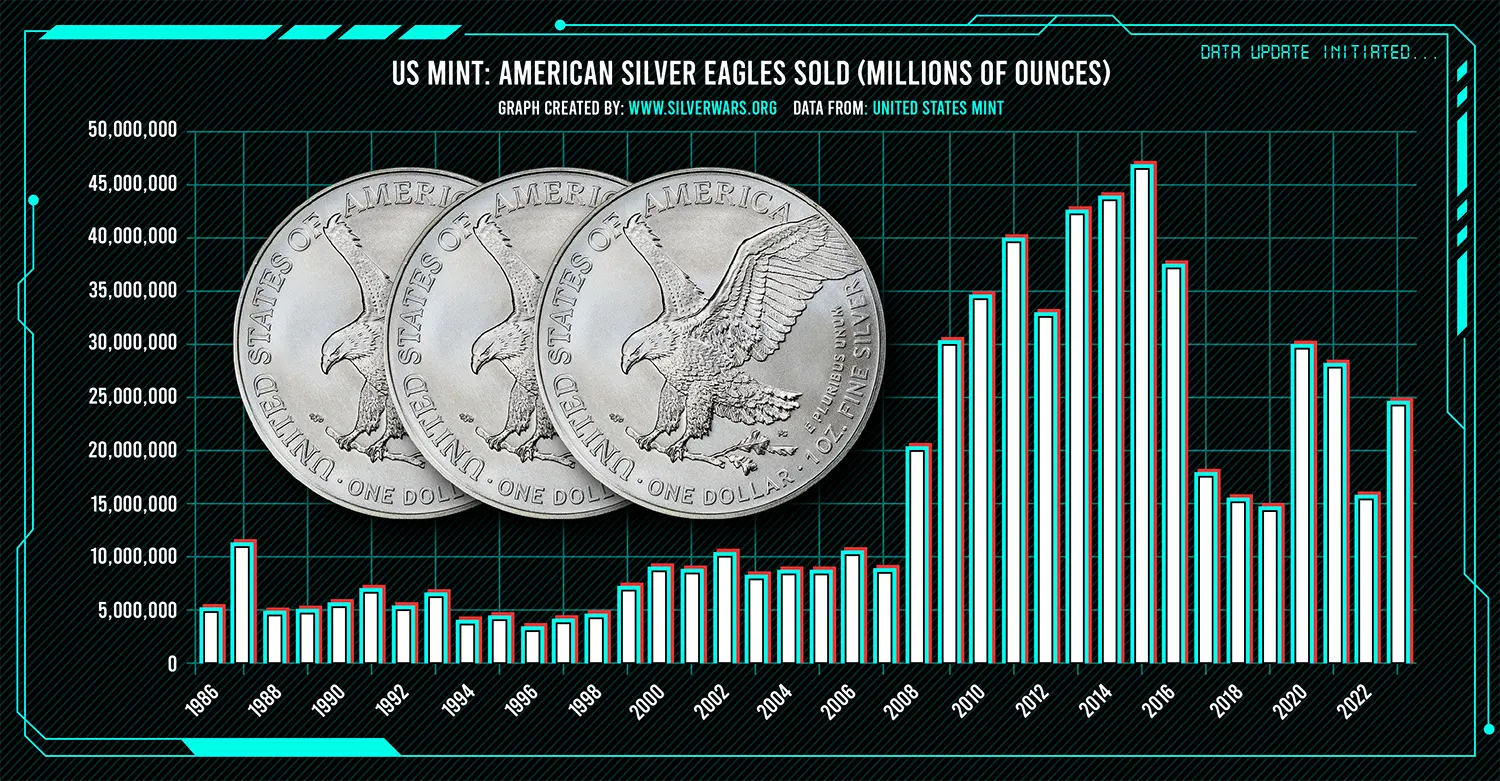

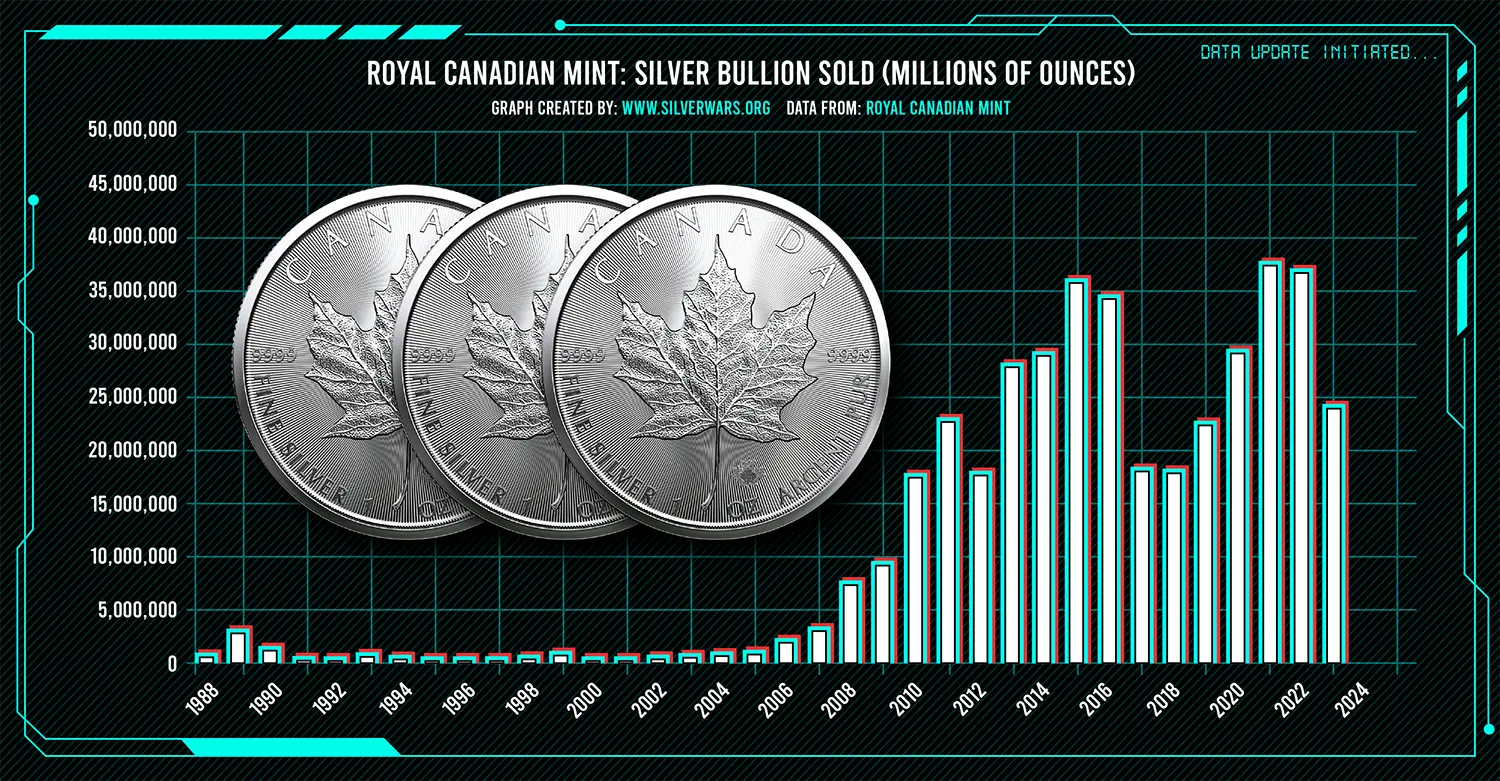

The Silver Eagle act thus repurposed the excess silver: instead of selling it directly, the government would gradually mint it into bullion coins. By law up to several million ounces per year of stockpiled silver were used to strike Silver Eagles, raising revenue for the Treasury (via coin sales) without a large one-time market dump.

Outcome and Aftermath (1986-2002)

The Silver Eagle program effectively depleted the stockpile’s silver over time. The legislation anticipated a gradual drawdown, and by the early 2000s, it was clear that the stockpile reserves were nearly exhausted. In 2002, Congress passed another law (P.L. 107-201) authorizing the Mint to buy silver on the open market once stockpile silver ran out.

In practice, no new stockpile silver remained by about 2002, when the program shifted to purchased bullion. (At that point the US no longer held meaningful stockpile quantities of silver, and the National Defense Stockpile management focused on other materials.)

Throughout this period, DoD’s role was largely advisory. DoD provided input on military needs (e.g. navy batteries, missile systems), but it did not press to keep silver in the stockpile. For example, GAO noted that even the Defense Dept. maintained only ~7M oz of silver in contract inventories, far less than the GSA stockpile.

The MX missile program’s battery requirement (35 M oz) was often mentioned, but planners assumed procurement could tap civilian production and allied supplies. In short, no service branch objected strongly to the disposal of excess silver once the civilian agencies deemed it surplus.

Economic and Policy Contest

By the late 1970s the government’s economic assumptions about silver had changed. During WWII and the early Cold War, silver (like other metals) had been valued partly for its connection to currency and film technology. But by the 1970s (1) US coinage no longer used silver in quarters, half-dollars, dollars and dimes, freeing Treasury silver; (2) photographic demand was seen as replaceable over time (color photography was rising, and digital imaging was far in the future); (3) domestic mining (plus allies) could meet foreseeable military needs. Officials also noted large above-ground inventories – in jewelry, silverware, and industry – that could be recycled. A commodity analysis in 1979 emphasized that “available supply of silver, even under wartime conditions, has been determined as more than adequate”.

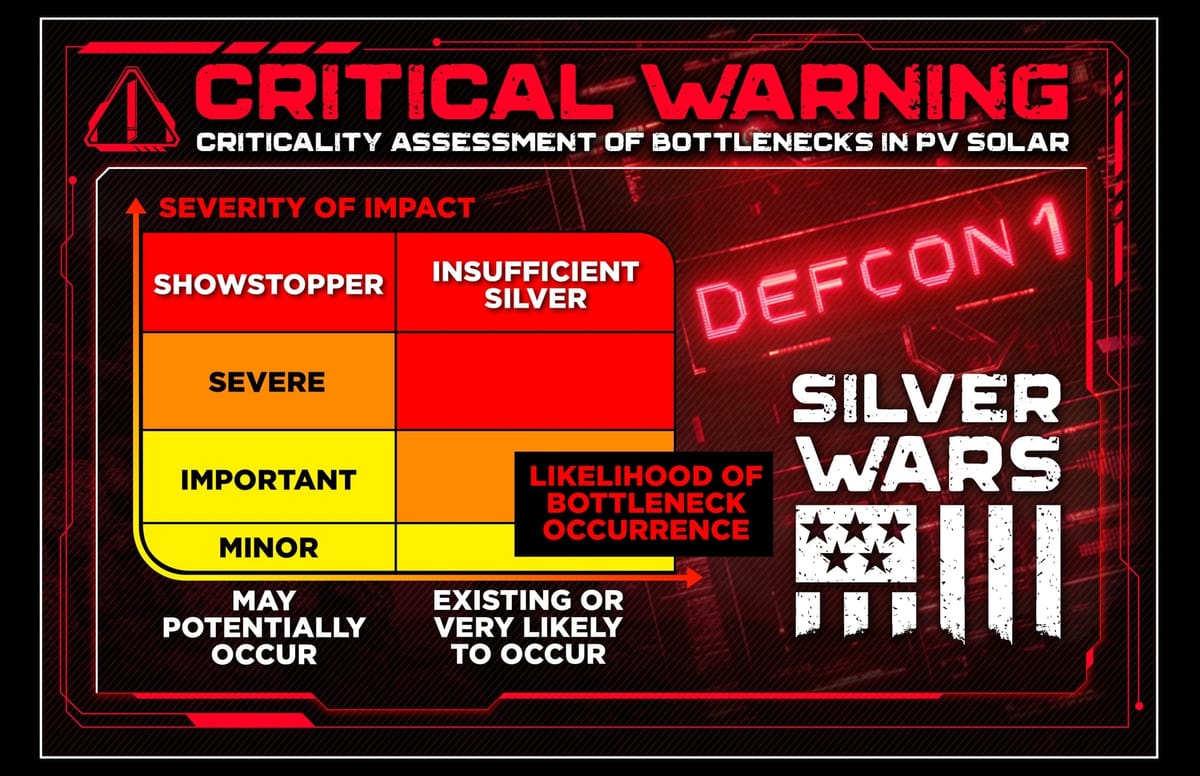

This is the same nonsense said today with no real data to back it up, just poor assumptions or blind hopes. No accurate data tracks the melting and refinement of discarded jewelry, silverware, and industrial waste worldwide. Anecdotally, from industry commentary on the subject is that the largest influxes of this type of above ground reserve occurred in the early 80s and 2010-11-ish timeframes. There is now no certainty, especially with a decrease in popularity and affordability of these items that there is enough that will be sold back to the market to satisfy industrial demand in the near term.

In other words, silver lacked the supply risk that defined the other strategic materials (such as rare earths, cobalt, or chromium) because its assumed that people will just give up their jewelry, silverware and bullion or that magically the other 80% of ignored E-Waste will recycle itself. Also don’t worry because Canada and Mexico will always be the United States’ allies and give up their silver regardless if it undermines their strength on the world stage. They will never ally with China/BRICs instead. Right?!

Market conditions also influenced the debate. In 1980 silver prices spiked to ~$50/oz (partly due to the Hunt Brothers’ cornering attempt) and then crashed. The matter of high silver prices were and still are a National Security issue due to fears that investor will hoard physical supply. The crash was orchestrated at the highest level of government and facilitated by the idea of injecting US stockpile supply into the market all at once.

High prices had dampened industrial demand (US consumption fell 25% in 1980). A large government sale at the peak could have further destabilized markets. The Reagan plan explicitly proposed a phased sale to “preclude market disruption”, and FEMA officials claimed past sales had minimal net effect on price (a citing of modest decline in historical sales). Nevertheless, anti-sale legislators feared any additional dumping (including simultaneous private sell-offs by the Hunts) would further drop prices and hurt US producers. Conversely, silver-using industries (electronic components, photography, battery manufacturers, dental supply, etc.) generally favored government sales to lower input costs. Congress wrestled with these competition pressures, ultimately channeling silver into the Mint program rather than open auctions.

Silver Wars’ Perspective

Silver was effectively removed from the US strategic-materials designation by the late 1970s in order to satisfy industrial demands, both civilian and defense orientated. Industrial interests freed and put the US stockpile of silver on the open market for both allies and enemies (globalism) to partake and gorge themselves to manufacturer for the US.

The US government intently controlled the market with its stockpile until its was fully depleted in 2002. After, the popularity of ETFs grew, and paper/digital limitations manipulate the price. All of this gaslighting is sanctioned by the US Government. All with the intent to get Investors to Sell and rig the market with the Military Industrial Complex goal's in mind. This is nothing short of the same elite entitlement that causes so many poor people to die in stupid wars for the goals serving only the mega wealthy. The Silver Bill is coming due and the general public will refuse to pay it.