The latest maneuvers in the South China Sea show a dramatic shift in naval strategy. China’s People’s Liberation Army Navy is deploying the Type 22 fast attack boats—small, fast, and packed with missiles—to intercept U.S. warships weighing over 10,000 tons. It’s a pure asymmetric play, and it’s raising deeper concerns beyond tactics and tonnage: a looming crisis in military silver consumption.

China's New Naval Gambit

The PLA’s Type 22 boats are designed for speed and shock value. Built primarily with aluminum alloys, using stealth shaping and waterjet propulsion, these 220-ton vessels are a fraction the size of a U.S. Navy destroyer but carry eight YJ-83 anti-ship missiles—enough firepower to threaten much larger ships.

Key Comparison:

Recent intercept operations by the Type 22 demonstrated that speed, stealth, and swarm tactics can close the gap against heavier U.S. forces operating near contested islands and reefs.

The Real Cost: Silver Burn Rate in Modern Naval Warfare

While attention focuses on ship counts and missile ranges, the hidden story is about resources—specifically, the silver embedded across every ship, missile, radar, and jammer deployed.

Systems highly dependent on silver include:

- Missile guidance packages

- High-frequency radar and sonar systems

- Electronic warfare (ECM) platforms

- Advanced communication arrays

Silver Depletion Risks in Naval Conflict:

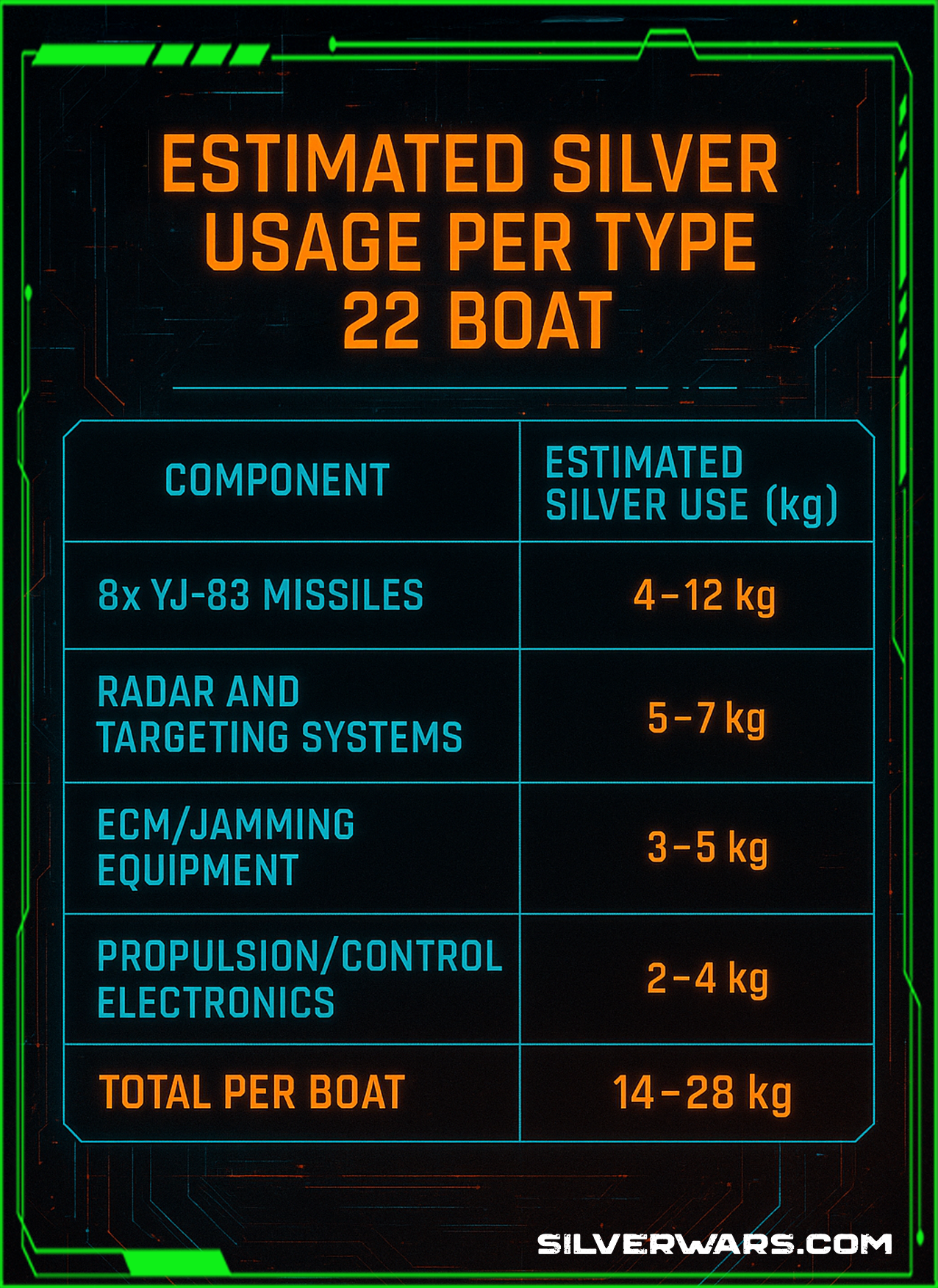

Type 22’s Silver Footprint: Small Ship, Big Appetite

Each Type 22 boat represents a concentrated silver demand across multiple systems. Despite its small size, the technology packed into these vessels makes their silver consumption meaningful.

Estimated Silver Usage Per Type 22 Boat:

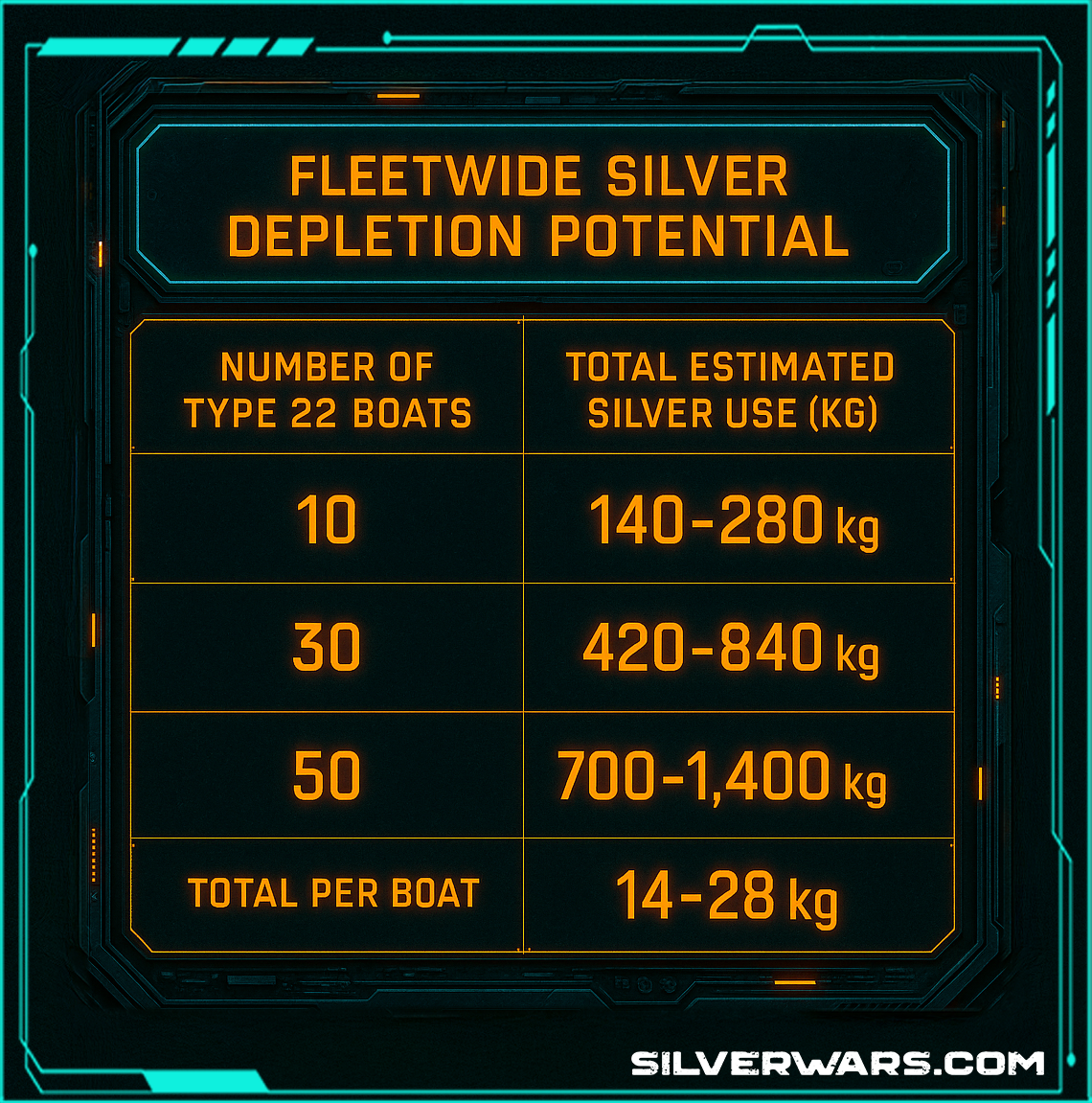

Deploying just 50 of these boats could burn through up to 1,400 kilograms of silver in combat-ready systems alone—before the first engagement even begins.

Fleetwide Silver Depletion Potential:

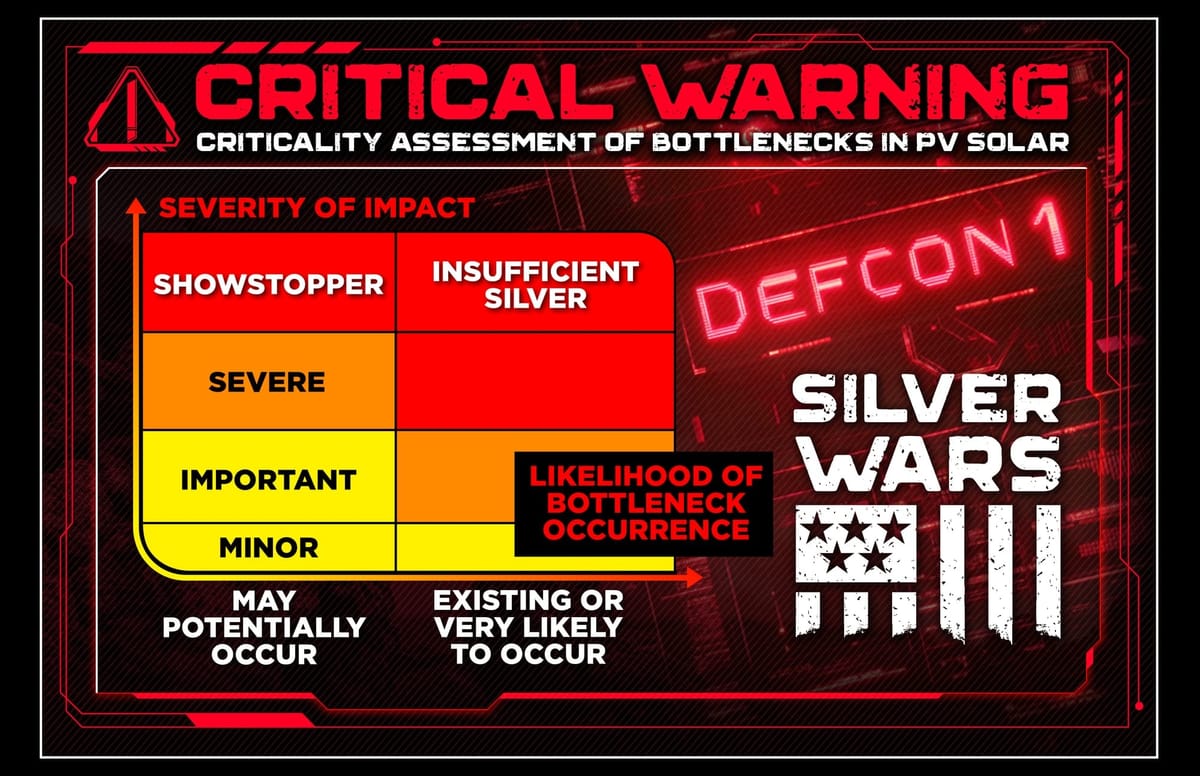

The Structural Problem: Stockpiles Are Not Ready

During the Cold War, the U.S. maintained about $50 billion in strategic materials. Today, that number sits closer to $800 million, but the silver specific stockpile has been depleted.

Unlike energy or fuel, silver isn’t easily replaceable. Defense electronics rely on silver for conductivity, corrosion resistance, and durability under battlefield conditions. Substitutes like copper simply cannot match performance requirements for advanced radar or missile systems.

And once depleted, replacing lost silver stocks is slow. Primary silver mining output is declining, just as industrial demands—from EVs to solar panels—are hitting record highs.

Why China’s Swarm Strategy Accelerates Silver Depletion

The deployment of fast, stealthy, missile-heavy boats like the Type 22 changes the silver equation:

- Higher missile consumption rates in any battle scenario.

- Constant radar and ECM usage requiring silver-dependent systems.

- Increased damage turnover, where even non-fatal hits force equipment replacement.

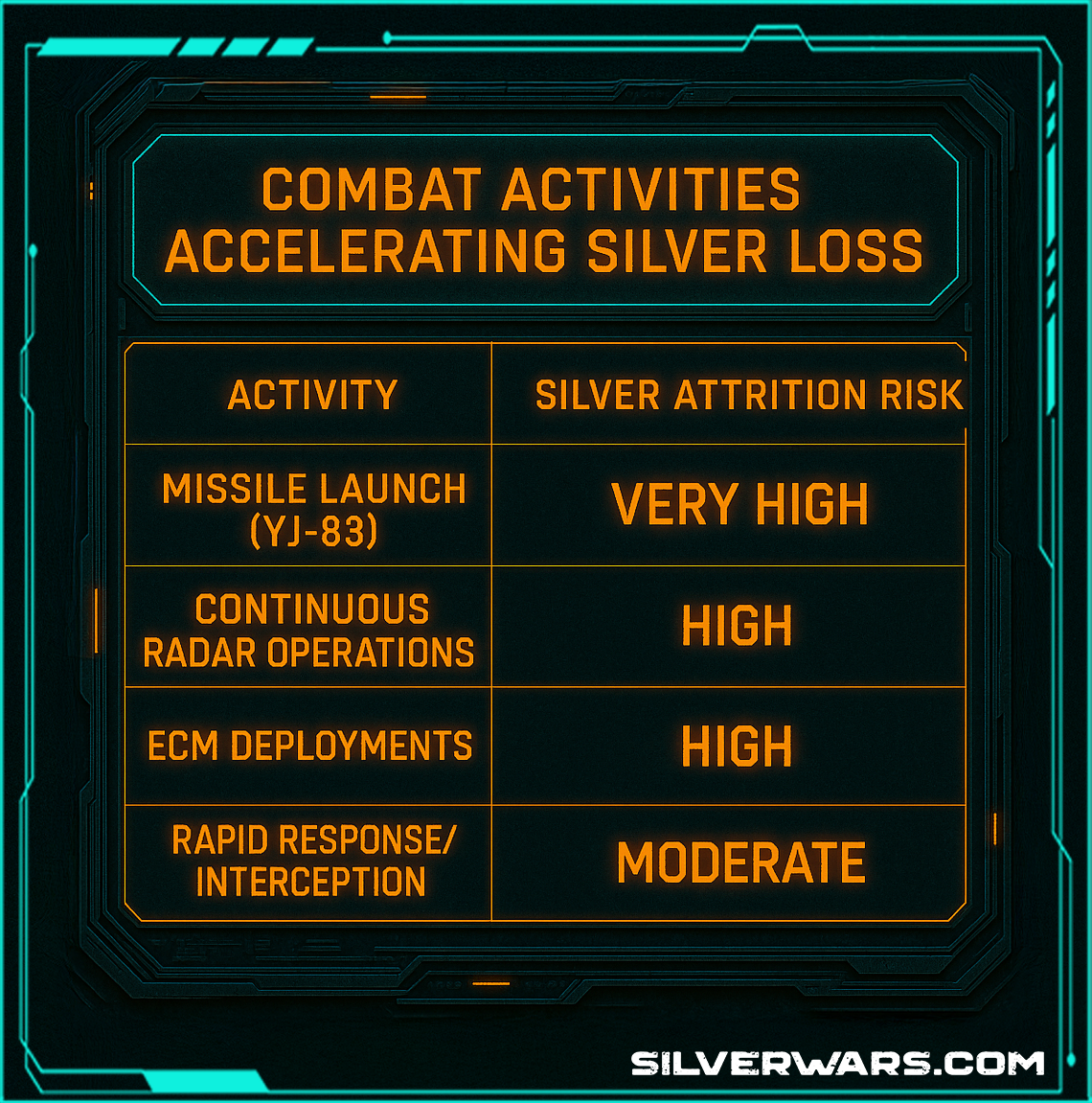

Combat Activities Accelerating Silver Loss:

In effect, every hour of high-intensity naval activity isn’t just burning fuel. It’s vaporizing critical silver stock at a rate that global supply chains cannot currently support.

The Silver Wars Continue

The flashy headlines are about tonnage mismatches and missile counts. But the deeper, quieter war is over minerals. China's Type 22 boats aren’t just challenging U.S. sea power—they’re pushing the limits of critical materials logistics, forcing navies into a long-term depletion trap.

Silver isn’t just an industrial commodity anymore, its critical for defense. In the next major Pacific naval standoff, it could become the true limiting factor between sustained operations and collapse.

Whoever controls the silver will control the fight. And right now, the clock is ticking faster than most defense planners realize.