Yesterday (Oct 27), the United States and Japan signed a sweeping framework agreement – valued at roughly $550 billion – to strengthen economic and defense cooperation. A central element of this pact is ensuring “resilience and security of critical minerals and rare earths supply chains,” aiming to reduce dependence on China for vital resources.

The agreement is part of a broader Indo-Pacific strategy to diversify supply sources and bolster alliances amid global resource competition. It follows similar U.S. deals with Australia, Malaysia, and Thailand to develop alternative critical mineral supplies. At the Tokyo signing, both nations underscored that shoring up supply chains for strategic materials is as much about economic security as it is about defense preparedness.

Notably, the deal came alongside Japan’s new Prime Minister pledging to accelerate military build-up (boosting defense spending to 2% of GDP) and to invest in U.S. industries like shipbuilding as goodwill measures. These moves reinforce the security alliance and indicate that industrial and defense cooperation will go hand-in-hand. Within this context, silver – traditionally seen as a precious metal – is now being reframed as a strategic material due to its critical role in high-tech and defense systems.

Below we analyze how the US–Japan agreement could impact the strategic silver supply chain, from establishing stockpiles to reorienting sourcing, especially under potential Asia-Pacific conflict scenarios.

Silver as a Critical Metal in Defense

Silver’s unique properties – highest electrical and thermal conductivity of any metal, corrosion resistance, and even antimicrobial traits – make it indispensable in military and aerospace technology. Modern defense systems rely on silver-bearing components for reliable performance:

💠Electronics and Avionics: Silver is used in high-performance circuit boards, electrical contacts, and soldering alloys in fighter jet avionics, radar and communication systems, and electronic warfare equipment. Its superior conductivity ensures signals and power flow with minimal loss, a necessity in mission-critical hardware

💠Missiles and Precision Munitions: Guidance systems in missiles and smart munitions often use silver-based wiring and contacts. Silver’s durability under extreme temperatures and vibration makes it ideal for connectors and sensors in these weapons. Some advanced batteries (e.g. silver-zinc, magnesium-silver, aluminum silver, etc. batteries) powering torpedoes or spacecraft are chosen for their high energy density and reliability in combat conditions.

💠Satellites and Sensors: Military satellites and surveillance systems use silver in solar panels, circuitry, and RF components. For example, silver-coated wires and RF amplifiers help satellites and radar arrays maintain signal integrity. Silver’s role is irreplaceable in such applications demanding ultra-reliable conductivity.

💠Other Defense Uses: The metal’s anti-microbial properties are leveraged in field medical equipment and water purification units for forces in the field. Even emerging technologies like 5G networks, AI hardware, and high-power lasers (with military applications) use silver in semiconductors and electrical contacts.

Crucially, U.S. policymakers now recognize that silver is not just a luxury or industrial commodity, but a strategic resource for defense and technology. In fact, the U.S. Geological Survey’s draft 2025 Critical Minerals List proposes adding silver for the first time, placing it alongside lithium, rare earths, and cobalt as essential to economic and national security. This pending designation underscores that silver supply disruptions could undermine military readiness and other critical systems.

Looking to diversify your portfolio with tangible assets? Jim Cook at Investment Rarities offers expertly curated asset investments with their extremely dedicated team. Discover unique opportunities often overlooked by traditional markets. Visit InvestmentRarities.com Today!

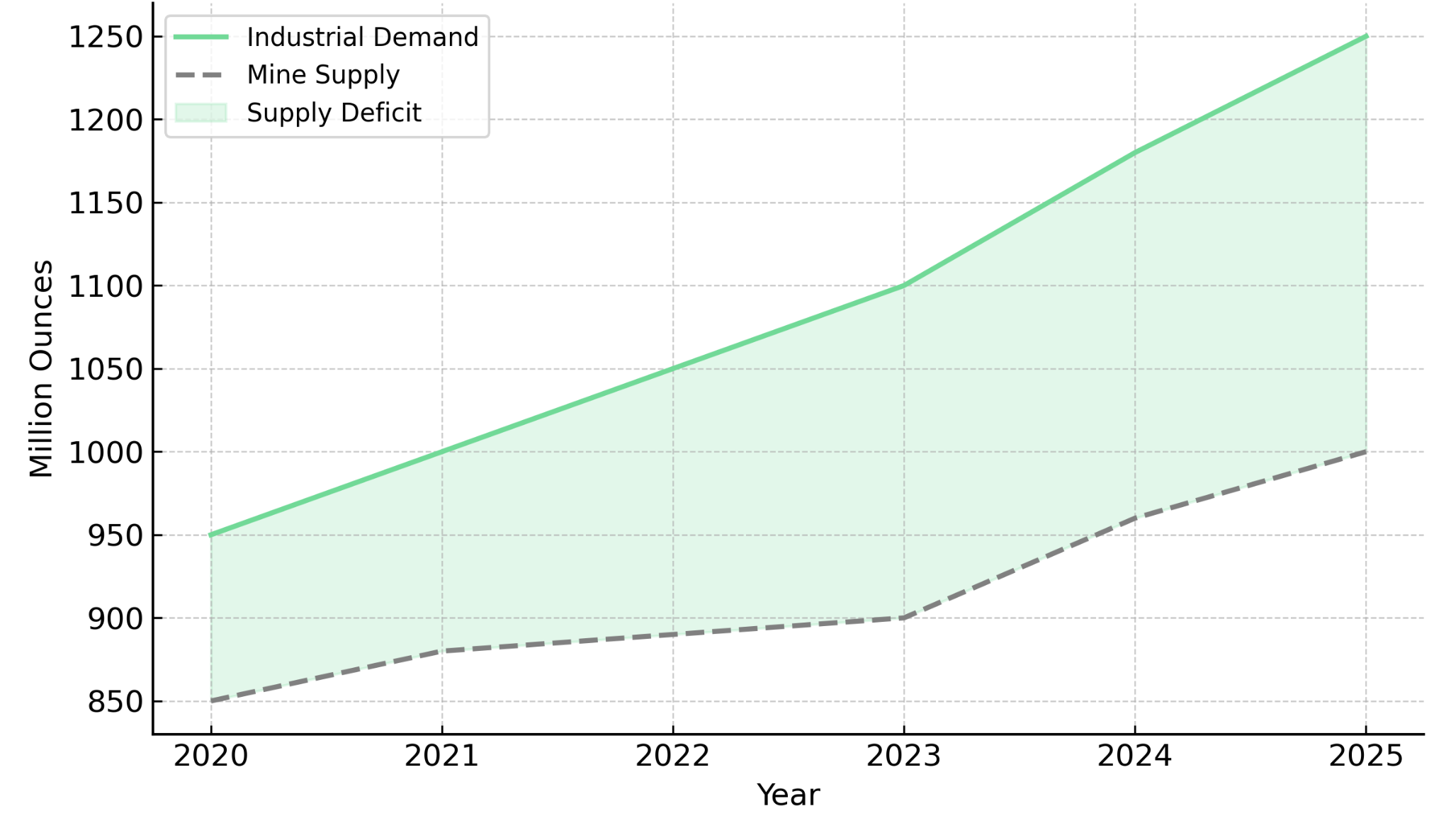

The U.S. currently imports over 70% of its silver consumption, and a significant portion of global silver refining is concentrated in China. Such import dependence – with China as a key processor – is viewed as a strategic vulnerability, since “silver-intensive technologies underpin everything from renewable energy infrastructure to advanced military systems”. In short, ensuring secure access to silver has become a national priority for the defense sector.

Strategic Stockpiling & Reserves of Critical Metals

One immediate implication of the US–Japan accord is a push toward strategic stockpiles of silver and other critical minerals. The agreement explicitly calls for exploring “a mutually complementary stockpiling arrangement” between the two countries, coordinated with allies, to guarantee supply chain security.

This indicates that Washington and Tokyo are considering joint or coordinated strategic reserves – effectively an allied buffer of critical materials that could be drawn down in an emergency. Silver, now falling under the “critical mineral” umbrella, would likely be included in such stockpiling initiatives alongside rare earths and battery metals.

Establishing silver stockpiles is a prudent defensive measure given history and threat scenarios. In past major wars, the U.S. suffered from mineral shortages because it lacked sufficient reserves and faced shipping disruptions. Today, the risk is starker: U.S. defense officials estimate that in a hypothetical war with China, the military could face shortages in 69 key materials needed for weapons production.

Silver’s inclusion on the critical list reflects a lesson learned – that even commonly available metals can become scarce at the worst time if supply lines are cut. A National Defense Stockpile (NDS) program for silver (analogous to those for oil or uranium) may be on the horizon. Indeed, critical status “legally mandates government focus on securing domestic supply chains through… strategic stockpiling,” according to defense materials analysts.

We may see the U.S. Defense Logistics Agency (which manages materials for military needs) begin direct silver purchases for a strategic reserve, just as it does for other strategic commodities. Such stockpiles would serve as war reserves to ensure production of missiles, avionics, and other systems can continue even if imports are disrupted.

Japan, for its part, has a history of stockpiling critical materials (for example, rare earth oxides after a 2010 Chinese embargo). A “complementary” US–Japan stockpiling plan could mean coordinated reserves – perhaps each country holding certain materials in larger quantity, with agreements to share in contingencies. This reduces duplication and creates a safety net for the alliance as a whole. The pact paves the way for silver to be treated akin to a strategic materiel, with allied stockpiles guarding against sudden cutoff.

From a defense-sector viewpoint, this greatly enhances supply security. In a conflict scenario (e.g. a Pacific crisis), pre-existing silver reserves could be tapped to manufacture the surge of missiles, guidance systems, and spare electronic parts that the U.S. and Japan would need. It buys time to scale up alternative supply or recycling if traditional mining sources are unreachable. Stockpiling does come at a cost – tying up capital in metal inventory – but the agreement’s scope (hundreds of billions in investment) suggests both governments are willing to invest heavily in supply chain resilience as “insurance”.

Indeed, officials cite that even a “low-probability but high-impact disruption” of a critical mineral warrants mitigation, given how a single missing input can halt production of a whole weapons system. We should expect new bilateral strategic reserves of silver and allied-critical metals to form a cornerstone of the US–Japan strategy.

Industrial Cooperation and Defense Manufacturing Demand

The US–Japan agreement also entails deeper industrial cooperation, including in defense manufacturing, which will inevitably boost demand for silver in military technologies. Part of the $550 billion framework is aimed at joint economic projects – the Japanese side, for example, has earmarked investments in areas like shipbuilding, energy, and high-tech manufacturing as part of the deal.

Prime Minister Takaichi’s government is pledging to purchase more U.S.-made defense equipment and co-develop military capabilities, while the U.S. welcomes Japan’s steps to expand its own defense production base. This military-industrial coordination means that both nations will be ramping up production of advanced hardware – from naval vessels and fighter jets to missiles and sensor networks – and silver-containing components will be built into all of them.

PM Takaichi gifts President @realDonaldTrump a golf bag signed by Hideki Matsuyama and Prime Minister Abe’s putter ❤️⛳️ pic.twitter.com/YlaYnfr846

— Margo Martin (@MargoMartin47) October 28, 2025

Consider the defense electronics supply chain: if the U.S. and Japan collaborate on a new radar system or jointly develop missile interceptors, they may share production tasks (one country producing certain subsystems, the other assembling final products). This distributed manufacturing could lead to higher aggregate usage of silver, as each country builds up capacity (duplicating some supply lines for redundancy). A hypothetical example is joint work on missile guidance units – the precision circuitry (with silver-laden circuitry boards and contacts) might be made in Japan’s electronics factories, integrated with warheads or airframes built in the U.S. Such arrangements leverage Japan’s strengths in electronics manufacturing and the U.S.’s in weapons integration.

Indeed, Japan is already a world leader in materials processing and electronics – it refines critical metals like lithium, cobalt, and rare earths, and produces high-end components for cars and aircraft. By tapping these strengths, the alliance can expand production of critical defense tech outside of China’s orbit. But it also means Japan will import more raw materials (including silver) to feed its factories, and the U.S. will similarly need steady inputs for any increased domestic manufacturing.

Beyond pure defense, the agreement’s emphasis on critical supply chains extends to sectors like semiconductors, batteries, and clean energy (areas that have dual-use benefit for defense). Both nations are incentivizing domestic semiconductor fabs and battery plants – for example, Japan’s cooperation with the U.S. on next-generation chips and its support of EV battery materials.

Silver plays a role here (semiconductor packaging, EV electronics, solar panels for military and civilian use), so industrial policies arising from the deal will boost silver consumption. If, say, new factories for solar panels or 5G infrastructure are built under US–Japan programs, the demand for silver in solder and contacts will rise in tandem.

From a defense perspective, increased allied production capacity is a strategic asset – it ensures the U.S. and Japan can produce the arms they need without relying on global supply chains that run through adversaries. But it also puts the onus on securing more raw inputs. We may see initiatives like joint procurement of silver from friendly sources or co-investment in mining. For instance, the U.S. might sign offtake agreements with mines in the Americas, while Japan (through JOGMEC or private firms) could finance projects in politically stable countries, and then the allies share the output. The agreement’s huge investment fund could even support reopening or expanding silver mines domestically (e.g. in the U.S. or Canada), given that easing permitting for critical minerals is explicitly part of the plan.

As the U.S. and Japan tighten their defense-industrial collaboration, silver’s strategic importance will grow commensurately. Every new radar, missile battery, or satellite constellation that the allies produce will incrementally increase silver usage, whether in wiring, sensors, or power systems. The $550 billion partnership effectively underwrites a potential surge in defense manufacturing, so part of the alliance’s job will be to ensure the silver supply chain can scale up to meet this without bottlenecks.

Notably, this realignment carries a strategic message to Beijing. By fortifying supply lines with trusted allies, Washington and Tokyo gain leverage in any future standoff. If China knows the U.S.–Japan bloc has secured alternate pipelines for critical materials like silver, any attempt at a mineral embargo would be less effective, potentially deterring that course of action. As one observer put it, even if building new supply chains takes time, “it changes the dynamics” – the allies are less susceptible to blackmail, which strengthens their position in a crisis. Thus, beyond the technical logistics, the agreement’s push to reorient silver and mineral supply chains is part of strategic contingency planning for great-power conflict. It’s about ensuring that if Asia-Pacific tensions boil over, the U.S. and Japan can still build the electronic brains and eyes of their defense systems without pause.