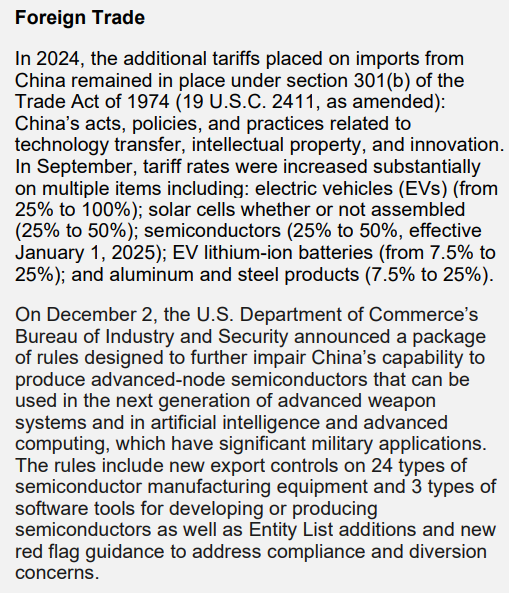

On September 13, 2025, China’s Ministry of Commerce opened two new trade investigations against the United States: an anti-dumping probe into U.S. analog ICs and a discrimination probe into U.S. export controls. At face value, this looks like another front in the semiconductor war. But behind the headlines lies silver — the silent, indispensable input both sides are fighting over.

Semiconductors Are Built on Silver

Analog and power management chips — including gate drivers and interface ICs — rely heavily on silver pastes, bonding wires, coatings, and sintering materials. These components handle high conductivity and thermal loads that no substitute metal can match. The very chips China is targeting sit inside EVs, solar inverters, and defense electronics — all industries where silver is irreplaceable.

DoD Warnings: Chips and Supply Chains

The U.S. Department of Defense has flagged semiconductors as defense-critical supply chains since 2021’s Executive Order 14017. Its 2022 report explicitly called for relocating semiconductor manufacturing and packaging back to U.S. soil. Yet dependency remains: U.S. production share of global semiconductors fell from 37% in 1990 to just 12% in 2020. Even the Pentagon’s recent Defense Production Act investment of $25.8 million into Honeywell’s rad-hard microelectronics fab underscores the point.

Looking to diversify your portfolio with tangible assets? Unable to source your silver quick enough from Bullion Banks? Jim Cook at Investment Rarities offers expertly curated asset investments with their extremely dedicated team. Discover unique opportunities often overlooked by traditional markets. Visit InvestmentRarities.com Today!

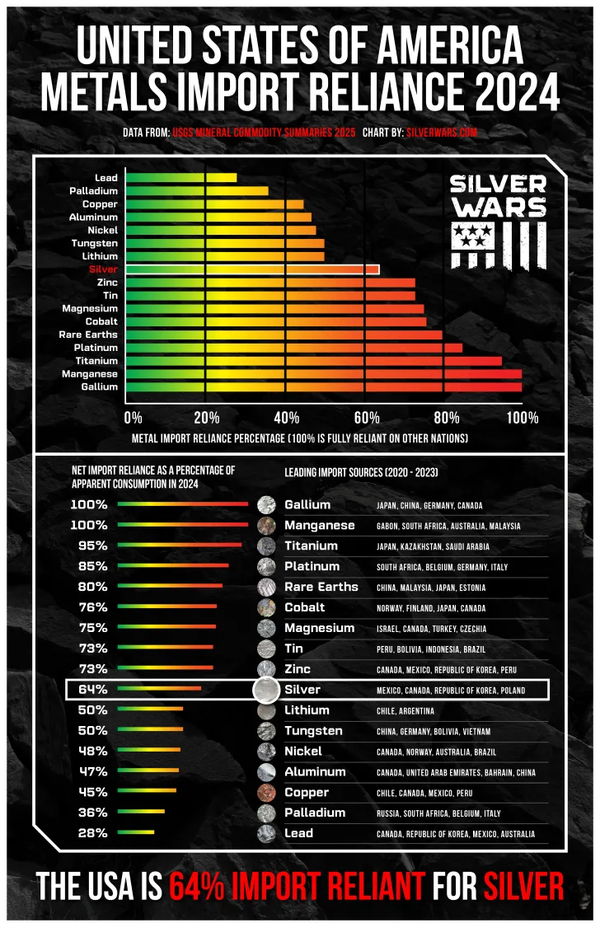

America's Silver Dependence

The United States mines only 1,000 metric tons of silver annually but consumes 6,700 tons — leaving it 70–80% import dependent. Imports come primarily from Mexico (44%), Canada (18%), and Poland. This reliance is so stark that in 2025, the U.S. Geological Survey added silver to the official Critical Minerals List.

China’s Silver Strategy

China produces roughly 3,300 - 3,600 tons of silver per year but consumes over 6,300 tons, leaving a 3,000-ton shortfall. Instead of leaving itself exposed, Beijing has moved aggressively:

- Buying unrefined ore/concentrates from Latin America.

- Deploying Zijin Mining’s new streaming fund.

- Bundling silver with Belt & Road resource deals.

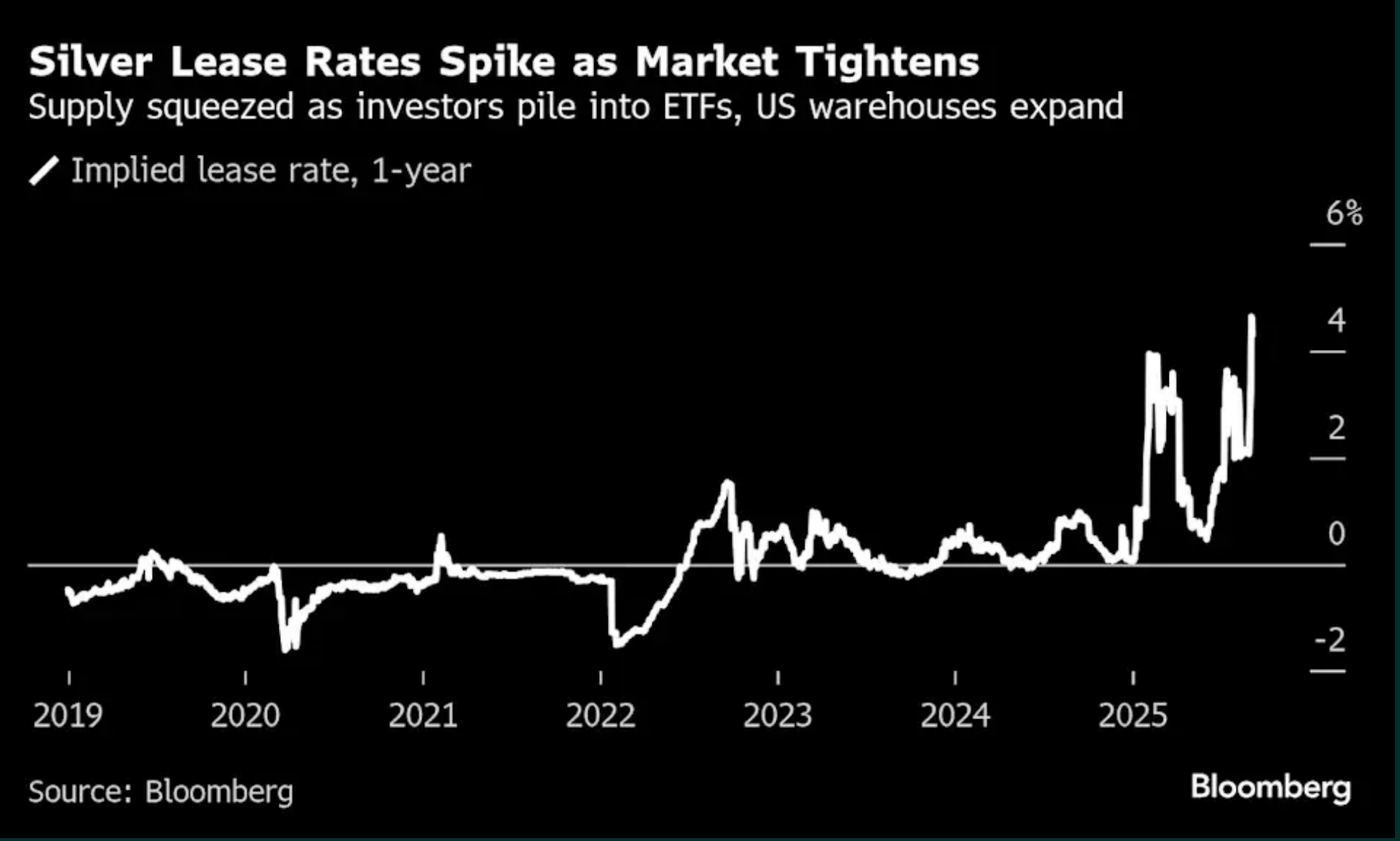

Lease Rate Warning

Silver lease rates have spiked above 6% – far above nominal interest rates near zero. Manufacturers are being actively discouraged from taking delivery. If Western vault inventories were truly flush, banks would not need to punish withdrawals. This suggests inventories are either encumbered or the West is bluffing with its silver security.

The Dangerous Game

The United States is fighting a tech war with imported silver and imported chips, while China methodically secures both. By raising lease rates, Western bullion banks are buying time but conceding credibility. The longer this continues, the more leverage shifts to Beijing, which is amassing not only refined silver but control of the upstream flows.

Silver truly is the world's most strategic metal, and today's probe is more than trade theater. It is another reminder that the U.S. cannot afford to remain dependent while its rivals build stockpiles and secure supply streams.

IF YOU DON'T HOLD IT; YOU DON'T OWN IT.