For over half a century, U.S. officials and aligned bullion banks have coordinated a quiet campaign to manipulate silver's true scarcity– diluting physical reality with paper promises. From the draining of America's strategic stockpile to the birth of SLV and rehypothecation under national security pretense, every act was meant to maintain illusion: that silver is abundant, stable, and cheap. But now, in 2025, the illusion is unraveling, and China's long-term strategic foresight is exposing Western denial.

1970: The US Warns of Imminent Silver Exhaustion

The U.S. Bureau of Mines projected in its 1970 Mineral Facts and Problems report that above-ground reserves would be depleted by the year 2000. This wasn't theory— it was a federal analysis based on mining trends and industrial demand. Rather than respond transparently, policymakers turned to covert liquidation and eventual market theater to conceal the facts.

1980: The Hunt Brothers Force a Glimpse of the Truth

When the Hunts aggressively accumulated physical silver in 1980, Federal Reserve Governor Andrew Brimmer openly admitted the silver market "shrank" as the squeeze intensified. This marked a rare, accidental glimpse at the fragile state of physical supply. It was quietly papered over with COMEX position limits, regulatory changes, and media narratives designed to kill the signal that silver was genuinely scarce.

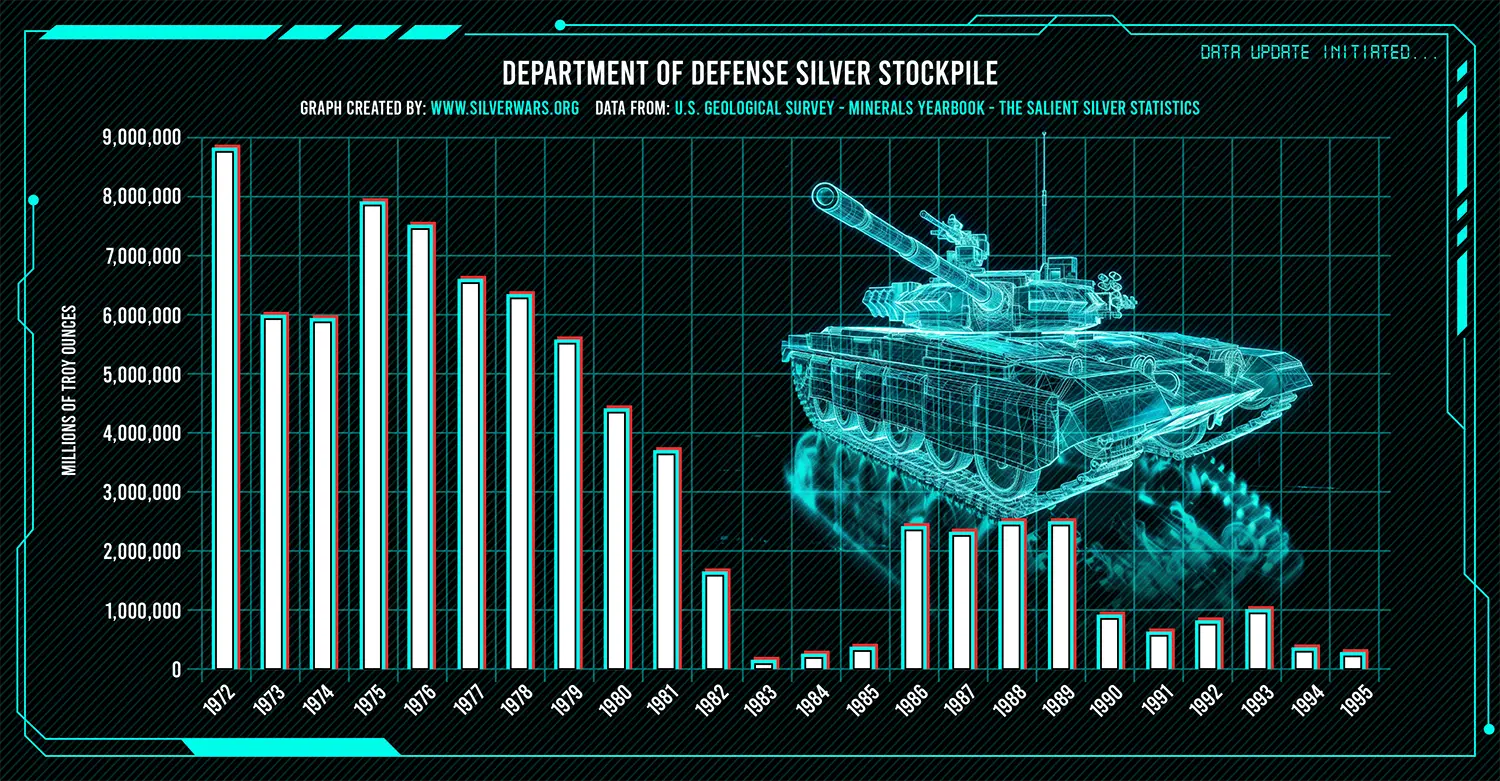

1981-2001: U.S. Liquidates Its Strategic Silver– Quietly

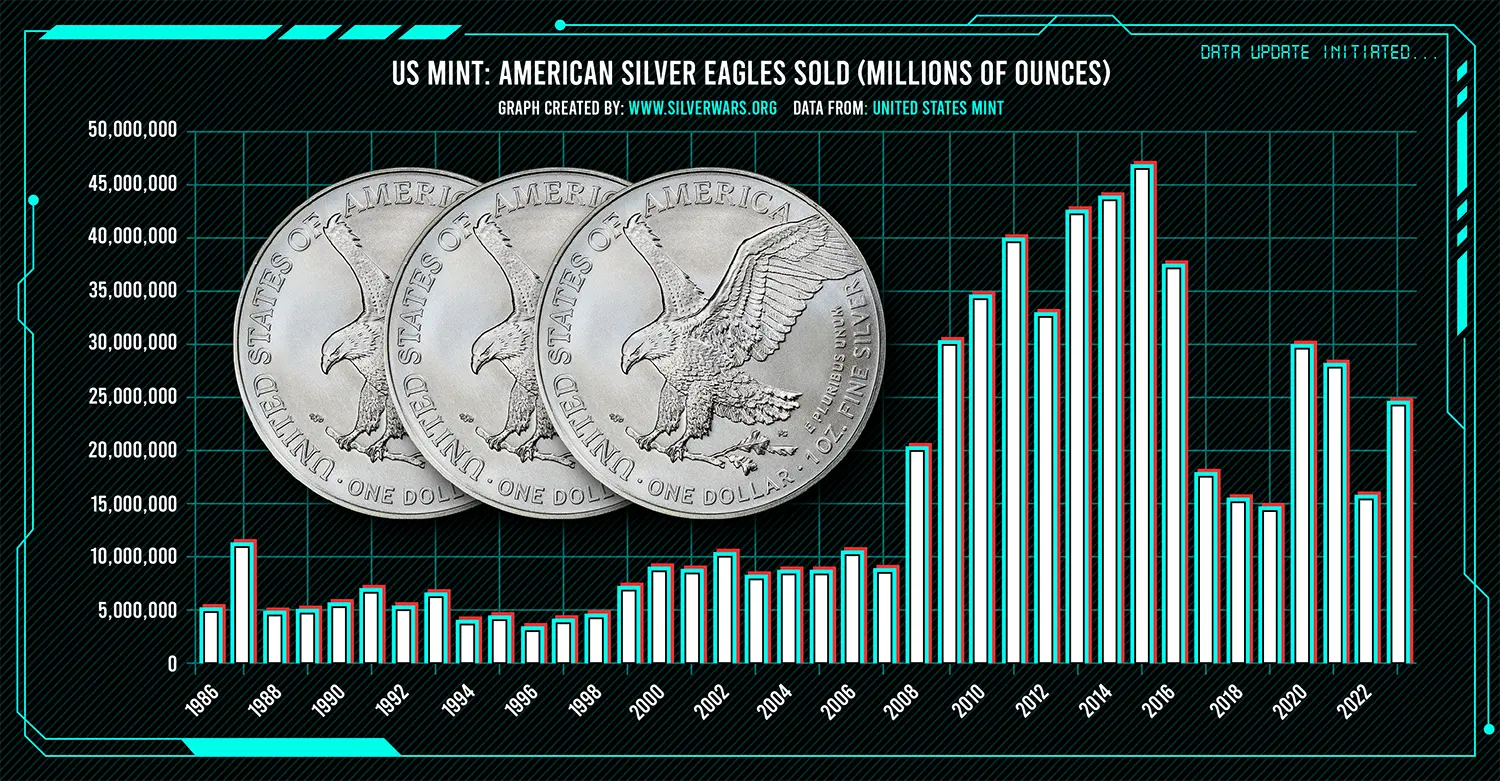

Following the Hunt crisis, the Reagan administration sought to dump silver from the Defense National Stockpile, first in bulk, then later in dribs through the American Silver Eagle program. This strategic silver– which had taken decades to accumulate– was depleted by 2001, just as ETF-era sleight of hand was about to begin.

1982: China Declares Silver a Persistent Global Problem

In stark contrast, China made silver a matter of national industrial policy. A 1982 directive from the People's Bank of China and the Ministry of Machinery warned that:

The world's silver production is about 8,000 tons per year... but the actual consumption is about 12,000 tons. The world's silver resources... are only sufficient for exploitation for 16-42 years. Silver shortages have become a lasting world problem.

Rather than suppress prices or dump reserves, China centralized silver supply management, required electrical manufacturers to seek approval for silver use, and invested in silver-saving technologies and substitutes. In effect, China institutionalized what the U.S. denied: silver scarcity is real, industrial, and systemic.

1982 + 42 = 2024

🤔

2006: SLV Is Born— And the Rehypothecation Era Begins

Despite the Silver Users Association warning that only 750 million ounces of above-ground silver remained globally, the SEC approved the iShares SLV ETF. Instead of triggering a price explosion, SLV launched smoothly—suggesting banks had found a workaround. The workaround was rehypothecation– multiple claims on the same ounces of silver– sanctioned under national security justifications like the Defense Production Act in conjunction with perpetually-activated National Emergencies.

Now: The Canary Sings — Lease Rates and London Panic

Fast forward to today. Silver lease rates—normally near zero—have soared to double digits, with some spikes hitting 40% and we've heard unverified reports of even higher! The London Bullion Market, long the epicenter of silver trade, is struggling to fill physical orders. COMEX inventories have plunged. Backwardation reigns.

RED ALERT: Learn Why London Completely Running Out Of Silver Signals A Massive Economic Earthquake- The Biggest In World History! pic.twitter.com/ucQtU11lS6

— Alex Jones (@RealAlexJones) October 20, 2025

Meanwhile, China is locking up upstream supply and routing it inward, starving Western refiners and manufacturers. While Western media insists there's "plenty of silver," the physical market is breaking down--and only one solution remains.

The Only Way Out: Price Truth = $1000+/oz

To halt industry starvation and incentivize silver recycling (from e-waste, landfills, and urban mining), silver must reprice drastically higher. A $1000/oz silver price would unlock millions of ounces from lost electronics and waste streams currently uneconomic to process. Anything less is a bluff the market can no longer sustain.

Conclusion: China Saw It. The West Hid It. Now Reality Rules.

The contrast is unavoidable: China planned, managed, and respected silver’s scarcity. The West denied it, suppressed it, and leased it into oblivion. That game is over.

To the insiders still reading: We understand why you did it. We know the strategic calculus. But the stackers and sober minds now run this endgame. Truth is the new collateral. Physical is king. Price must rise—or you lose everything to those who never gaslit in the first place.

The karma of the Opium Wars has now come due and the people are done with the gaslight.

Checkmate.