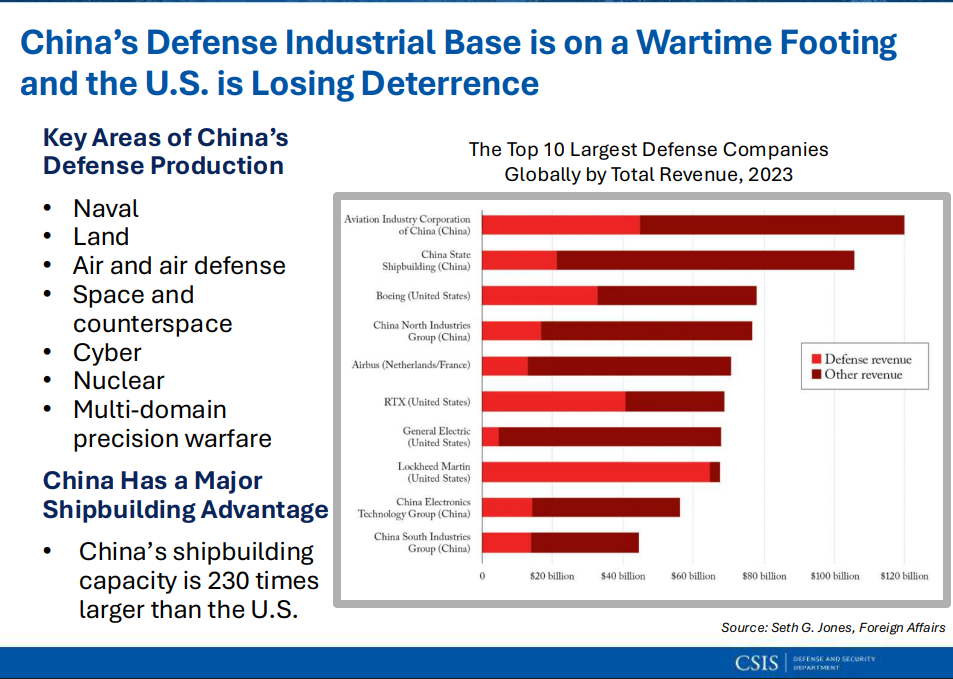

The U.S. defense industrial base is burning through munitions faster than it can replace them, while China is scaling up to make the replacement race unwinnable on current timelines. Layered on top is a critical‑minerals reality almost no one is pricing in: the U.S. fights modern wars with imported silver and with no strategic silver reserve. That’s a logistical trap, not a strategy.

Munitions Math: Weeks of Firepower, Years of Rebuild

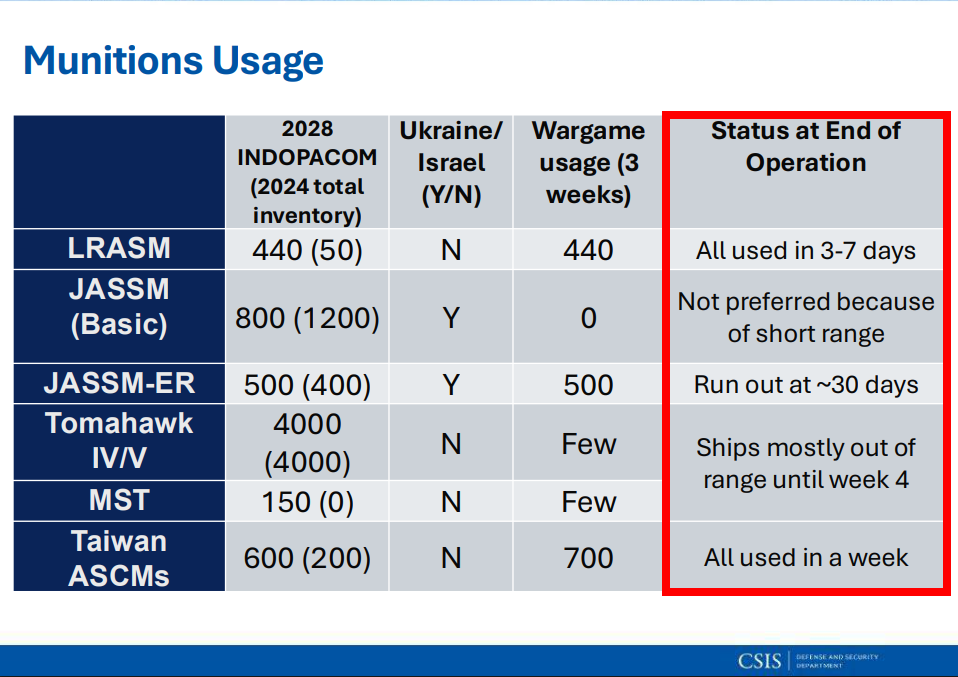

In late‑2024 congressional wargaming concluded that in a high‑end fight with China, U.S. stocks of long‑range anti‑ship, cruise missiles, and guided bombs would be “nearly expended” within a month—and some would be gone in days. That’s not a spicy hot‑take; it’s a sober readout.

The replenishment curve is brutal. Even with emergency funding, inventories of Tomahawk‑class weapons, Patriot/PAC‑3, LRASM, SM‑6, and others take years to rebuild—because these are complex systems with fragile supply chains. Fresh reporting shows the Pentagon urging primes and subs to double to quadruple output across a dozen munitions lines to prepare for a China contingency—because current stockpiles are too low for a prolonged fight.

Industrial Reality Check: Missiles vs. Time

| Program type | Typical lead time | Key chokepoints | What doubling really means |

|---|---|---|---|

| Long‑range cruise (e.g., Tomahawk/LRASM) | 18–36 months | Guidance electronics, propulsion casings, energetic materials | Multi‑year supplier CAPEX; new tooling; export commitments must be sequenced |

| SAM/interceptors (e.g., PAC‑3, SM‑6) | 12–30 months | Seeker heads, radomes, high‑temp composites | Second‑source qual + workforce ramp; component QA bottlenecks |

| Glide kits / PGMs | 6–18 months | MEMS, GPS/INS modules | Electronics allocation; ITAR/export SRD planning |

Allied Orders vs. Home Stock: The Production Squeeze

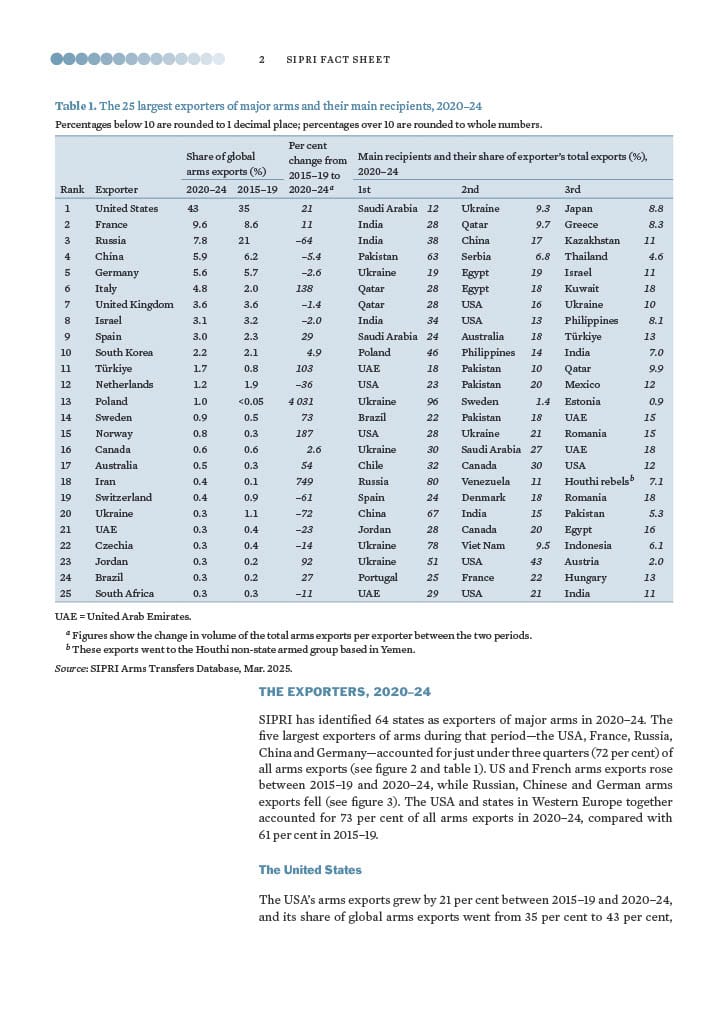

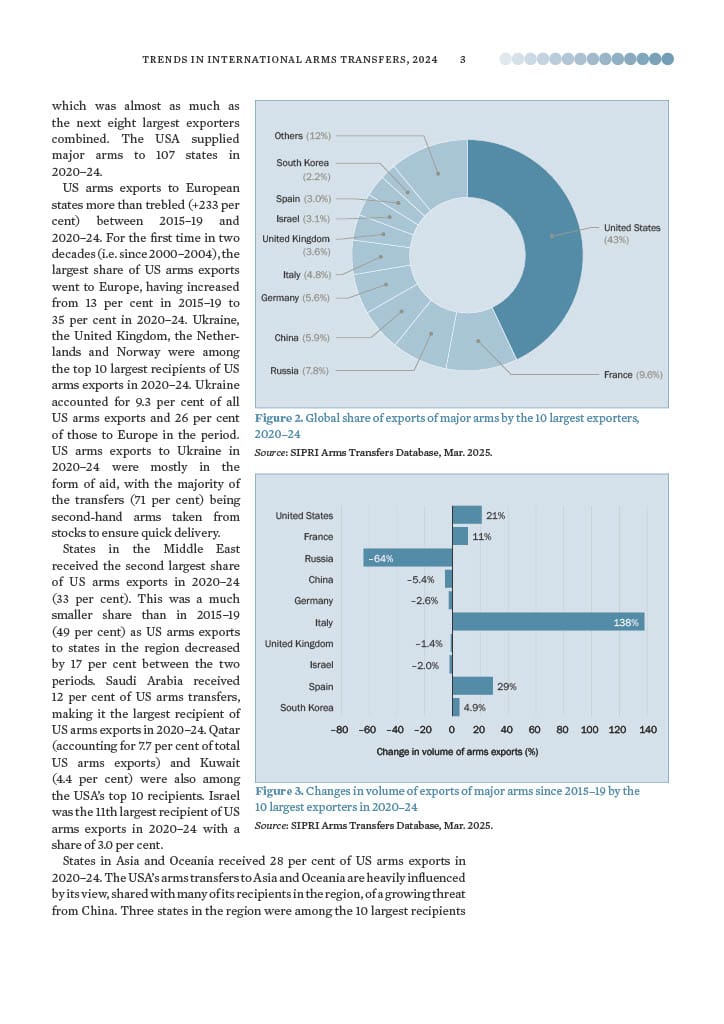

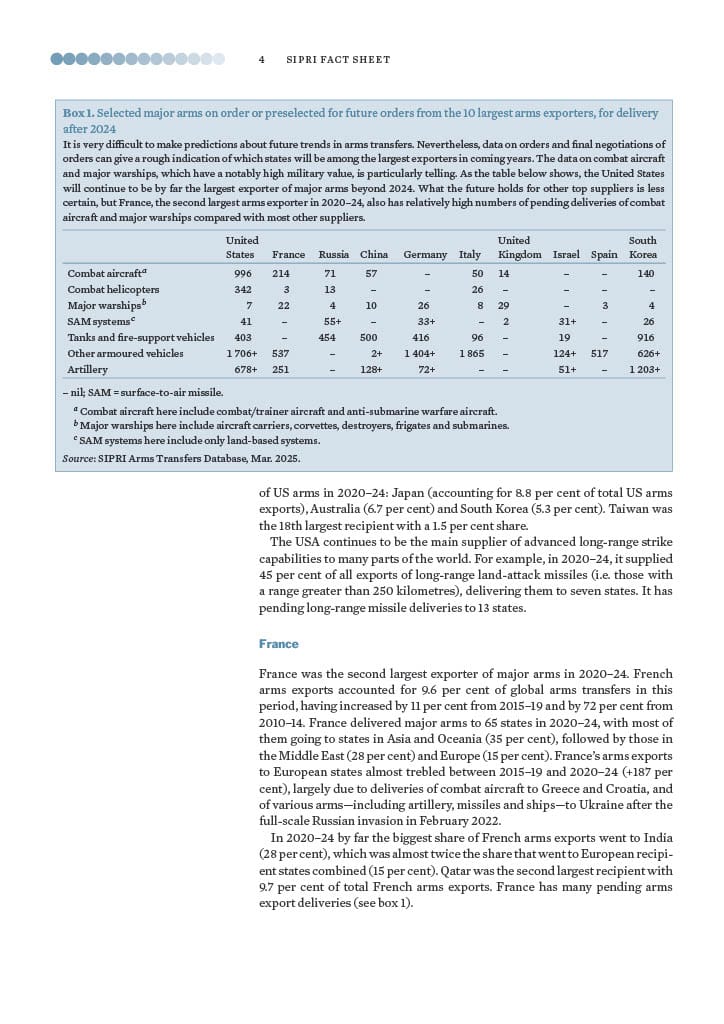

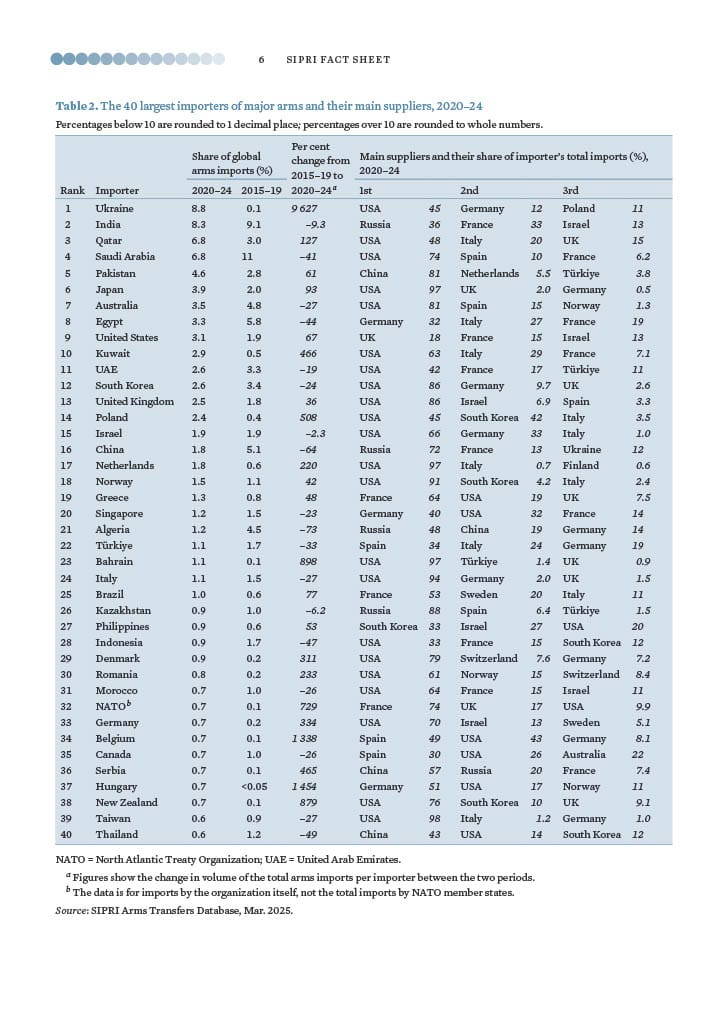

While the U.S. tries to refill its own magazines, allied demand is surging. SIPRI’s 2025 data show Ukraine became the world’s #1 arms importer (8.8% of global) in 2020–24, with about 45% supplied by the U.S. European NATO states also doubled imports versus 2015–19. These aren’t paper orders; they sit on the same U.S. lines making our own missiles and aircraft.

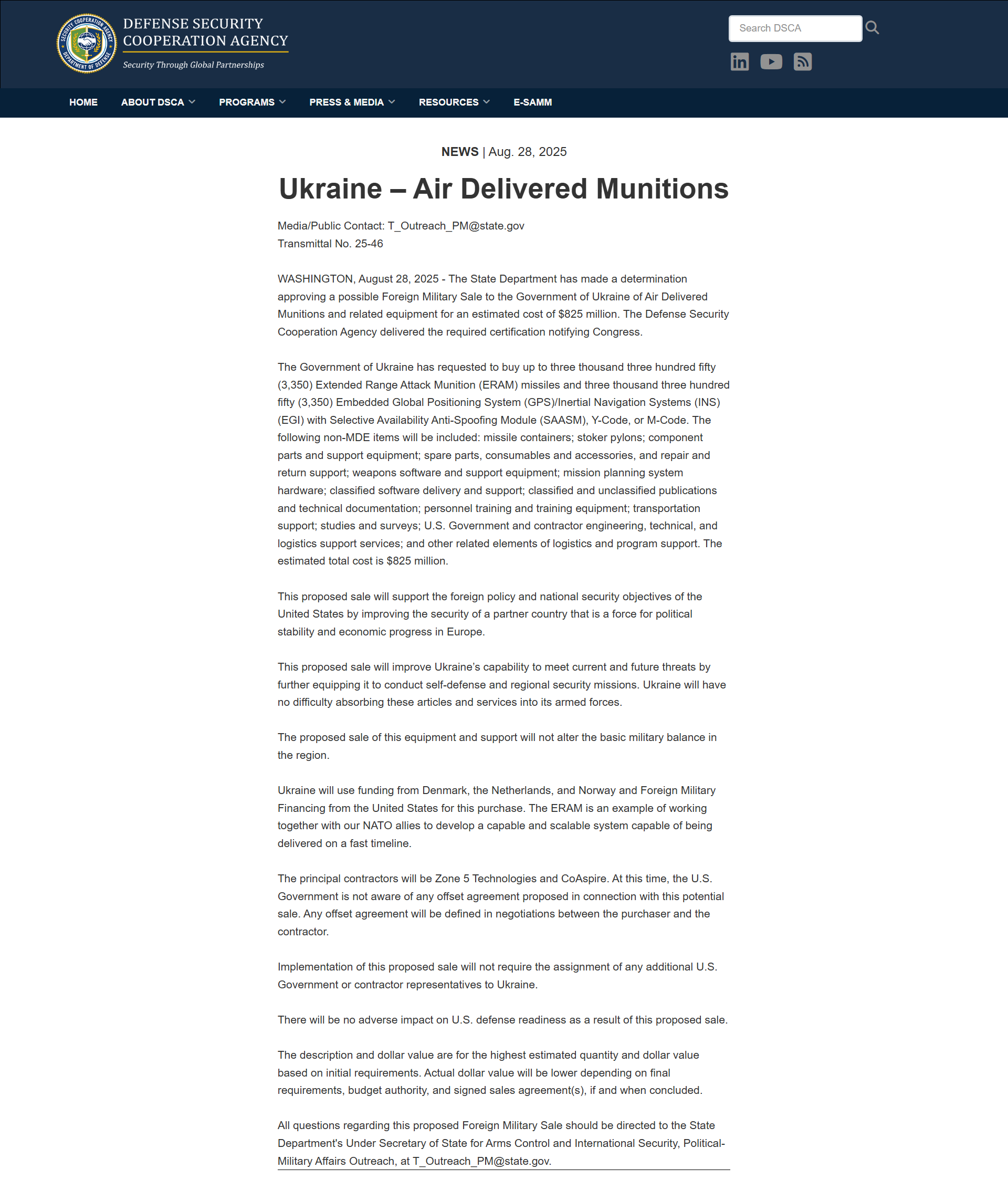

Case in point: in August 2025 the State Department cleared a package for 3,350 Extended‑Range Attack Munitions (ERAM) to Ukraine—thousands of precision air‑launched missiles pulling from limited avionics, seekers, and energetics supply. Official notices always say “no adverse impact on U.S. readiness,” but physics and factory calendars disagree.

Beijing’s Message: Range, Speed, Saturation

September 2025, Beijing rolls out a parade of new kit: YJ‑15/17/19/20 anti‑ship missiles (including hypersonic profiles), mobile ICBMs, plus JL‑1 (air‑launched) and JL‑3 (SLBM). The point isn’t the show—it’s the math of denial at range. More missiles with more throw‑weight, more decoys, more speeds means higher U.S. interceptor expenditure per raid and faster burn‑rates in any Pacific crisis.

China's Military Parade of All New War Technology.

Saturation Economics

| Raid profile | U.S. interceptors per inbound needed (rule‑of‑thumb) | Stockpile burn if 100+ inbounds | Strategic effect |

| Subsonic AShM salvo | 1.5–2.0 | 150–200 shots | Magazine depletion forces stand‑off |

| Hypersonic AShM mix | 2.0–3.0 | 200–300 shots | Expensive interceptors consumed first |

| Ballistic/Maritime mix | 2.0–3.5 | 200–350 shots | Prioritization stress; leakers more likely |

Silver: The Quiet Bottleneck No One Budgeted

Silver isn’t just “precious”; it’s critical. It’s unmatched for conductivity, signal integrity, and corrosion resistance, which is why you find it in radar T/R modules, RF relays, high‑reliability contacts, solder/brazes, thermal control films, and silver‑zinc batteries that still power torpedoes, missiles, and spacecraft. In 2025 the U.S. government moved to add silver to the Critical Minerals List—finally acknowledging what defense engineers have known for decades.

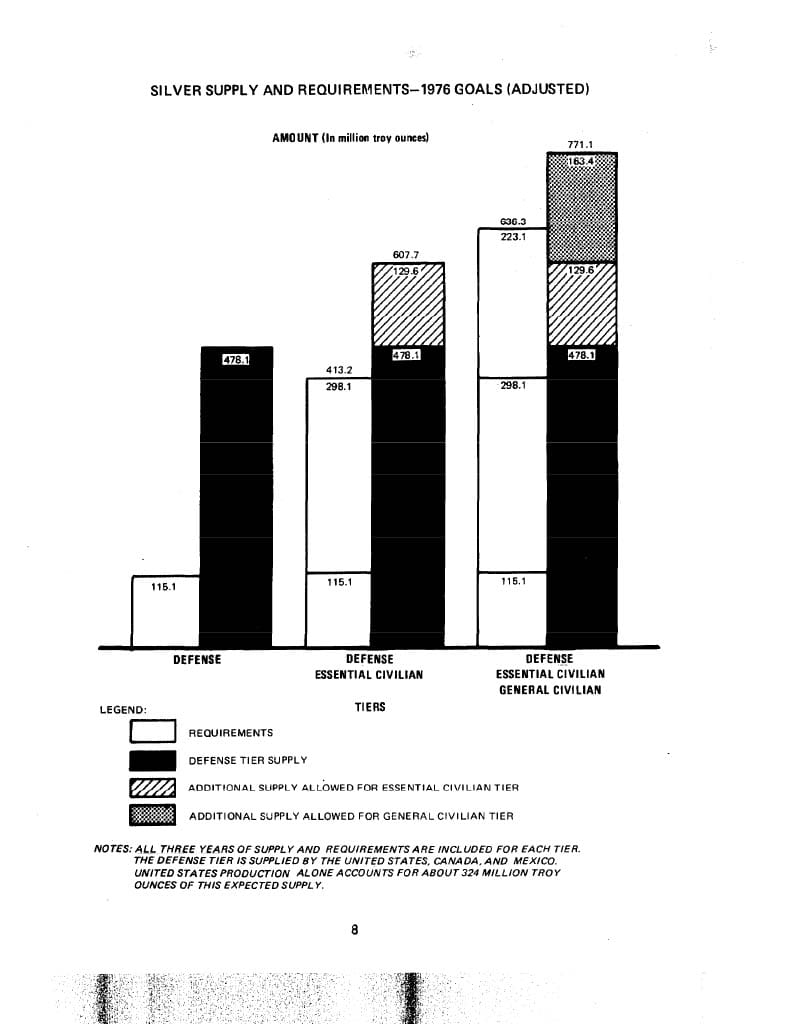

Here’s the rub: the U.S. is a net‑import‑reliant silver consumer—USGS pegs net import reliance ~64–80% in recent years—and most refining capacity sits abroad. And unlike the Cold War era, we no longer maintain a national silver stockpile; decades of GAO‑documented disposals ran the Defense National Stockpile down, with policy voices bragging that silver wasn’t “strategic.” That take has feels like cyanide pours onto the brain.

Where the Silver Goes in Defense

| Platform/system | Silver‑intensive components | Typical silver use (order‑of‑magnitude) |

| Guided missiles (LRASM/ERAM class) | RF relays, high‑reliability contacts, solders, seekers; primary/backup Ag‑Zn cells | Tens to hundreds of grams per round; higher for battery‑heavy profiles |

| Interceptors (PAC‑3/SM‑6) | Guidance electronics, radar modules, thermal interfaces | Tens of grams per interceptor |

| Combat aircraft/ISR | Avionics buses, AESA T/R modules, EMI shielding | Hundreds of grams to >1 kg per aircraft (lifecycle) |

| Naval torpedoes/UUVs | Primary Ag‑Zn batteries; control electronics | Kilograms per torpedo/UUV (battery dominant) |

| Satellites/space | Silvered thermal films; high‑reliability contacts; Ag‑Zn primaries | Hundreds of grams to kilograms per spacecraft |

| Notes: Order‑of‑magnitude engineering estimates from battery/avionics. |

Now stack that usage against supply. World mine output is flat‑to‑down; U.S. recycling covers a sliver of demand; and industrial uses are non‑recoverable in wartime tempos. Every new missile or fighter quietly consumes silver that won’t be recycled during the conflict.

Strategic Implications: War on Yesterday’s Inventories

Put the threads together: rapid munitions burn + long rebuilds + allied orders + an adversary designed for saturation + a critical‑materials chokepoint where the U.S. is import‑dependent. That’s a picture of a force optimized for short wars and exposed in long ones. If a Pacific crisis drags, we’ll be forced to choose between arming ourselves, arming allies, or conserving silver‑intensive components for the next wave.

Risk Register (Next 24–36 Months)

| Risk | Likelihood | Impact | Mitigation |

| Missile stockouts in a protracted Indo‑Pac crisis | High | Severe | Multi‑year surge contracts; component second‑sourcing; magazine depth via cheaper interceptors |

| Silver supply disruption (Mexico/Peru/China issues) | Medium | High | Designate & stockpile silver; bilateral offtakes with Canada/Australia; incentivize U.S. refining |

| Allied orders crowd out U.S. replenishment | High | High | Export pacing aligned to U.S. readiness metrics; surge funding tied to domestic fill rates |

| Adversary saturation drives interceptor burn | High | High | Dispersed sensors; decoys; hard‑kill + soft‑kill mix; longer‑range fires to attrit launchers |

Policy Moves That Actually Matter

Avoid avoidable escalation. Wargames say we run dry early. Don’t wager the magazine on signaling. Diplomacy and crisis‑management buy the time industry needs.

Conserve and stockpile—munitions and materials. Stand up a Strategic Silver Reserve alongside rare‑earths: buy refined metal, contract strategic recycling, and pre‑position for defense batteries/electronics. Tie FMS approvals to proof that U.S. readiness stays above threshold fill‑rates.

Harden critical supply chains. Use DPA Title III, multiyear IDIQs, and off‑take agreements to onshore Ag‑refining and Ag‑Zn battery capacity. Fund substitution R&D where performance allows; where it doesn’t, pay for redundancy.

Rebalance spending to magazine depth. Fewer boutique platforms; more cheap, attractable shooters and decoys. Silver‑sipper designs beat silver‑guzzlers over a long war.

If You Care About Silver, This Is the Whole Ballgame

If we pretend silver is “just another input,” we’ll find out the hard way it isn’t. It’s the quiet thread running through the guidance kits, the radar faces, the comms relays, and the batteries that make a modern arsenal more than a pile of aluminum. The U.S. gave up its silver cushion decades ago; now we import the fuse for our own deterrent. Fix that, or plan for austerity in a shooting war.