As of November 6, 2025, the U.S. Department of the Interior—acting on U.S. Geological Survey (USGS) recommendations—formally added silver to the nation’s Critical Minerals List alongside copper, rhenium, potash, silicon, and others.

This wasn’t a surprise to investors, engineers, or defense contractors. It was an overdue admission of reality. For decades, the establishment dismissed silver as a “precious” curiosity—while the world quietly built its power grids, guidance chips, and satellite circuits out of it.

Now, with official confirmation from the same agency that once downplayed it, the truth is impossible to ignore: silver is indispensable to America’s security and technological survival.

The Methodology That Finally Forced the Truth:

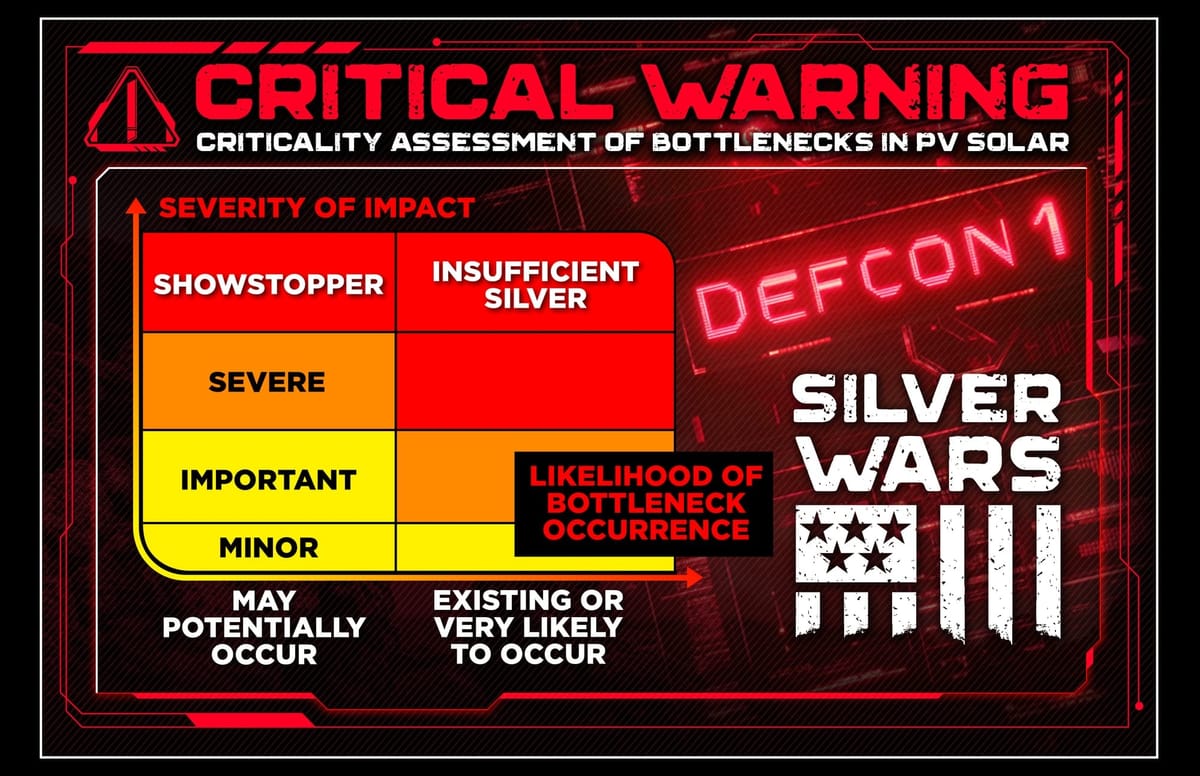

According to USGS Open-File Report 2025-1047, analysts ran 1,200 supply-disruption scenarios across 84 minerals and 400+ industries.

Silver ranked high enough in economic vulnerability and disruption potential to justify immediate inclusion.

“The minerals, elements, substances, or materials that are essential to the economic or national security of the United States … serve an essential function in the manufacturing of a product—including energy technology-, defense-, currency-, and healthcare-related applications—the absence of which would have significant consequences for the economic or national security of the United States.”

— Energy Act of 2020 / USGS OFR 2025-1047 (p. 2)

Even the USGS admits its analysis only scratched the surface:

“…although defense-related industries are captured in the IO tables, consequences to the national security of the United States beyond economic effects are not directly factored into this analysis…” (p. 26)

Translation: silver was critical enough to score high on economic risk alone—without even counting direct military dependence.

Why the Omission Wasn’t an Oversight—It Was Policy

Silver’s industrial dominance has been clear for two decades:

- 55 % + of demand is industrial;

- every missile, radar, and satellite uses silver wiring;

- solar and EV production devour millions of ounces yearly;

- the U.S. imports > 80 % of its supply.

Yet previous lists (2018, 2020, 2022) excluded silver, hiding behind claims that it was “not supply constrained.” That excuse protected derivative markets and short-selling structures that depend on the illusion of abundance.

By omitting silver, policymakers delayed investment in domestic mining, refining, and recycling—ensuring continued reliance on foreign producers like Mexico, Peru, and China.

A Quiet Reversal with Loud Consequences

The 2025 inclusion isn’t symbolic—it rewires U.S. strategic policy.

Once on the List, a mineral becomes eligible for Defense Production Act funding, research grants, and strategic-stockpile review. Expect the Pentagon, Department of Energy, and major defense contractors to begin scrambling for secure silver supplies just as U.S. inventories tighten and China moves to restrict exports.

Meanwhile, above-ground silver stocks are near record lows, LBMA physical holdings keep shrinking, and recycling can’t keep up with consumption. For an industrial economy pivoting to electrification, this is no longer a market story—it’s a national-security emergency!

Global Implications: Time for Allies to Follow

If Washington finally acknowledges silver’s critical status, allies must do the same. Rapidly.

- Energy security: every solar module and power inverter relies on silver paste.

- Defense readiness: satellites, sensors, and radar arrays cannot function without silver contacts.

- Economic resilience: AI hardware, semiconductors, and EVs all depend on it.

SilverWars calls on the UK, Canada, Australia, the EU, and Japan to update their own critical-minerals frameworks—before shortages evolve into strategic leverage by adversarial blocs.

The Verdict: USGS Was Late

The USGS’s own admission is a vindication for those who saw through the paper façade years ago. Silver’s addition proves that the real scarcity was never in ounces—it was in honesty.

They knew the stakes—and they delayed anyway, fearing the public would hoard the metal. The public hoarded it anyway.

The silver truth is finally official, but the war for supply is just beginning.

We started our mission to warned the USGS on December 25, 2024, that silver had to be recognized as critical. If NATO allies hesitate to act now, the strategic contest with China may already be lost.

“The federal government relies on the List of Critical Minerals and the analysis behind it to assess risks to core functions, such as national defense, from supply-chain disruptions.”

— USGS Mineral Resources Program