The message coming out of Oklahoma City wasn’t subtle. In a rare moment of clarity on industrial strategy, Interior Secretary Doug Burgum threw down the gauntlet: “It’s not just drill, baby, drill. It’s mine, baby, mine.”

That line isn’t just for applause. It’s a full-throttle signal that the Trump administration is preparing to invest directly into American mining and mineral processing. Not just to compete—but to fight back. The target? China’s stranglehold on critical minerals.

What’s At Stake

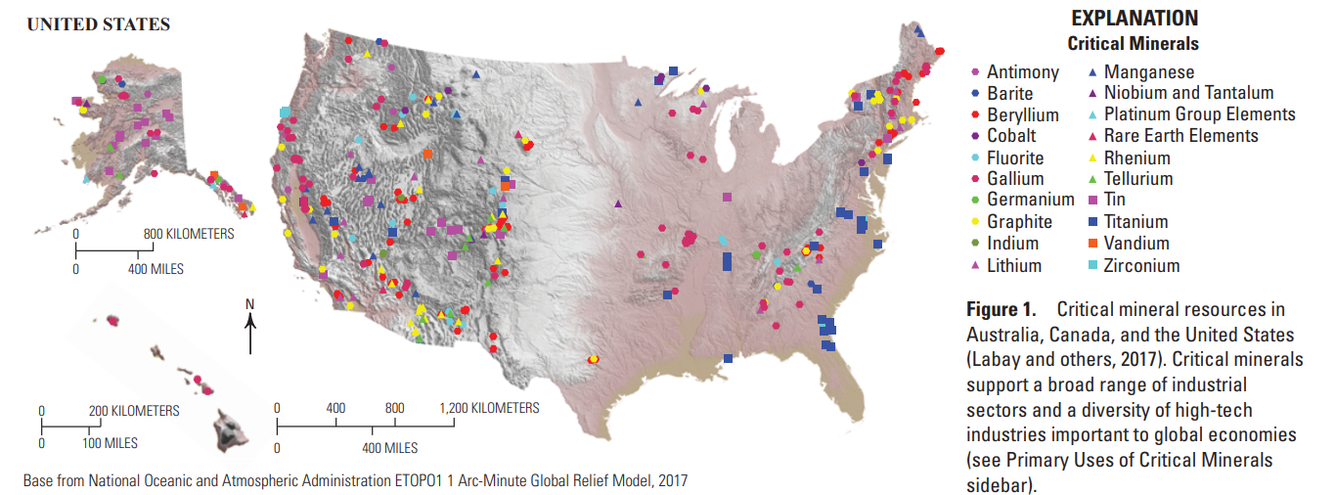

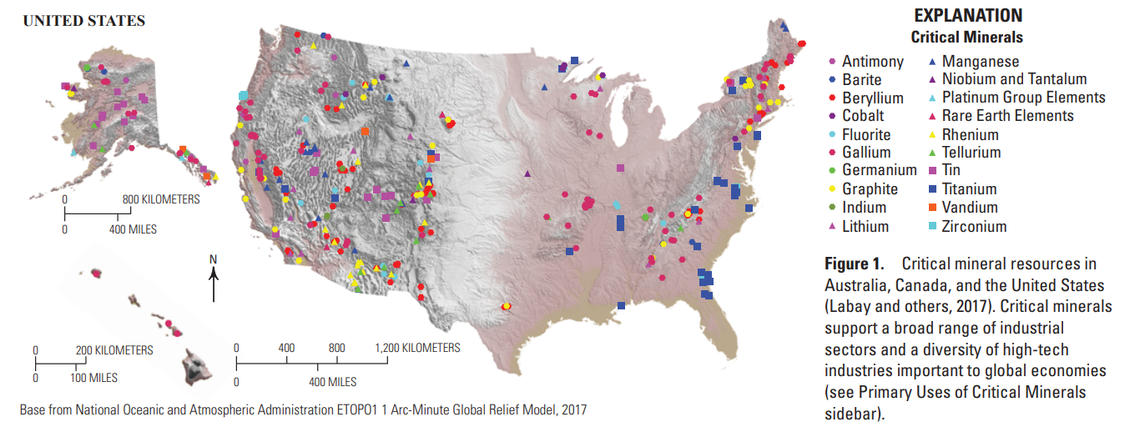

Critical minerals aren’t luxury goods. They’re foundational to defense systems, electric vehicles, semiconductors, satellites, renewable energy, and every lithium-ion battery out there. China has been using its dominance in this arena like a crowbar against U.S. supply chains.

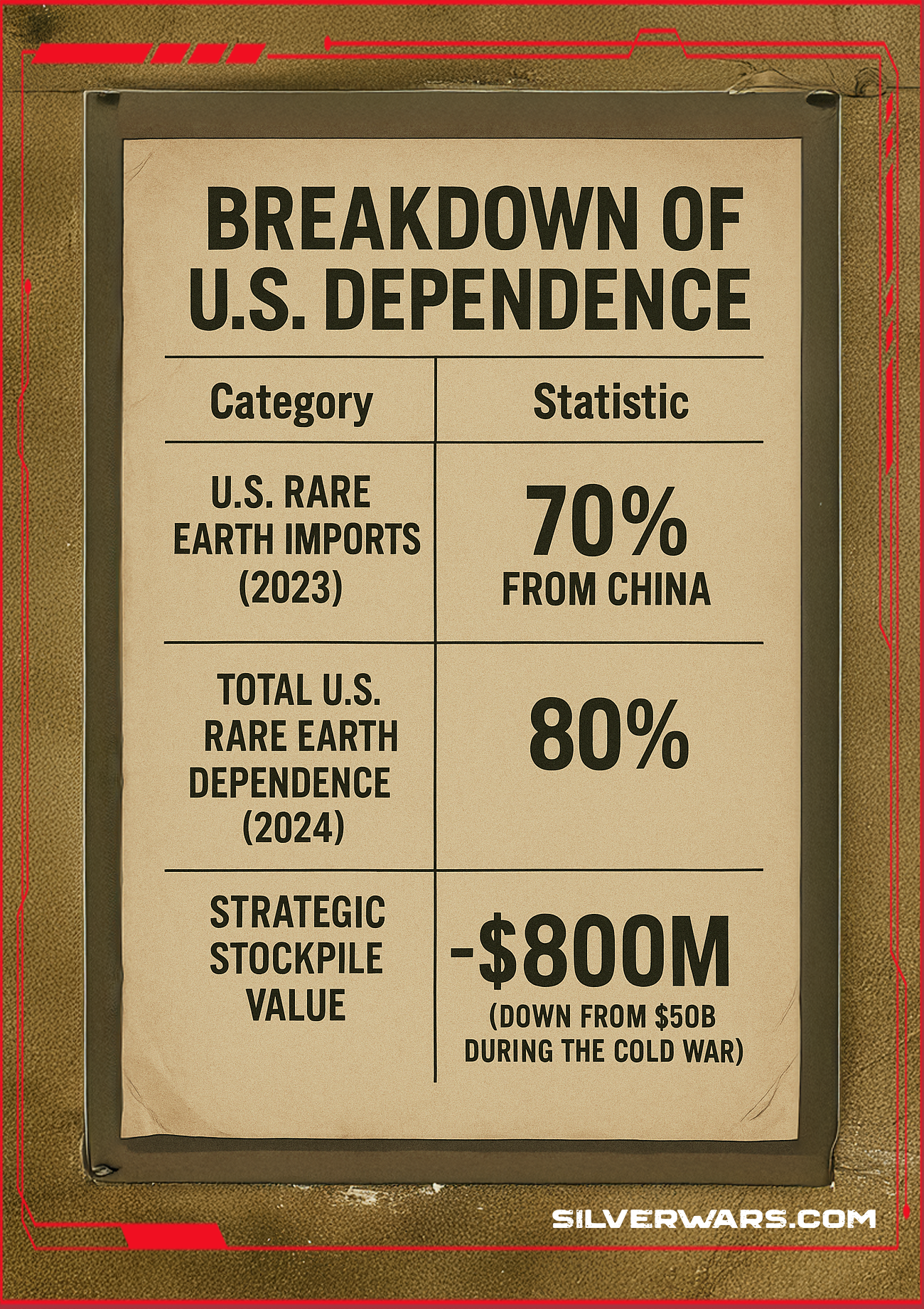

Breakdown of U.S. Dependence

Burgum made the stakes explicit: “If we don’t mine, we will not be successful. We will literally be at the mercy of others that are controlling our supply chains.”

The Trigger: China’s Export Curbs

Beijing slapped new export controls on rare earth elements this month—an aggressive counter-move to President Trump’s increased tariffs on Chinese-made goods. These aren’t obscure metals. They’re used in:

- Military drones

- Missile systems

- Battery-powered vehicles

- Consumer electronics

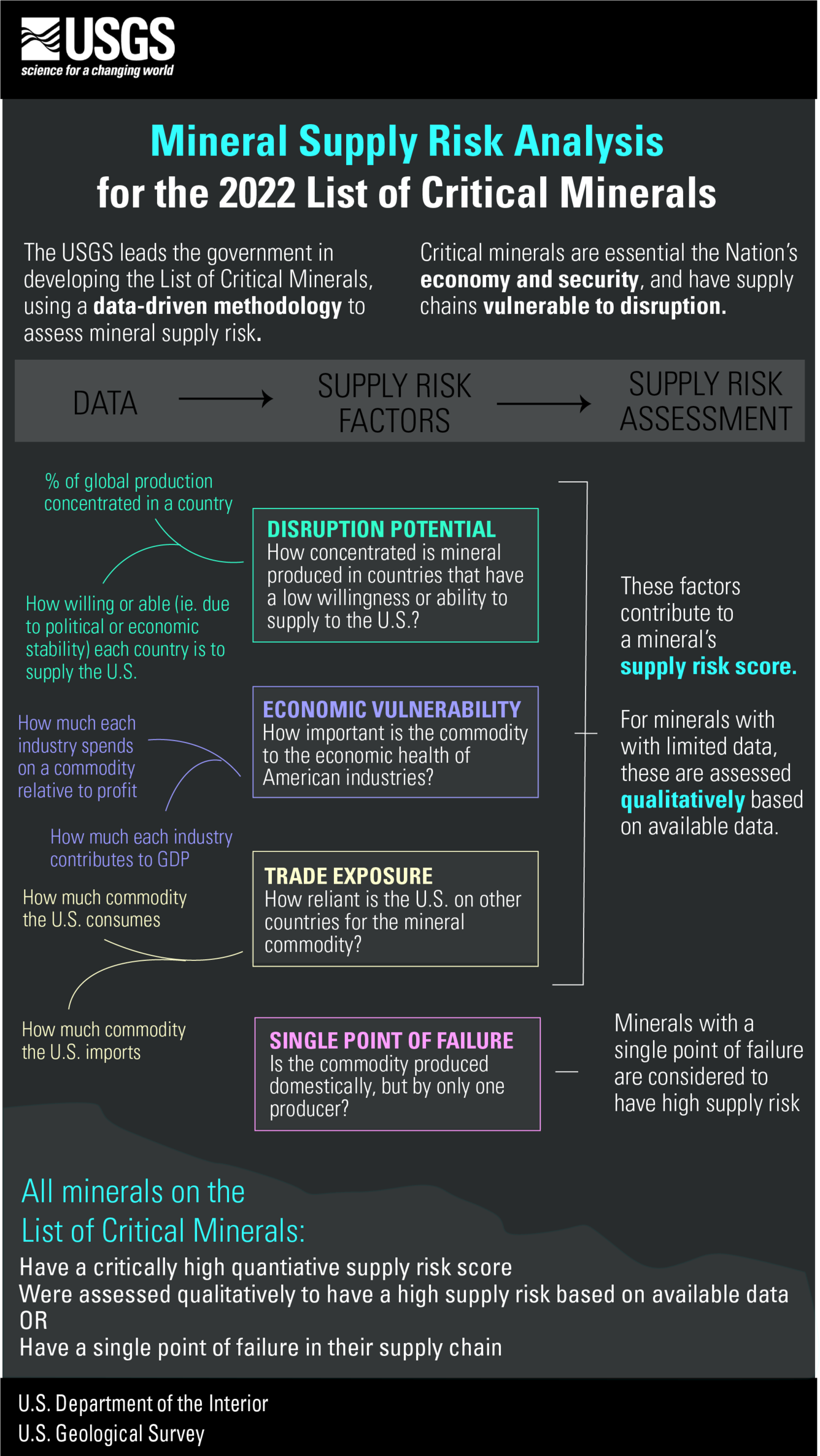

According to the U.S. Geological Survey, rare earths are a “single point of failure” for entire industries. That’s not just a supply chain issue. That’s national security on the ropes.

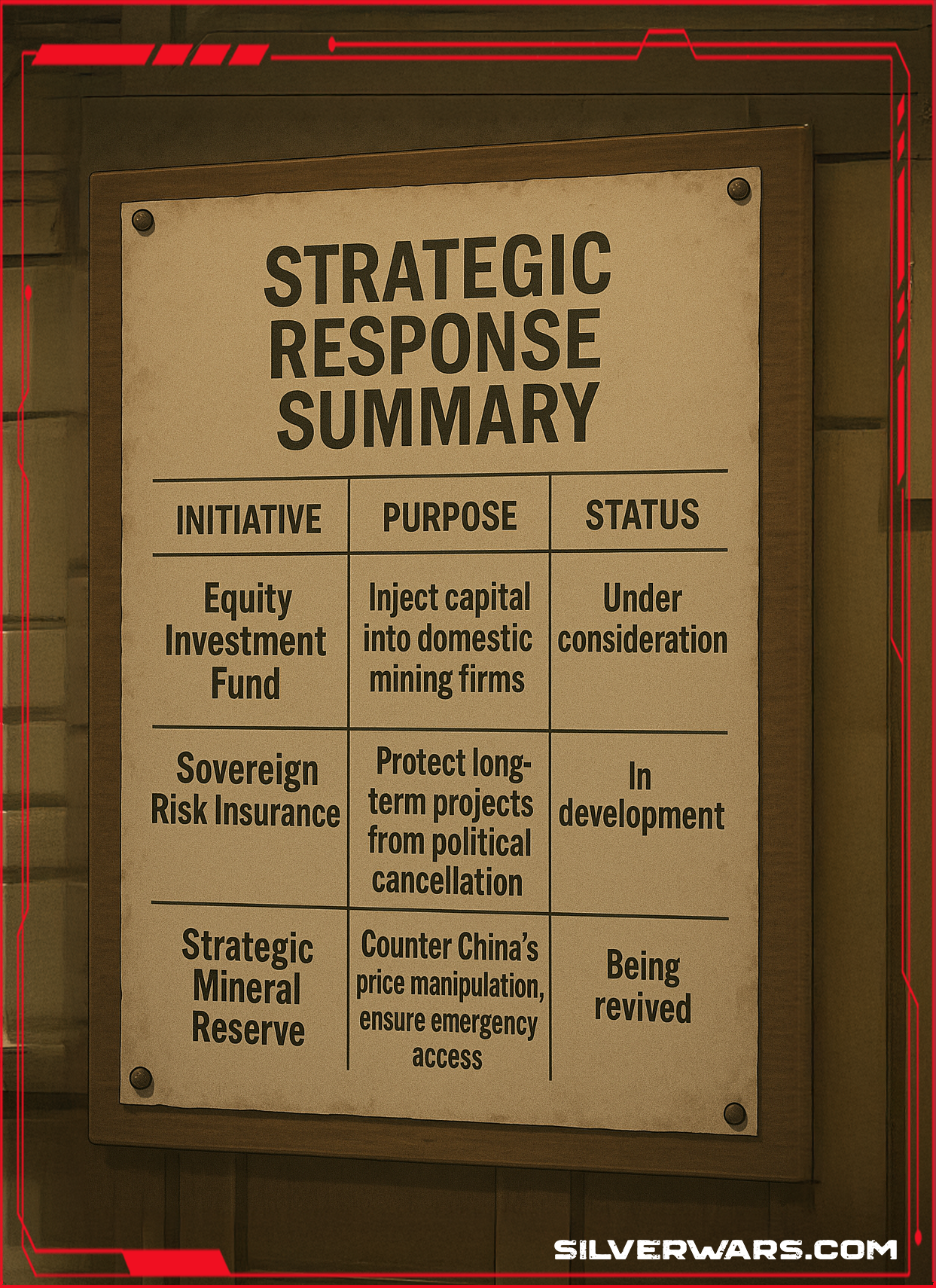

Trump’s Three-Part Counterattack

1. Equity Investment in Miners

Forget loan guarantees. Trump wants the federal government to take equity stakes in U.S.-based mining and processing companies. This isn’t just funding—it’s ownership. It’s the kind of state-involved capitalism the U.S. hasn’t flexed since World War II.

“We should be taking some of our balance sheet and making investments,” Burgum said.

2. Sovereign Risk Insurance Fund

Political instability has crushed more than one mining venture. To stop future administrations from pulling the plug on projects via executive order, Trump wants a federally backed insurance mechanism. Cancel the project? The government writes a check to cover the loss.

“You got to write a check,” Burgum said. “There’s got to be a financial cost if you’re destroying a company’s opportunity.”

3. National Mineral Stockpile

Back in Cold War days, the U.S. had a $50 billion stash of critical materials. Today? Less than $1 billion. Trump wants to rebuild the stockpile—and use it tactically. When China crashes global prices by flooding the market, the U.S. buys. Stockpile cheap. Stabilize demand. Hit back.

Strategic Response Summary

Fallout: Industry on Edge

The export controls have set off alarms across federal agencies. Reports indicate some companies are down to just 40 to 60 days of mineral reserves. No rare earths, no semiconductors. No batteries. No drones.

Industry is scrambling for alternatives, but it’s not a simple pivot. These minerals require long-term infrastructure and high-risk capital. And China knows it.

“This is fast emerging as our Achilles’ heel,” said Ashley Zumwalt-Forbes, a former energy official. “Oftentimes one of these materials is a single point of failure.”

Bigger Picture: A Structural Play, Not a Quick Fix

The administration is well aware this isn’t a one-quarter earnings story. Building new supply chains takes 10 to 15 years, according to Cove Capital CEO Pini Althaus. But Trump’s team is positioning this as the long game. The aim: a structural decoupling from China’s mineral dominance.

“This administration is trying to find every domestic and allied mining project they can back,” said Gracelin Baskaran from the Center for Strategic and International Studies.

The strategy is to throw weight—diplomatic, fiscal, industrial—behind any project that breaks the bottleneck.

China’s Hand: Weaponized Trade

This isn’t the first time China’s used minerals as leverage. In 2010, a dispute with Japan over fishing rights led to a total rare earth export ban. The ripple effects were immediate: supply crunches, manufacturing slowdowns, geopolitical fallout.

China knows how to use minerals like economic sanctions. And now, it’s doing it again.

“They feel they can do significant harm to U.S. manufacturing,” said Cornell economist Eswar Prasad. “That is the choke point.”

This is Another Game Changer in Policy

For years, U.S. manufacturers have lobbied against restrictions that would have forced them to localize supply. Why? Profit margins. Pollution. Complexity. But that comfort is gone. What’s left is urgency. Companies are now calling up every non-Chinese supplier they can find.

Europe’s also feeling the squeeze. Their own projections show an impending shortfall. They’re scrambling too—looking for new deals, partnerships, and supply chains before the trap fully snaps shut.

Critical Minerals Are In Every Nations Sights

This isn’t just policy theater. This is an industrial pivot—one that could define the next decade of U.S. economic security. Whether the U.S. can move fast enough to matter remains to be seen.

But the signal’s clear: the U.S. is getting back in the game, not with sanctions, but with ownership, stockpiles, and sovereign insurance. The minerals war is on. And this time, America’s bringing a checkbook to the gunfight.