![Strategic Minerals - US Alternatives [1990]](https://www.silverwars.com/content/images/2025/09/Strategic-Minerals---US-Alternatives---DoD---1990-1.png)

Strategic Minerals - US Alternatives [1990]

1990 – U.S. recognized silver as vital for defense electronics, avionics, and alloys, but judged it less vulnerable than chromium or cobalt due to stable imports from allies and strong recycling, keeping it important yet secondary in strategic stockpile policy.

SUMMARY:

Silver in the Context of U.S. Strategic Minerals Policy. Classification of Silver:

- Silver is not considered a top-tier “strategic” mineral in the same sense as chromium, cobalt, manganese, or platinum-group metals.

- Instead, it appears in the broader category of important nonfuel minerals where the U.S. is partially import dependent.

- Silver is recognized as essential for both industrial and defense applications, but unlike the “Big Four,” the supply is more diversified and less vulnerable to foreign cutoff.

U.S. Supply and Import Dependence

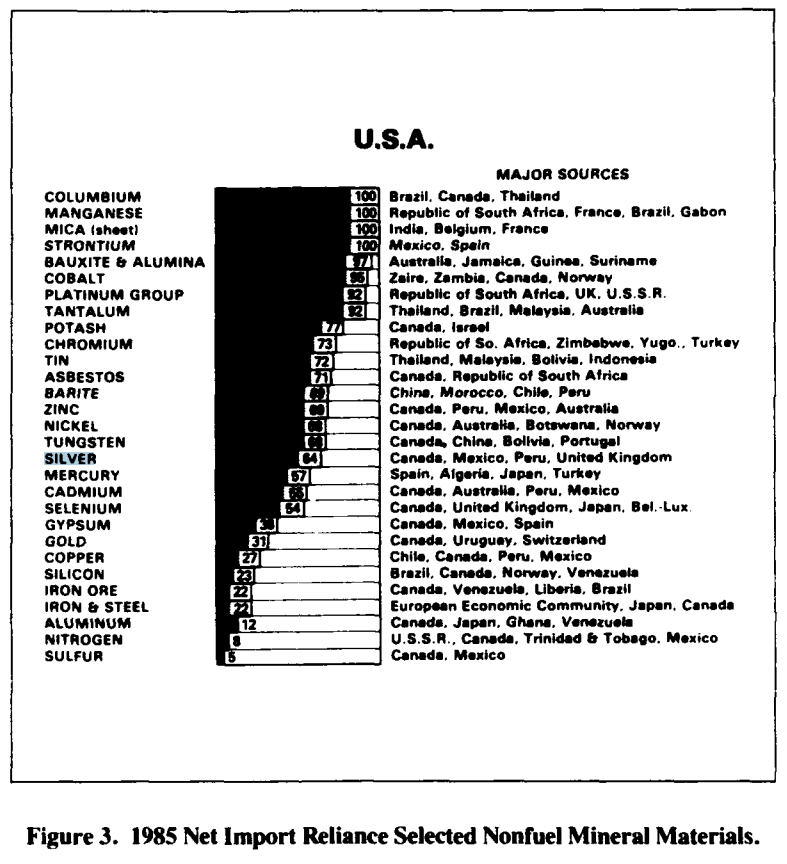

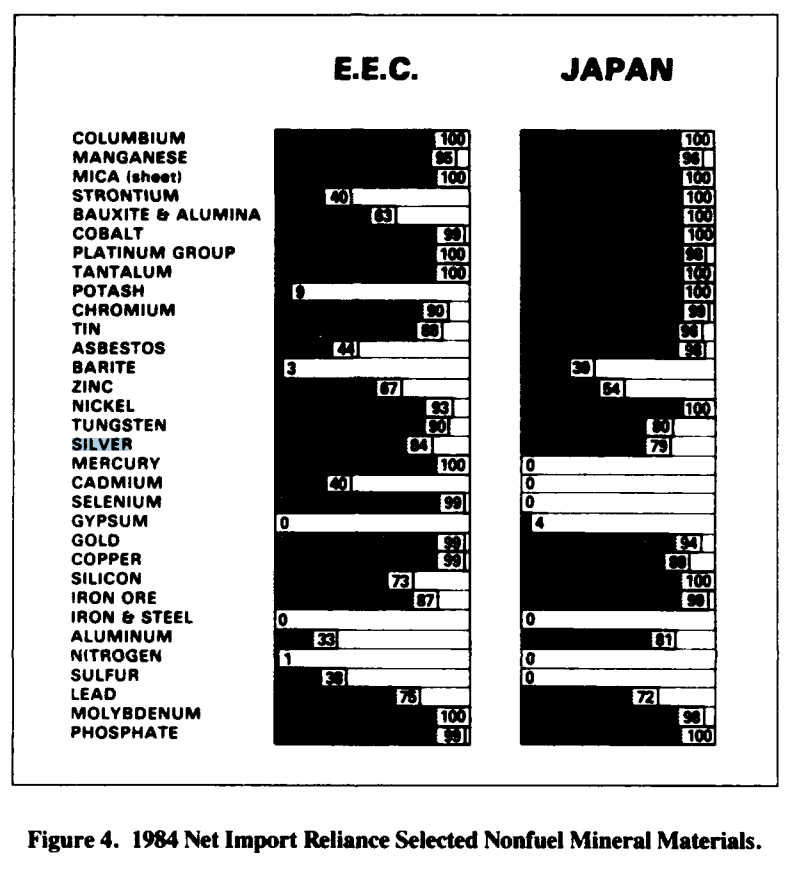

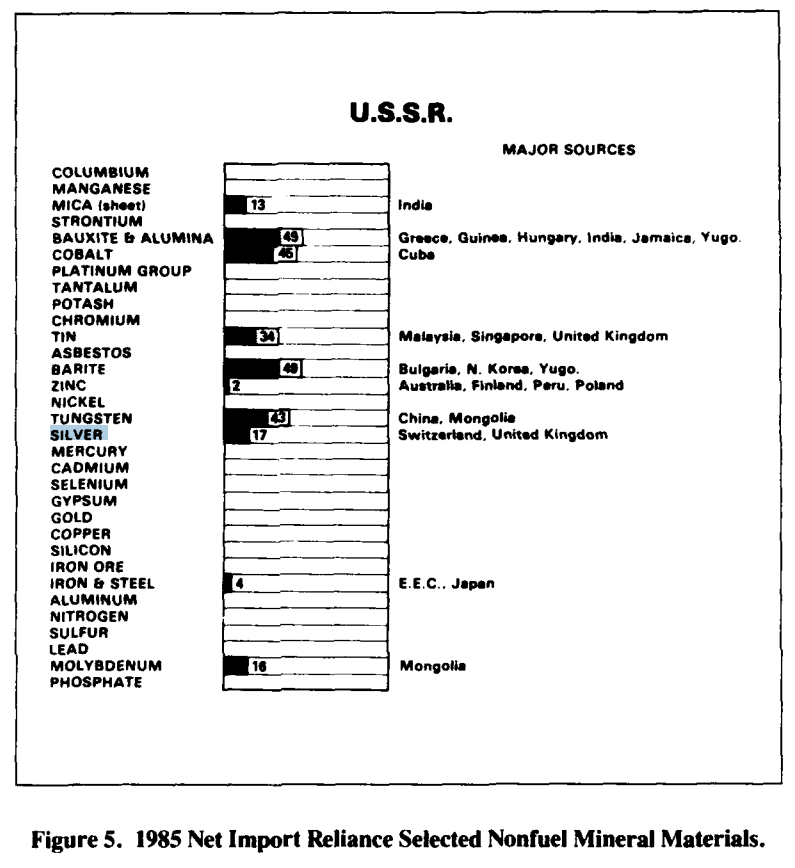

- By the mid-1980s, the U.S. sourced much of its silver domestically but still imported a significant portion from countries like Canada, Mexico, Peru, and the U.K. Stockpile.

- The Bureau of Mines data (1985) listed silver as a mineral where the U.S. had a net import reliance, though not as extreme as platinum or cobalt (which were 90–100% import-dependent).

- Canada and Mexico were particularly important suppliers, reducing the strategic risk compared to dependence on politically unstable regions like southern Africa.

Strategic and Military Uses of Silver

- Electronics and Avionics: Silver’s unmatched conductivity made it crucial in wiring, connectors, and circuit boards.

- Defense Systems: Used in guidance systems, avionics, and satellite components.

- Alloys and Coatings: Incorporated in certain high-performance alloys and in reflective/mirror coatings for aerospace and missile systems.

- Nuclear Applications: Though not highlighted as much as cobalt or chromium, silver had specialized uses in control rods and shielding.

Silver was thus recognized as a “critical input” in defense production, even if it was not placed in the top vulnerability tier.

Stockpiling and Policy

- The U.S. National Defense Stockpile did include silver, but its role was secondary compared to the “List of Ten” minerals exempted under the Comprehensive Anti-Apartheid Act (chromium, manganese, PGMs, etc.).

- Stockpiling of silver had a history of policy controversy:

- In earlier decades, the U.S. Treasury held enormous reserves of silver as part of its monetary policy.

- By the 1980s, the question was whether those government holdings (including coinage silver) should count toward strategic reserves.

- The report suggested that while silver was important, its supply lines were more reliable than for African-sourced minerals.

Broader Policy Implications

- Silver illustrated the tension between “dependency” and “vulnerability.”

- The U.S. was import dependent for a share of its silver.

- But it was not judged highly vulnerable, because supply came from stable allies.

- The report emphasized that substitution, recycling, and technological innovation could reduce risks.

- Silver recycling (from electronics, photography, and industrial scrap) was already significant by the 1980s.

In this 1990 defense-oriented study, silver was acknowledged as a strategic mineral with important defense and industrial uses, but not as critical or vulnerable as the “Big Four” (chromium, cobalt, manganese, platinum-group metals). U.S. policy treated silver as important but not at the center of the national security minerals debate, largely because supplies could be secured from friendly nations (Canada, Mexico, Peru) and supplemented through recycling and existing government holdings.

Today, government stockpiles have been depleted. Foreign relations are strained and gold, silver, PMG are not interchangeable with one another. The US is still over 60% reliant on foreign imports. This report no longer paints the picture of a valid strategy.

Discrepancies:

Gold, Silver, Platinum and Palladium are NOT "near-perfect" substitutes for one another.

| Metal | Electrical Conductivity (vs Copper = 100%) | Corrosion Resistance | Typical Use in Electronics |

|---|---|---|---|

| Silver (Ag) | 106% (highest of all metals) | Moderate (tarnishes in sulfur-rich air) | Contacts, conductors, solar cells |

| Copper (Cu) | 100% | Good (but oxidizes) | Wiring, bulk conductors |

| Gold (Au) | 70% | Excellent (does not tarnish/oxidize) | Connectors, bond wires, high-reliability circuits |

| Palladium (Pd) | ~16% | Very good | Plating for connectors, multilayer ceramic capacitors (MLCCs) |

| Platinum (Pt) | ~16% | Excellent (very stable chemically) | Sensors, electrodes, specialized electronics |

1. Silver (best conductor)

- Strengths: Highest conductivity, cheapest of the four precious metals (per unit conductivity).

- Weaknesses: Tarnishes. Tarnish isn’t a big problem because the contact force (pressure, sliding) breaks through the thin sulfide layer. The bulk silver beneath remains extremely conductive.

- Implication: Excellent for bulk conduction (switches, solders, power contacts), but not ideal for fine connectors where tarnish could cause signal loss.

2. Gold (reliability metal)

- Strengths: Inert — doesn’t corrode or oxidize even in harsh conditions. Excellent malleability (easy to plate or draw into wires).

- Weaknesses: Conductivity lower than silver, much more expensive.

- Implication: Used where absolute reliability is critical (aerospace, medical implants, high-end connectors).

3. Palladium (niche substitute for gold)

- Strengths: Good corrosion resistance, cheaper than gold historically (though volatile). Widely used in MLCC capacitors as electrodes.

- Weaknesses: Conductivity much lower than gold/silver.

- Implication: Works in low-current applications (signal electronics, capacitors), but not suitable for high-power conduction.

4. Platinum (specialist role)

- Strengths: Very stable, withstands high temperatures and aggressive chemicals.

- Weaknesses: Poor conductivity compared to silver/gold, very costly.

- Implication: Used in sensors, thermocouples, electrodes where stability matters more than conductivity.