The West’s high-tech military might rests on a mirage of silver—a critical resource now bleeding out of London vaults to unknown buyers. NATO’s defense posture has a strategic Achilles’ heel: decades of complacency and manipulation have depleted Western silver stockpiles, leaving allied nations dependent on foreign sources for the metal that powers everything from missiles to satellites. As silver flows out of the LBMA toward BRICS-aligned nations, the West is sleepwalking into a wartime supply crisis. The time to secure physical silver is now, before the lights go out.

1980: The Hunt Brothers Expose the Fragile Supply

Silver’s weakness was exposed in 1980, when the Hunt brothers’ buying spree sent prices over $50/oz and nearly broke the system. Their attempt revealed how tiny the physical supply really was: a few investors buying hundreds of millions of ounces exhausted global inventories. Policymakers learned the wrong lesson—rather than treating silver as strategic, the U.S. moved to liquidate its hoard.

In 1981, the Reagan Administration proposed selling the entire 139.5 million-ounce national stockpile, claiming domestic mining made silver non-strategic. Officials promised an “adequate supply in case of war.” In hindsight, that confidence was delusional. Selling the reserve was like melting down one’s shield for scrap coin.

Draining the Stockpile Through Coin Programs

The drawdown began earlier. By 1965, rising silver prices threatened coin circulation, so Congress removed silver from coins, ended bullion redemption in 1968, and legalized melting in 1969—dumping 400–700 million oz into the market to suppress prices. The Silver Users Association (SUA), representing manufacturers, cheered these sales to keep industry supplied and investors disinterested.

By the 1970s, the government tapped the Defense Stockpile for coinage: 40% silver Eisenhower dollars and auctions of older coins. When Reagan’s 1981 plan to sell 100 million oz sparked outrage, Congress pivoted to a “controlled disposal” via bullion coins. Senator James McClure’s 1985 Liberty Coin Act authorized the American Silver Eagle program—minting stockpiled silver into one-ounce coins for gradual sale. Between 1986 and 2002, about 105 million oz were minted and sold, quietly emptying the strategic reserve. By 2001, the Mint had to buy silver on the open market.

Officials bragged that prices stayed stable—proof of careful “market management.” But the long-term cost was the loss of national reserves. By the 1980s the GAO insisted there was “no reason to have silver in the stockpile,” trusting allied mines in North America to meet wartime needs. This globalist mindset—shared supply chains instead of self-sufficiency—seemed rational in peacetime but guaranteed shared weakness in crisis. Today, the U.S. imports roughly 70% of its silver, most refining occurs abroad, and the once-strategic metal was only re-added to the Critical Minerals list in 2025.

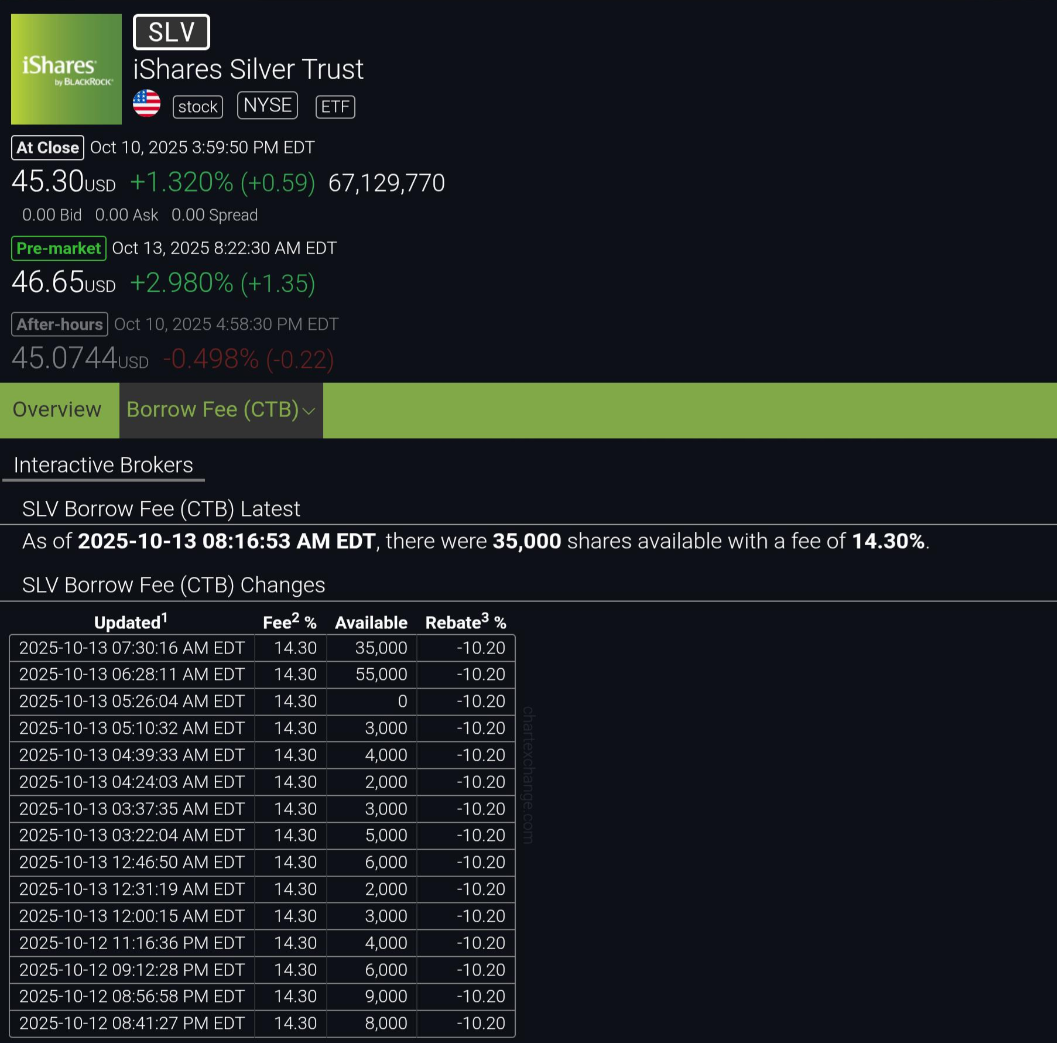

Paper Alchemy: SLV, ETFs, and the Illusion of Abundance

With the physical stockpile gone, the West turned to paper. The 2006 launch of the iShares Silver Trust (SLV) marked the pivot to financial alchemy. Ostensibly for investors, SLV vacuumed up remaining silver into London vaults under bullion-bank control. The SUA warned the SEC that such ETFs would remove metal from circulation and “have dire consequences for manufacturers.” They were right: above-ground silver was barely 750 million oz at the time.

Nevertheless, SLV and peers like PSLV amassed over 1 billion oz by 2021. Analysts pointed to these ETF holdings as proof of plentiful supply—a dangerous illusion. The metal sits concentrated under custodians like J.P. Morgan, subject to seizure or “force majeure” under the fine print. In any emergency, governments could requisition the metal while investors get paper.

Meanwhile, bullion banks maintained a fractional-reserve system of silver leasing: loaning out claims on silver that didn’t exist. Manufacturers leased rather than purchased metal, paying upon shipment and keeping inventories near zero. It worked—until delivery was demanded. COMEX “inventories” are mostly paper. This leverage kept silver prices suppressed for decades with tacit government approval under “national security” doctrines like the Defense Production Act and Security of Supply agreements among NATO allies. The system’s unspoken goal: keep silver cheap, uninteresting and flowing to industry, regardless of physical limits. The cat is out of the bag and the great silver hoarding has begun.

London’s Vanishing Silver and the BRICS Drain

All roads still lead to London—the LBMA, heart of the physical silver trade—but the hemorrhage is accelerating and now radiating outward through the entire Western financial system. Once the West’s Fort Knox, London’s vaults have become a funnel feeding the East. India alone imported a record 8,200 tonnes (263 million oz) in 2022, while China effectively cornered the world’s mine output by 2023, paying premiums directly at the source. That flow has not reversed.

Today, the contagion has reached the next tier of Western finance itself. Recently reported, three of India’s largest asset managers—Kotak Mahindra, UTI, and SBI Mutual Fund—suspended new investments in their Silver ETF Funds-of-Funds, citing an outright shortage of deliverable metal and domestic prices trading 10 percent or more above international benchmarks.

Reuters called it a “temporary suspension due to scarcity of physical silver.” NDTV Profit and Moneycontrol confirmed that while systematic investment plans remain open, fresh lump-sum inflows have been frozen until supply improves. In plain terms, there isn’t enough metal to back new shares.

That decision—made in a nation whose refiners depend on LBMA supply—signals that London’s drain has reached critical mass. When bullion banks can’t source bars for ETFs, paper promises collide with physical reality. The same ETFs that once symbolized Western abundance now broadcast shortage. Lease rates have exploded above 30 percent as banks scramble to locate inventory; a billion ounces changed hands in a single day, exposing how deeply the system had rehypothecated the same bars.

Bloomberg reported that “liquidity has almost entirely dried up.”

Those vanished ounces almost certainly ended up in Eastern or BRICS-aligned vaults—state or private hands that will not sell back. The geopolitical logic is brutal: every ounce leaving London is one less missile, satellite, or sensor the West can produce in wartime. NATO’s defense posture, once assumed invincible, now hinges on imports from nations with no obligation to supply them. The West’s silver stockpiles were a mirage; its ETFs, a paper façade; and its supply chains, a single point of failure that rivals now exploit.

A Global Wake-Up Call

The Indian ETF freeze is not an isolated event—it is the first visible crack in the global silver-leasing regime that kept prices artificially low for decades. What began as a monetary drain from London is morphing into a structural shortage that has reached the financial front lines of the world’s largest democracy and a key NATO partner in waiting.

If India’s ETF issuers can’t source metal, how long before Western ETFs confront the same reality?

This episode validates what industry insiders long feared: the illusion of limitless silver is ending. The same scarcity now choking bullion banks will soon test Western mints, defense contractors, and energy manufacturers. The global paper-silver edifice is crumbling—one halted ETF at a time.

Mining Won’t Save Us

Could new mines fix the problem? Not soon. Modern silver projects require 5–10 years to develop, and global output is flat or declining. The easily mined ore is gone. The real “mines” are landfills—billions of devices containing dispersed silver. Recycling only becomes viable at much higher prices; at $1000/oz, recovery would boom and substitutes would be invented. At $50/oz, silver keeps vanishing into waste.

Quad-digit silver prices aren’t hyperbole—they’re necessity. High prices would unlock recycling, attract new supply, and incentivize substitution far faster than any government program. It’s painful for industry, but far cheaper than losing a war because guidance chips or battery contacts can’t be made.

The False Fix of Confiscation

Confiscation is futile. FDR’s 1930s gold and silver seizures netted modest sums; today the public’s holdings are trivial beside industry’s needs. Modern silver stackers hold maybe a few hundred million oz total—less than one year of U.S. consumption. Trying to seize it would destroy confidence and spark unrest for negligible gain. The only realistic policy is to revalue silver upward and let the market refill the pipeline.

Raise the Price — or Lose the War

Western elites sold the strategic silver birthright for short-term convenience. They assumed global supply chains were eternal and that paper markets could substitute for metal. Now, the empire’s secret fragility is no longer theoretical—it’s flashing red on trading terminals across the world.

When India’s largest mutual funds froze new silver ETF inflows in October 2025, citing a “scarcity of physical silver,” the illusion finally cracked. What began as a quiet drain from London vaults has erupted into a systemic failure: the financial West can no longer conjure silver out of paper. A nation once reliant on LBMA deliveries now faces a real shortage of metal, and its fund managers have done what Western policymakers refuse to do—admit the silver isn’t there.

This is the canary in the global vault.

If India—one of the world’s biggest importers and refiners—can’t source silver for regulated ETFs, what happens when defense contractors or energy suppliers face the same crunch? NATO’s “arsenal of democracy” is built on a resource the market can no longer reliably deliver. Missiles, satellites, radars, solar arrays—all need silver. No metal, no modern war.

The remedy is brutal but simple:

Raise. The. Price.

Rebuild strategic stockpiles. Halt uncontrolled outflows from London. Let silver’s price reflect its wartime value. Four-figure silver isn’t speculation—it’s survival. Elevated prices would trigger recycling, revive mining, and restore balance far faster than bureaucratic programs or rationing ever could. Suppressing silver’s value only empowers adversaries to hoard it cheaply and deny it strategically.

The United States finally re-listed silver as a Critical Mineral in 2025, but a label isn’t a plan. What’s needed is a Manhattan Project for supply sovereignty—stockpiling, recycling, substitution research, and transparent pricing unshackled from the paper markets that hollowed out the West’s reserves. The longer leaders delay, the more ounces vanish eastward—each one a piece of the future that can’t be rebuilt once lost.

Silver wins wars. Those without it do not. Psyops are no longer effective.

India’s halted ETFs are the first tremor. The next will shake the foundations of Western industry and defense...