Silver's Day of Reckoning May Have Been Foretold. A long-buried document from 2006 has surfaced like a ticking bomb in the vaults of Wall Street. This explosive letter– penned by the Silver Users Association (SUA) and quietly filed with the SEC– predicted a catastrophic physical silver shortage if a silver-backed exchanged-traded fund (ETF) were approved. Nearly two decades later, as the world grapples with a silver supply crunch, the contents of this recently unearthed letter read like a prophecy fulfilled. It warned in stark terms that siphoning silver into an ETF would drain the market of metal, spike volatility, and wreak havoc on industries dependent on silver.

What is the true state of silver affairs? – a poignant question for our times, as this document reveals insiders warned that a silver-backed ETF could trigger a persistent global shortage. Nearly 20 years on, silver's supply crisis can no longer be ignored.

A WARNING IGNORED

Dated February 13, 2006 and addressed to the SEC, the Silver Users Association’s letter opposed the creation of the world’s first silver ETF with an urgency that is only now fully understood. The SUA– representing companies that process 80% of all silver used in the United States– feared that an ETF would "require the holding of physical silver in allocated accounts, thus removing large amounts of silver from the market." In other words, vast quantities of bullion would be locked away in a trust, no longer available for industry or investors. This, they cautioned, could trigger nothing short of a supply meltdown.

“Silver is a different market in that the supply is much more limited. Since it is a relatively small market it is subject to more speculative behavior and volatility… In such a small market, a silver ETF could strain market liquidity and introduce a new element of volatility. This could have dire consequences for manufacturers for whom silver is such a critical component."

Those words, lifted straight from the 2006 letter, are chilling in hindsight. The SUA hammered home the silver's above-ground supply was tiny relative to gold. Citing CPM Group data, the letter noted "above ground levels of silver in 2004 were roughly 750 million ounces... compared to roughly 3 billion ounces of gold". There was four times more gold than silver available– a fact long unknown to most investors but well understood by industrial users.

Gold, they argued, had deep liquidity and ample hoards, making a gold ETF feasible, "where silver is not". Silver's limited supply, critical industrial use, and history of wild price swings (from under $4 to nearly $50 an ounce within five years during the volatile 1970s) meant an ETF could "make silver illiquid", with "dire consequences" for the economy.

The letter even posited that a silver ETF might become "a legal way for investors to squeeze the silver market" – effectively cornering physical supply under the guise of an investment vehicle. SUA members painted a dire picture: if huge amounts of silver were stockpiled by an ETF, manufacturers would face skyrocketing costs, consumers would pay higher prices for goods, and workers could lose jobs as production lines stalled for lack of silver. It was a bold plea not just for industry self-interest, but for broader economic stability. Yet in April 2006, despite these stark warnings, the iShares Silver Trust (SLV) – the first silver ETF – was approved and launched.

SILVER SUPPLY: THEN VS. NOW

How severe was the physical silver shortage foreseen in 2006, and where do we stand today? The contrasts are striking – and unsettling. In the mid-2000s, after years of production deficits and the end of government stockpiles, the world's accessible above-ground silver reserves had been whittled down to roughly 750 million ounces. For perspective, that's less than one year's worth of silver demand today. By comparison, above-ground gold was estimated at ~3 billion ounces, reflecting centuries of hoarding and central bank vaults.

Silver has no such cushions; the US strategic silver stockpile had been completely drained, forcing the US Mint to buy silver on the open market for coin production since 2001. Even billionaire Warren Buffet's famous 1998 silver purchase– 130 million ounces acquired for Berkshire Hathaway – sent shockwaves through supply. As the SUA reminded the SEC, "It was 1998 when Warren Buffet purchased over 100 million ounces of physical silver and the spot price rallied over $3... [and] the one month cost of borrowing silver soared over 30%." Just one big buyer nearly broke the market's fluidity, a stark illustration of silver's razor-thin margins of supply.

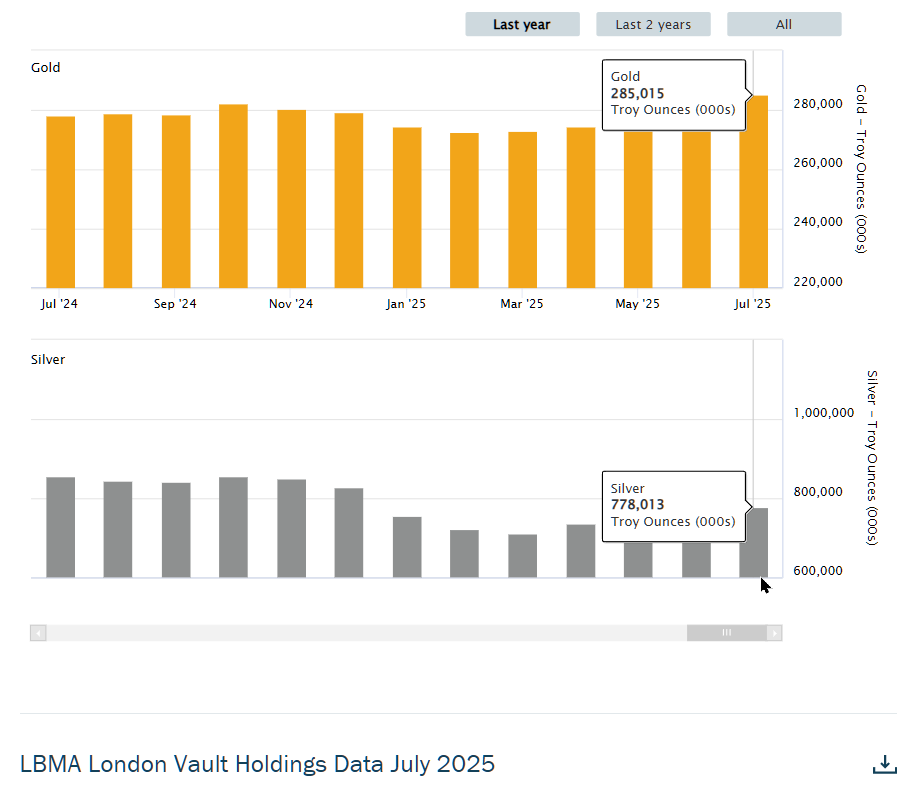

Fast forward to today, and the official narrative around silver's supply has shifted dramatically – almost suspiciously so. On paper, at least, the world now appears awash in above-ground silver. Global silver ETFs and ETPs have accumulated over 1.1 billion ounces of silver in their vaults (as of mid-2025), a hoard nearly 50% larger than the entire above-ground supply cited in 2004. In fact, during the Reddit-driven silver rush of early 2021, combined ETF holdings briefly peaked at 1.21 billion ounces – more silver than humans ostensible had available in the world two decades ago!

Mainstream analysts today insist that "ample above-ground stocks remain", pointing to bullion inventories equal to about 15 months of global mine supply sitting in London and New York vaults. Metals Focus, a consultancy that contributes to the World Silver Survey, has gone so far as to call these large stockpiles the "key challenge to [rising] prices", confidently assuring that they should "prevent a physical squeeze" in the short term. The message from establishment sources is clear: Don't worry about physical silver, there's plenty above ground.

But dig a little deeper into the data (and the vault) and a very different picture emerges – one that validates the SUA's original alarm. Yes, silver held in ETFs and exchange warehouses ballooned in the 2010s, but those stockpiles are now rapidly shrinking in the face of record demand and chronic mining deficits.

The world silver market has been in structural deficit every year since 2021, with cumulative shortfalls for 2021‑24 reaching 678 million ounces—roughly ten months of global mine production. The latest World Silver Survey shows that, although industrial demand rose 4 % to a record 680.5 Moz in 2024, total demand fell 3 % because coin and bar buying slumped, allowing the annual deficit to narrow to 148.9 Moz. World mine production increased about 0.9 % to 819.7 Moz (the U.S. Geological Survey’s estimate is 25 000 t, down slightly from 2023).

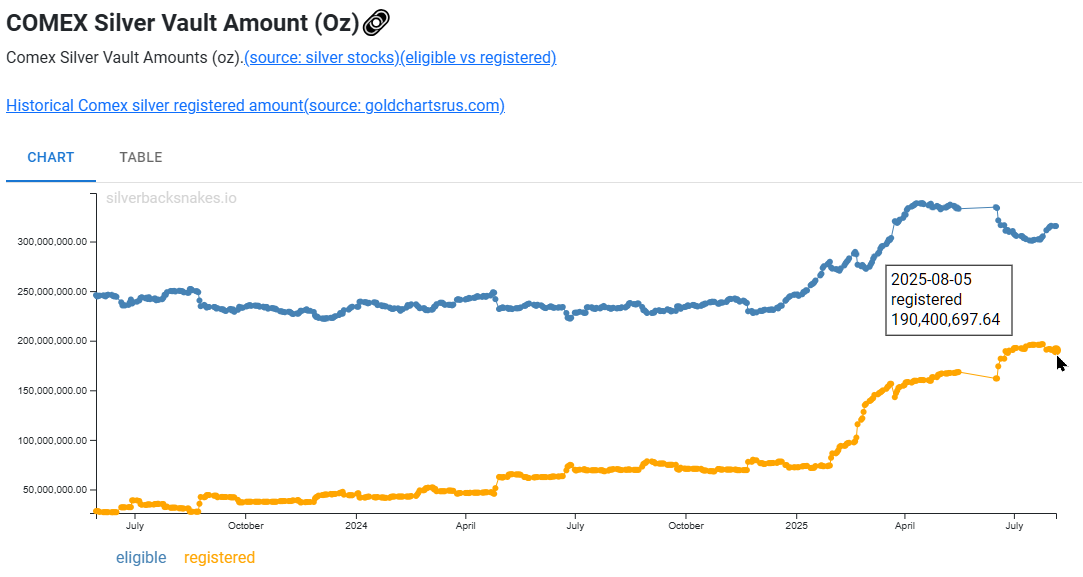

Meanwhile, COMEX vault inventories illustrate how above‑ground stocks have been drawn down: the exchange held more than 400 Moz of silver in early 2021, but inventories slid to around 291 Moz by April 2024—only about 47 Moz of which was registered for delivery. Elevated futures premiums attracted metal back to the United States later in the year, lifting CME warehouse stocks to about 375.8 Moz by mid‑February 2025. Despite that rebound, the broader trend since 2021 still shows a substantial drawdown in readily available silver and an ongoing structural supply deficit.

London's bullion vaults (the LBMA), traditionally the deepest pool of silver, have likewise shed over 300 million since 2021, dropping their reported holdings from ~1.2 billion oz to under 900 Moz. Crucially, most of this remaining silver may not truly be "available". In COMEX warehouses, only 47 million oz are classified as deliverable "registered" metal, with the rest tied up in "eligible" storage and unlikely to hit the market unless owners choose to sell. The LBMA does not disclose how much of its stash is spoken for, but as one report noted dryly, "it is almost certainly for less than the reported total."

What about the colossal tonnage held by ETFs – isn't that a new source of stability? To the contrary, it might be a hidden weakness. Silver ETFs were supposed to add metal to the market's coffers, but lately they have been bleeding silver, even as prices rise. In the spring of 2023, when silver prices rallied sharply, the biggest silver ETF (SLV) saw a net outflow of metal – a highly counterintuitive and ominous sign.

Over just two weeks in April 2023, SLV's bullion holdings dropped by 27 million ounces (a 5.6% decline) even though silver's price was climbing. Authorized Participants of the ETF, rather than contribute more metal to meet investor inflows, were pulling bars out of the trust. Where did that silver go?

Perhaps to meet the ravenous defense sector demand which was exacerbated by the War in Ukraine – or to plug the very supply gap that authorities claim is of "no immediate concern." The bottom line: despite today's official claims that above-ground silver is abundant, the real-world float of available silver is vanishing. The 750 million ounces the SUA flagged as the entire world supply in 2004 may well have been an overestimate of freely available metal back then – and an underestimate of how little is accessible now, after years of structural deficit.

Indeed, the silver reserve numbers have been "revised" upward over time (now counting immobile forms like jewelry and antiquated silverware in the nebulous "above-ground stocks" category), giving a false sense of security. But no accounting gimmick can erase the physical truth: the world is consuming silver faster than it can be mined, and the vaults are being drained to cover the shortfall.

Wall Street Silver Reddit is the Home of #SilverSqueeze. We love silver. Every Troy Ounce! No diamond-hands without EXTREME Pressure!

[Now Under SILVER WARS Management]

THE SILVER SIPHON ETF EMERGES

When Barclays Global Investors launched the iShares Silver Trust (SLV) in April 2006, it was heralds as a triumph of financial innovation – "modernizing" silver investment and making it easy for institutions and individuals to get exposure to the metal. Behind the scenes, however, the birth of SLV was "shrouded in controversy," as one contemporary account put it.

The SUA's fierce lobbying against the fund fell on deaf ears at the SEC. The ETF was approved, opening the floodgates for a torrent of silver purchases to back the new shares. The SUA's nightmare swiftly materialized. By mid-2010 – not even five years into SLV's existence – the fund's holdings hit an all-time high of 352.5 million ounces of silver. This hoard, "the equivalent of half a year's world of all the silver mined in the world", was vacuumed off the market and sealed in vaults on behalf of ETF shareholders. The industrial silver consumers' worst fears had come to pass: a single Wall Street product had absorbed a huge chunk of global supply.

The impact on price was dramatic – at least initially. Silver began an epic rally, rising from under $10/oz at SLV's debut to over $30 by the end of 2010, and peaking near $50 in spring 2011. Retail investors and institutions alike poured into SLV, effectively competing with each other to grab slices of the shrinking physical pie. In the words of one analyst at the time, "American stock investors, by buying shares in SLV, have already absorbed the equivalent of half a year's mine production... The young ETF has grown into a silver juggernaut."

The 2006 letter's warnings about increased volatility and speculation proved prescient – silver's price exploded in a speculative frenzy, then crashed violently after 2011, wiping out many leveraged bets. Was that crash purely a natural correction, or did the ETF itself enable big players to strategically dump silver back onto the market to suppress prices? Silver commentators have long suspected the latter.

There is intriguing evidence that SLV's initial metal was sourced in unconventional wars, possibly to prevent the very shortage it was causing from spiraling out of control. Historical data shows that Warren Buffet's Berkshire Hathaway quietly sold its 129.7 million-ounce silver stash around 2006, right as SLV was launching. Some analysts allege that Buffet's silver was used to "seed" the ETF, transferring a private hoard into the custodial vaults to back the new shares. This creates the foundation, but none of that silver would be deliverable to average SLV holders. In other words, the very metal that silver enthusiasts thought they owned via ETF shares may have been recycled bullion – shuffled from one vault to another – and effectively locked away from ever reaching the open market.

The ETF's sponsors and custodians claimed this structure would boost transparency and liquidity, but skeptics argue it instead concentrated control of physical silver in a few powerful hands and papered over a brewing scarcity with the illusion of "shares" that could be traded in lieu of actual metal.

The gold market offers a telling parallel. A gold ETF (GLD) had debuted in 2004 without incident, but gold's dynamics are fundamentally different. Gold has always been hoarded as a monetary asset, and by 2004 the world's above-ground gold (private and official) was in the billions of ounces, much held by Central Banks. Creating a gold ETF did not threaten to absorb a critical percentage of the available gold. Silver's story was the opposite: decades of consumption in industry (electronics, photographic, defense, medicine, etc.) meant far less silver was left in bullion form. Unlike gold, most silver that gets used is gone for good – dispersed in landfills or tiny quantities in countless devices. The SUA letter detailed how silver had been in deficit for years, with even the US government's once-massive holdings dwindling to zero. Thus, launching a silver ETF in 2006 was like plugging a high-powered vacuum hose into an already underfilled reservoir. It sucked up whatever bullion was for sale, and then – critics contend – the ETF structure allowed banks to pull those reserves out to dump when convenient.

PAPER SILVER ILLUSION

Perhaps the most troubling aspect of the silver ETF saga is how it may have enabled institutional manipulation of the silver market – the very thing silver investors long suspected was holding prices down. By design, a physical silver ETF must store metal with a trusted custodian on behalf of shareholders. In SLV's case, that custodian is JPMorgan Chase – a fact that raises eyebrows in retrospect.

Between 2008 and 2016, JPMorgan traders were found to have engaged in a "pattern of manipulation" in precious metals futures, including spoofing orders to artificially suppress prices. In 2020 the bank paid a record $920 million fine to US regulators and admitted wrongdoing for years of metals market manipulation. This is the same institution responsible for guarding SLV's silver stash.

Little wonder that the late silver analyst Ted Butler (who had monitored these markets for decades) grew suspicious that the ETF's metal was being double-counted or used surreptitiously. In late 2022, Butler directly asked the SEC and CFTC a pointed question: Is the 100 million ounces of silver reported as SLV's holdings – stored by JPMorgan – also being reported as part of JPMorgan's COMEX vault inventory? In essence, are the same bars being counted twice to pad the perceived supply? Regulators have yet to answer this troubling query.

The implications are staggering. If a significant portion of ETF silver is not in addition to exchange inventories but rather the same metal under a different label, the true available silver supply is far smaller than believed. It would mean the ETFs function not as add-ons to physical demand, but as shell games shifting metal around – all while creating a paper claim (the ETF share) that traders treat as equivalent to silver. "The vast majority of above ground silver stocks are immobile," notes a recent Silver Institute report – much is in private hoards or industrial products, "with only small net additions or subtractions from stocks on an annual basis."

In practice, that means new investment demand has few places to source metal except from ETFs or existing vaults. When investors buy SLV shares in bulk, authorized banks source metal (driving up price); when investors sell, banks can return metal to market (adding supply to cap price). It's a two-way valve that can be, and arguable has been, abused to manage the price of silver to suit institutional and governmental interests.

Even former CFTC Commissioner Bart Chilton acknowledged that the silver market has been plagued by large concentrated short positions and manipulative activities by major banks — what many in the silver community dubbed "suppression". The silver ETF may have unintentionally helped facilitate that suppression by pooling a significant portion of the physical silver under custodians who also happen to answer to Wall Street's biggest players.

The SUA letter eerily foresaw this conflict of interest: "Approving the proposed silver ETF... [means] all of these sectors will be left holding the bag when the ETF doesn't live up to the initial speculation," the 2006 letter cautioned, noting the risk of market disruption and investor harm. That line – "left holding the bag" – rings true for those who bought into silver ETFs expecting to indirectly own metal, only to find the "bag" may be empty or rehypothecated many times over. One does not have to look far for proof that paper promises in silver can be misleading: when retail buyers attempted a run on silver in January 2021's "Silver Squeeze," SLV's managers had to quickly change their prospectus, warning that demand was so extreme that "we may not be able to acquire enough silver to meet rising share issuance". Physical premiums surged even as the ETF price lagged, suggesting a disconnect between paper and metal. In short, silver ETFs might have evolved into a pressure-release mechanism for the market – absorbing demand when convenient, and feeding supply back in when need to quell price spikes, all under a veneer of legitimacy.

To CFTC: This Article Provides the Evidence that Meets the Burden of "Recklessness"

CONFRONTING THE HIDDEN TRUTH OF SILVER RESERVES

The SUA's 2006 letter is more than a historical curiosity – it is a smoking gun that validates the silver community's long-held suspicions. For years, silver enthusiasts, independent analysts, and manufacturers have whispered that "something doesn't add up" in the silver market. How could a metal essential to industry, in perennial deficit, remain so undervalued? How could there be "plenty of silver" above ground when government mints periodically halt coin production for lack of raw blanks, and when technology manufacturers scour for high-purity supply? The newly unearthed document from 2006 confirms that even insiders knew there was a problem – a potentially catastrophic shortage – and that an ETF would likely make it worse. They tried to warn us. They were overruled. And everything they cautioned about has come to pass.

It's now abundantly clear that the official narrative around silver has been carefully curated. Early on, the danger of a supply crunch was acknowledged (750 Moz available, a tiny fraction of gold's availability). Later, as ETFs and financial institutions took the driver's seat, the story shifted to "nothing to see here, silver stocks are ample" – even while behind the curtain the shelves were being emptied and JPMorgan itself was penalized for rigging the game. Such contradictions can no longer be ignored. The time has come to revisit what was hidden: to demand transparency about where silver will come from in the coming years of growing industrial demand; to question whether the silver we think we own (in ETFs, in pool accounts) actually exists in deliverable form; and to expose any financial illusions propping up a broken market.

As late silver analyst Theodore Butler remarked after learning of the SUA's admission that silver was rarer than gold, "never... will there ever be more silver above ground than gold". The natural reality of silver's scarcity cannot be papered over indefinitely. The 2006 letter is vindication for all those who sounded alarms that were dismissed as "conspiracy theories." Now, with silver at the heart of the green energy revolution, electronics, and even defense systems, the stakes are higher than ever! Silver Wars have been waged in boardrooms and markets, quietly and in the shadows; it's time to bring them into the light.

The resurfaced SUA document is our call to action. It urges us to scrutinize the promises of paper silver and the true status of physical reserves. It validates the silver believers who long argued that the metal's price has been artificially suppressed by mechanisms exactly like the ETF. And it implores anyone who will listen that silver's moment of reckoning is near – a moment that will reward those who saw through the smoke and mirrors, and punish those who assumed an ETF's paper claim was "as good as gold."

The alarm bells rang in 2006 and were ignored. They are ringing again loudly in 2025. Will we listen this time, or will we too be left holding an empty bag when reality finally catches up? The truth about silver's supply is out there, in black and white, on SUA letterhead from 2006. Now is the time to confront it – before the long-hidden shortage makes itself known in the only way it can: an inability to source silver at any price, and a market convulsion that will surprise all but the few who dared suspect that the emperor had no silver.