CFTC Letter to Silver Investors (2004)

2004 — CFTC’s “Dear Silver Investor” letter claimed no manipulation and ample stocks. Two decades later, JPMorgan spoofing cases, LBMA inventory drawdowns, multi-year deficits, and the vanished U.S. silver stockpile prove that comfort wrong—underscoring silver’s strategic risk.

Summary:

- "No evidence of manipulation"

Subsequent enforcement actions flatly contradict this assurance. JPMorgan admitted unlawful precious-metals trading and paid a record $920.2M in 2020; DOJ and CFTC detailed years of spoofing in gold and silver futures. Senior JPM precious-metals traders were later convicted (2022) and sentence (2023). That doesn't prove every allegation circa 2004, but it decisively disproves the letter's categorical "no manipulation" comfort. - "Large above-ground stocks make deficits irrelevant"

The US National Defense Stockpile of silver was sold down to nothing by the early 2000s– eliminating a key buffer the letter implicitly leans on. Once strategic stocks are gone, "production deficits" do bite. GAO and DoD records through the late-1990s/early-2000s document the deliberate sell-off of stockpiled materials (including silver) under Annual Materials Plans, culminating in the early 2000s era the letter was written. - "Stocks vs. weeks of consumption" comparison is misleading

The letter compares silver "weeks of consumption" to base metals to imply comfort. But silver's use is uniquely dispersive (electronics, solar, medical, coatings), much of which is economically unrecoverable– so gross "stocks" aren't equivalent to mobilized supply. Modern vault data show that London's silver holdings peaked in 2021 (~36,706 t) and then fell materially to ~24,199 t by July 2025– a drawdown of ~12,500 t (~400Moz). Stocks are not an inexhaustible cushion. - "Cash and futures track; therefore no problem"

Parity between spot and futures only shows functioning arbitrage; it doesn't prove the absence of abusive microstructure tactics. The very spoofing cases above occurred on futures while spot tracked them– exactly the scenario where apparent basis "normality" masks manipulation. - "Commercial shorts are just hedging; no 'naked' short concern"

CFTC's own public hearing record cites the August 2008 Bank Participation Report showing 1-2 U.S. banks suddenly carrying an enormous concentrated silver short– orders of magnitude jump in a month– raising durable concentration concerns that simple "hedger vs spec" labels don't resolve. Concentration risks are a structural issue. - "We see no collusion or coordinated action"

Again, later facts undercut the letter's blanket reassurance. DOJ described a multi-year scheme on a major bank's desk involving tens of thousands of unlawful sequences. Even if not "industry-wide collusion," it shows that material, repeated misconduct escaped detection in the era where this letter claimed comfort. - "Position limits: spot-month only is fine"

The post-crisis legal framework (Dodd-Frank) pushed CFTC toward boarder position limit regimes, precisely because pre-crisis comfort proved misplaced. The agency's later rulemakings reflect that the 2004 stance undervalued concentration/limit risks. (See CFTC position-limits docket history and Bank Participation Reports.) - Physical-market tightness has since become obvious

Silver's industrial role accelerated (PV, electronics). World Silvery Survey data show multi-year structural deficits since 2021, with cumulative stock drawdowns on order of hundreds of millions of ounces– exactly the outcome one would expect after government sales end and demand rises. Noted in the 2004 World Silver Survey, the deficit was estimated to average about 133Moz per year in the ten years from 1994 to 2003. In 2003, the World Silver Survey noted that a mere one percent difference in one's assumptions about cumulative historical mine production can affect the imputed size of current bullion stocks by over 400Moz. - Vault-data & lease-rate stress

LBMA vault holdings fell materially from 2021 highs; episodes of tightness also showed up in elevated silver lease/financing costs--symptoms of scarcer readily mobilized metal, not the comfy surplus implied in 2004. - Strategic framing the letter ignored

Silver Wars has emphasized silver's national-security role (aerospace, defense, energy). With no U.S. defense silver stockpile today, reliance on "the market will provide" is a policy risk the letter never grappled with– even as U.S. agencies later elevated supply-chain security concerns.

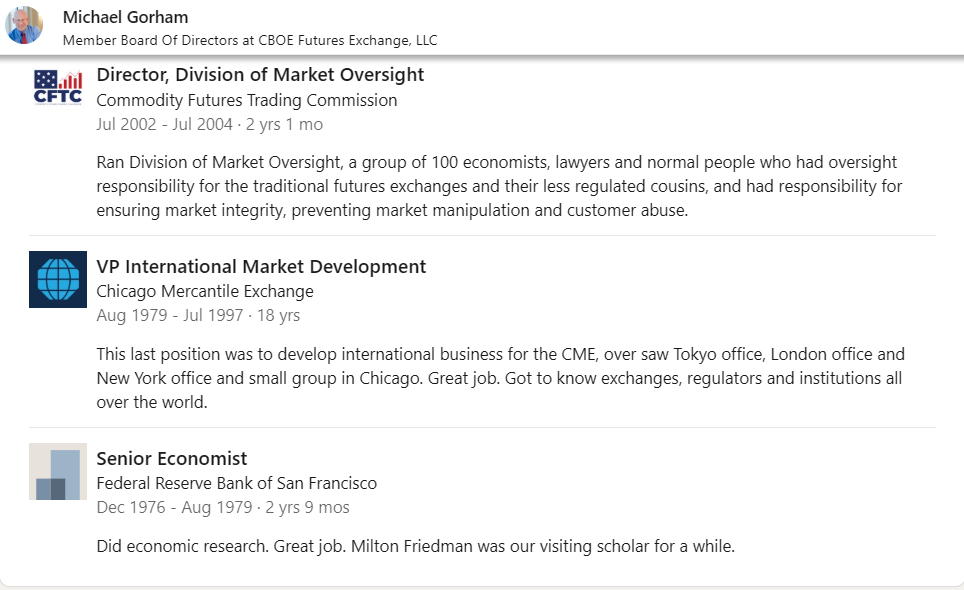

The letter was written by Michael Gorham. Before his two year appointment at the CFTC, Michael worked as VP of International Market Development for the Chicago Mercantile Exchange and was a senior economist for the Federal Reserve Bank of San Francisco.

Do we even have to point out the obvious conflict here?

The bottom line is, this letter's central reassurances– no manipulation, ample stocks, benign concentration, minimal need for broader limits– have been overtaken by facts. Subsequent enforcement records, vault-stock declines, multi-year market deficits, and the absence of strategic reserves all validate the reality that silver's "buffer" was finite, its industrial critically rose, and oversight comfort circa 2004 was unjustified.